ARTICLE AD BOX

- A large transfer of 108,000 ETH signals potential selling pressure as Ethereum struggles to maintain key resistance levels.

- Ethereum’s recent transaction fees reaching $45 million highlight increased network activity.

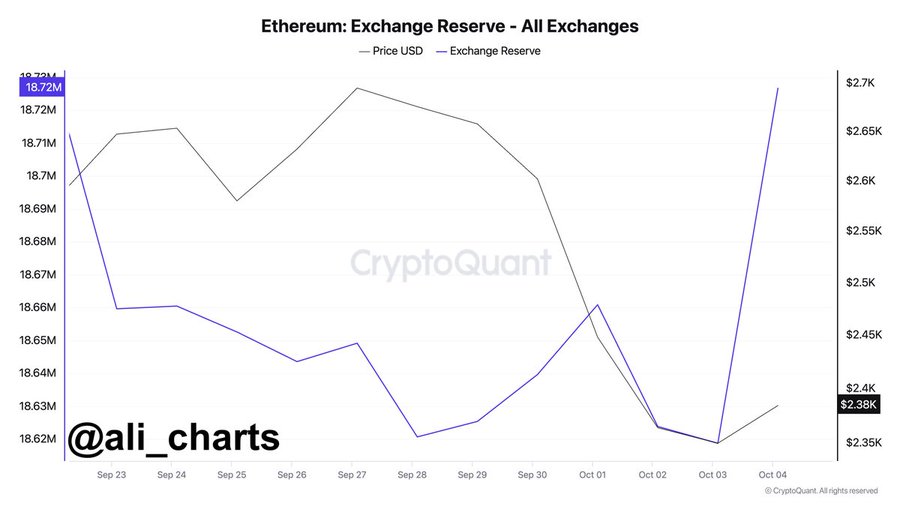

With 108,000 ETH—valued at around $259.2 million—sent to different crypto exchanges during a 24-hour period, Ethereum has lately experienced a notable shift in its market. The community is worried about possible selling pressure that can cause Ethereum’s price to drop thanks to this significant token flood.

On-chain analyst Ali Martinez emphasized the move, noting that it reflected a change in market activity since the transfers were notably higher than on past days.

Source: Ali Martinez on X

Source: Ali Martinez on XETH Faces Key Resistance Levels Amid Increased Market Activity

Ethereum is trying to keep important resistance levels; hence, this significant move occurs at a moment. The ETH price dropped from $2,600 to roughly $2,300 earlier this month, showing a quick reversal.

Should selling pressure rise, market watchers have observed that this might indicate more negative risk for Ethereum, hence perhaps bringing the price down to the $2,200 level.

Large crypto transfers to exchanges have long been interpreted as evidence of holders perhaps getting ready to sell their holdings, which would cause the price to decline as supply on exchanges rises.

Some analysts think Ethereum might recover despite these negative indications. Several traders have speculated that Ethereum might revert to its past highs and maybe hit $4,000 in the following few months. Still, this would mean the crypto overcoming levels of significant resistance at $2,400 and $2,850.

Should Ethereum be able to recover these levels, it may turn the present downswing upside-down and create conditions for a more general comeback. Resilient in the past, the crypto has outperformed Bitcoin under some market conditions, which has given some investors faith Ethereum might pick up pace following this time of downturn.

Underperformance Persists Despite Initial Optimism from Spot ETF Approval

Conversely, Ethereum has been called among the most disappointing big-cap cryptocurrencies of 2024. This underperformance stands in sharp contrast to the early hope around Ethereum’s spot ETFs, which were supposed to generate higher demand for the coin.

Ethereum has witnessed more severe reductions during market downturns, even as it has followed Bitcoin during market rises. Some investors think Ethereum might experience yet another round of selling pressure before a steady pricing floor is discovered.

Meanwhile, as of writing, Ethereum’s price is about $2,414, down 9.62% over the last 7 days. The network’s foundations hold great strength even with this downturn.

According to our prior report, Ethereum transaction fees came out to be shockingly $45 million, pointing to growing network activity and future expansion possibilities.

.png)

1 month ago

3

1 month ago

3

English (US)

English (US)