ARTICLE AD BOX

Mystery of Crypto, a popular analyst and cryptocurrency veteran, identifies ten altcoins with strong potential amidst the prevailing uncertain market conditions.

The crypto market is actively recovering from Monday’s shock, leading some to believe this is a good time to buy promising assets.

Altcoin Picks for Optimal Performance Amid Market Jitters

Amidst market fears, the crypto industry recorded over $1 billion of liquidations. It marked the biggest collapse a single day after the FTX scenario in November 2022. Spotting them for stability and growth prospects, the analyst identifies ten altcoins that are safer bets during uncertain market conditions.

Toncoin (TON)

Toncoin is the first choice, given the number of decentralized applications (DApps) built atop the network. These DApps span gaming, social, and DeFi, among others, and have recorded significant user growth over the last six months.

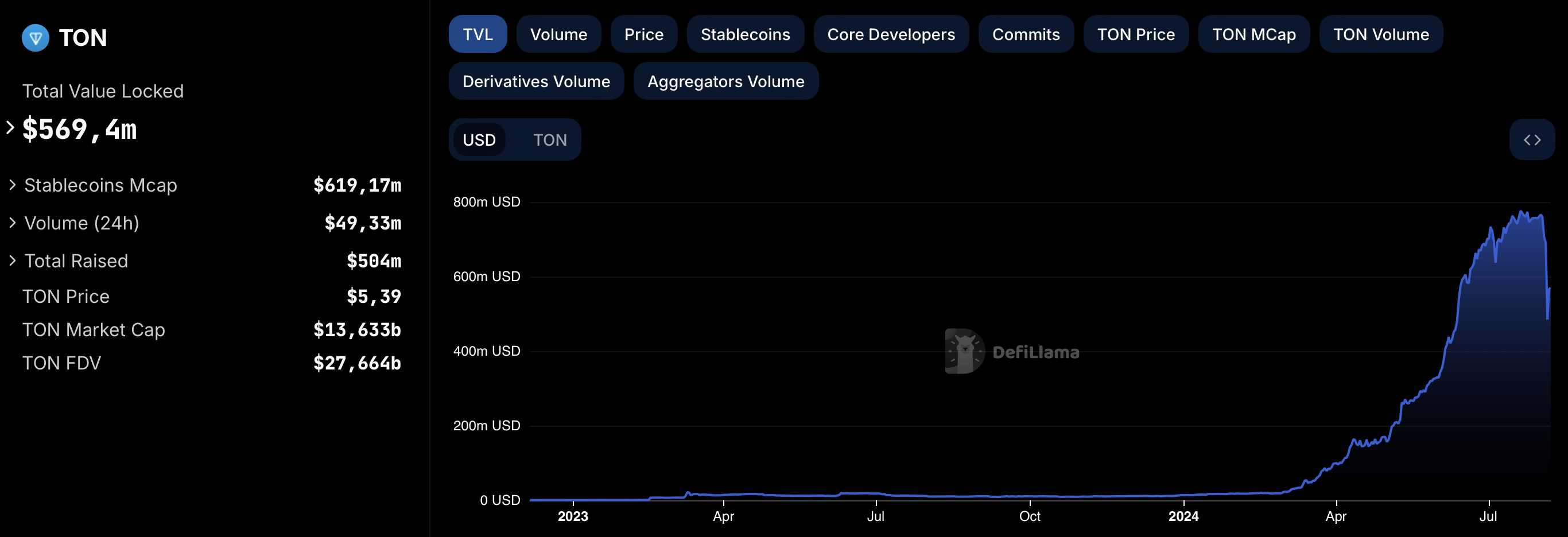

Based on DefiLlama stats, TON blockchain records over four million daily transactions. Latest data shows that it has a total value locked (TVL) above $560 million, a 20% growth since Monday, adding credence to the analyst’s selection.

Read more: 6 Best Toncoin (TON) Wallets in 2024

TON TVL. Source: DefiLlama

TON TVL. Source: DefiLlamaSolana (SOL)

Solana secures the second place in the list due to its strong performance in 2024. The analyst highlights its key features: high scalability and low transaction fees, making it a compelling choice. Strong interest from developers and institutions also supports SOL’s position as a top-tier altcoin.

Recently, Solana outperformed Ethereum in weekly revenue. More closely, it remains the most preferred blockchain for memecoin traders, which positions SOL for performance. There are also prospects for a Solana ETF, which continues to provide tailwinds for SOL.

Arbitrum (ARB)

Arbitrum is a key player among Ethereum’s Layer-2 (L2) scaling solutions, boasting over 408,000 daily active users. Data shows that its TVL is above $2.5 billion, higher than Polygon (MATIC), Optimism (OP), and other L2s.

After its Kwenta launch and Orbit expansion, Arbitrum delivers a top-tier trading interface and is frequently praised for the best perpetuals user experience in DeFi. This, coupled with the backing of Pantera Capital, positions ARB for good performance, according to Mystery of Crypto.

Ondo Finance (ONDO)

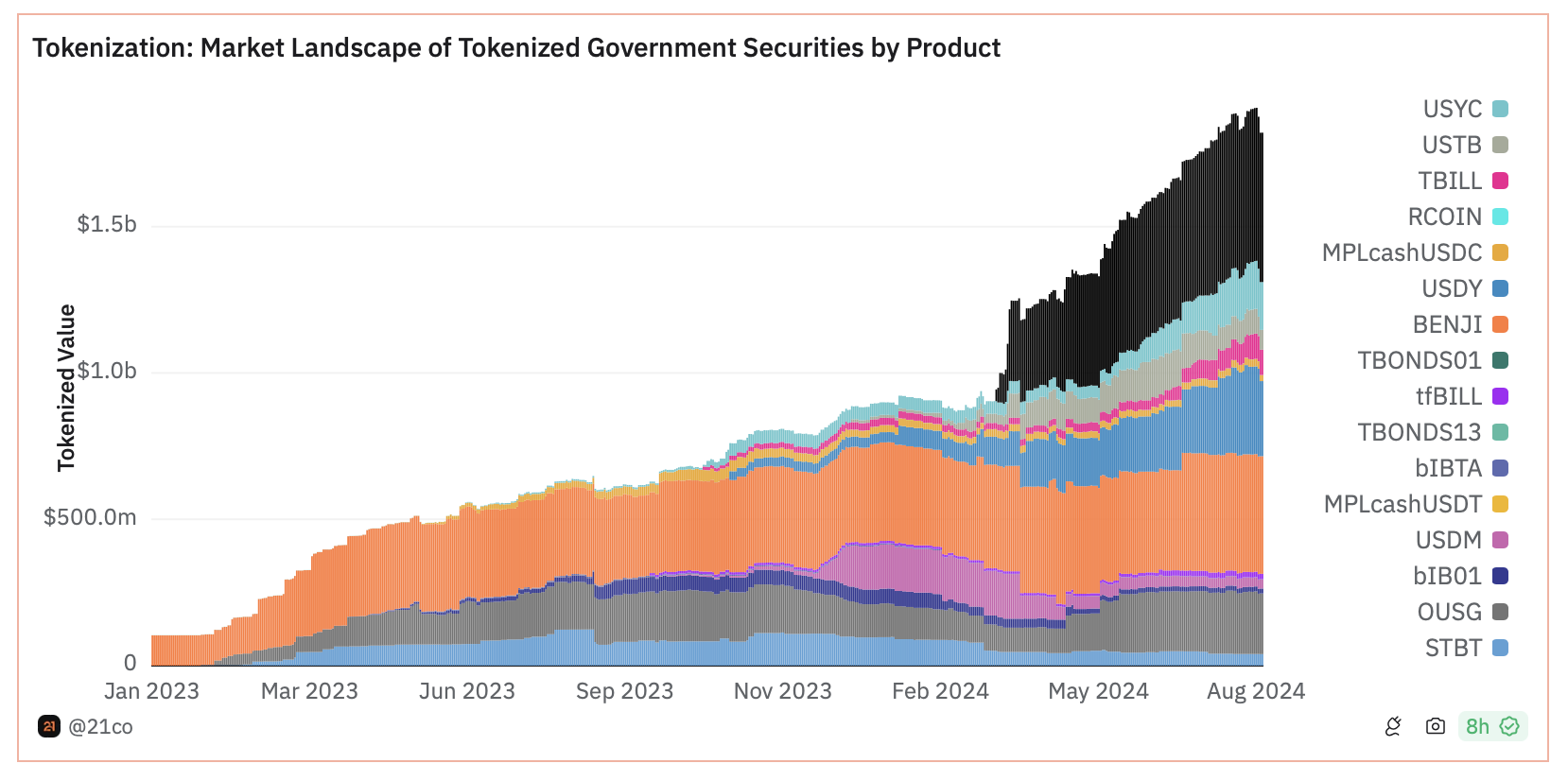

Ondo Finance features on the list of multiple analysts, including AltcoinDaily, with both citing its ability to turn RWAs into digital tokens.

The network’s strong partnerships with BlackRock and Coinbase Ventures also make strong fundamentals for the project. Moreover, the Pyth Network launched a USDY/USD price feed in collaboration with Ondo Finance, which adds to the list of project fundamentals.

Read more: What is Tokenization on Blockchain?

Total Market Value of Tokenized US Treasury Products. Source: Dune/21co

Total Market Value of Tokenized US Treasury Products. Source: Dune/21coNear Protocol (NEAR)

According to the analyst, the Near Protocol is known for resilience and innovation. Its developer-friendly platform continues to attract more projects, and it has an $800 million ecosystem fund to seed and support new projects.

It boasts the highest daily active users among L1 scaling solutions, only second to Solana, which positions NEAR to do well in uncertain market times.

Mantra (OM)

Mantra meets the analysts’ bar, given its move to enhance Ethereum functionality and promote accessible financial services. Given the growing interest in real-world asset (RWA) tokenization, it is also positioned for good returns.

The project launched Season 2 of 50,000,000 OM GenDrop, whereas the dYdX ecosystem added OM to its chain, bringing new exciting opportunities. Further, with more than $50 million OM tokens staked, the reduced supply increases the chances of further upside for OM tokens.

EtherFi (ETHFI)

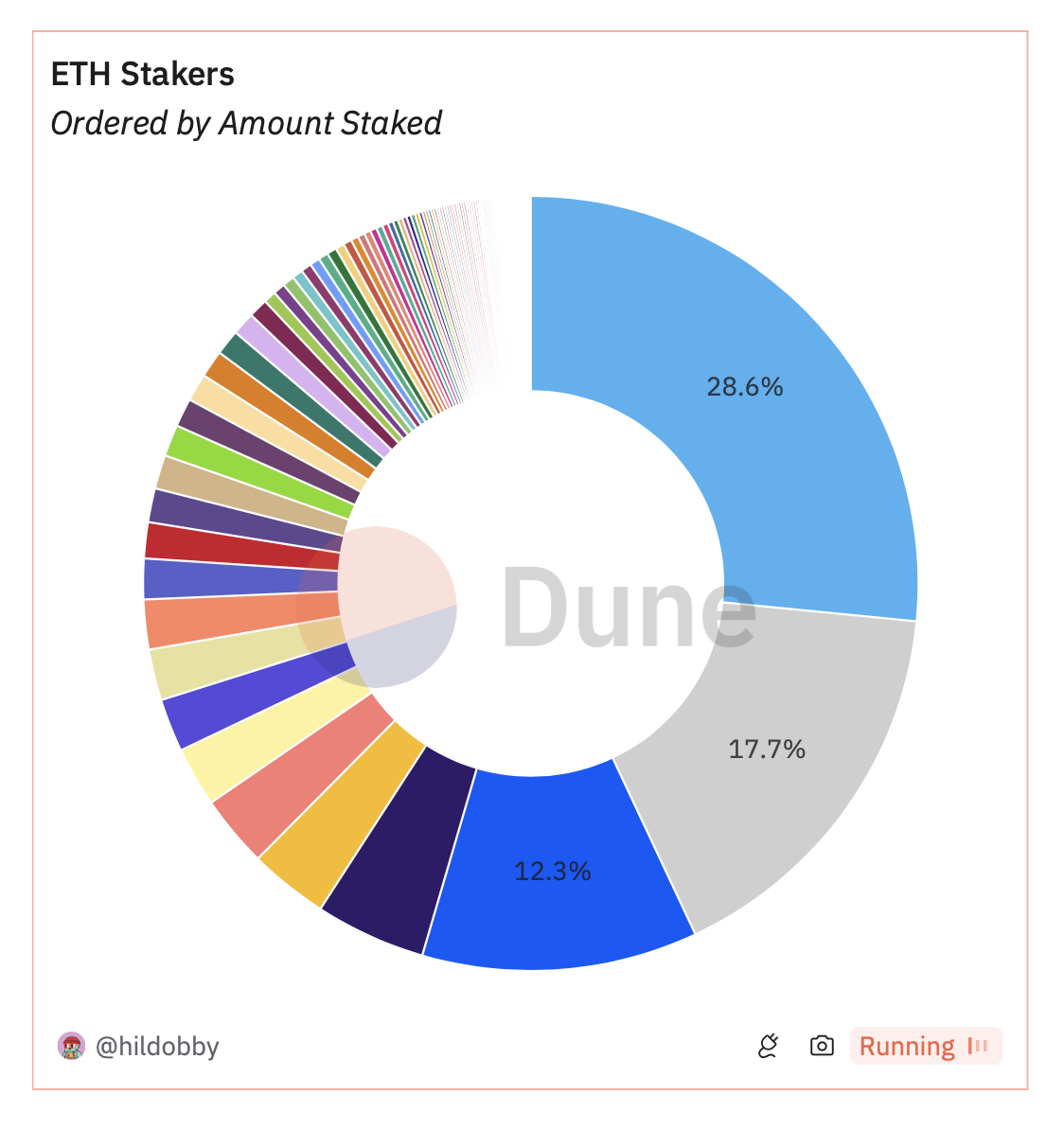

EtherFi is a leading restaking platform running on Ethereum. The project recently released Season 2 claim checker, distributing more than 53 million ETHFI tokens worth approximately $100 million.

Its participation in the rewards model, which promises even more exciting opportunities for users, could drive more interest in the ETHFI token. Moreover, the project also has Cash, a mobile wallet with Visa credit card integration.

Read more: Ethereum Restaking: What Is It And How Does It Work?

ETH stakers. Source: Dune

ETH stakers. Source: DunePolygon (MATIC)

The Polygon blockchain collaborates with Axie Infnity’s Ronin Network via its Polygon Chain Development Kit. Given its essence as a scaling solution for Ethereum, more than 17,800 DApps are actively running on Polygon. It is popular among DeFi and NFTs projects, with 35 million MATIC tokens allocated for its ecosystem projects.

Render (RNDR)

Render is one of the AI crypto coins with decentralized GPU network services, which makes it essential for gaming and movies. Recent social dominance, active addresses, and whale transaction metrics have been at a six-month peak amid AI hype, making RNDR a potential big shot.

Arweave (AR)

Arweave has been demonstrating its strength in the blockchain industry. This network provides permanent data storage, with users leveraging it to store data for a one-time payment. Over one petabyte of data is stored on the Arweave network, which connects individuals needing storage with those with hard drive space.

The project announced a 100% fair launch for its new token with no pre-mine or pre-sales. This, coupled with its recent partnership with InQubeta, a blockchain firm that enhances technology, makes AR a coin to watch.

Mystery of Crypto also highlights Chainlink (LINK) as a potential big shot, citing its launch of a digital assets Sandbox for tokenization trials. Its partnerships with technology giants like Google and Oracle make LINK a good choice.

Nevertheless, traders must not rely solely on analyst predictions. Conducting one’s own research is always advisable.

The post 10 Altcoins Analyst Says Are Safe in Market Jitters appeared first on BeInCrypto.

.png)

3 months ago

1

3 months ago

1

English (US)

English (US)