ARTICLE AD BOX

Millennium Management, a leading international hedge fund, has unveiled its substantial investment in spot Bitcoin exchange-traded funds (ETFs), amounting to nearly $2 billion. According to its 13F filing with the United States Securities and Exchange Commission (SEC), the firm held $1.94 billion across five major Bitcoin ETFs as of the first quarter of this year.

Millennium’s Diverse Bitcoin ETF Holdings

As of March 31, Millennium Management’s portfolio included significant investments in the ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Grayscale Bitcoin Trust (GBTC), iShares Bitcoin Trust (IBIT), and Fidelity Wise Origin Bitcoin ETF (FBTC). The hedge fund’s largest allocation was in BlackRock’s Bitcoin fund, with over $844 million invested. Fidelity’s Bitcoin ETF followed closely with $806 million worth of FBTC shares.

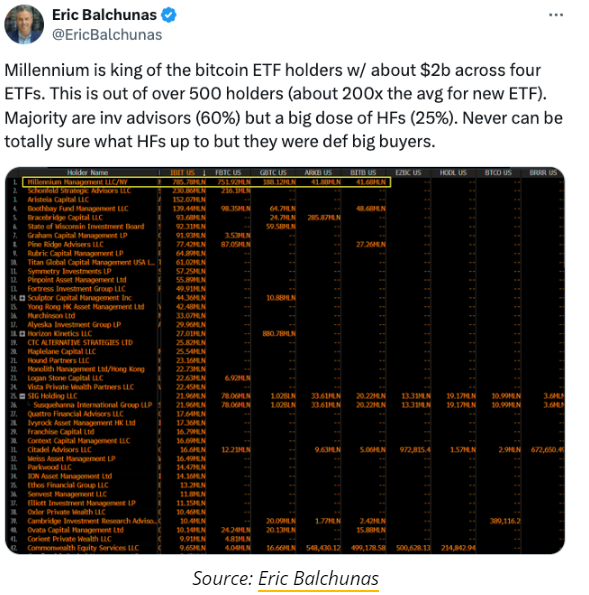

Bloomberg ETF analyst Eric Balchunas highlighted Millennium’s dominance in the Bitcoin ETF market, describing the firm as the “king” of Bitcoin ETF holders. Millennium’s exposure was 200 times greater than the average new ETF holder among the top 500 investors.

Institutional Interest Fuels Bitcoin ETF Market

The detailed disclosures from the recent 13F filings have provided valuable insights into the institutional buyers of spot Bitcoin ETFs. Bitwise chief investment officer Matt Hougan expressed his growing optimism about Bitcoin’s future, citing the significant scale of institutional interest as a positive indicator.

Hougan emphasized the notable presence of professional investors in the Bitcoin ETF market, including firms such as Hightower Advisors, Bracebridge Capital, and Cambridge Investment Research. In a memo to investors on May 13, Hougan stated, “The big news is: a lot of professional investors own Bitcoin ETFs.” He projected that by the May 15 filing deadline, the total number of professional firms involved could exceed 700, with assets under management (AUM) nearing $5 billion.

Broader Implications for the Crypto Market

The increasing institutional investment in Bitcoin ETFs underscores the growing acceptance and legitimacy of cryptocurrency within traditional finance. On May 14, the State of Wisconsin disclosed its own substantial investments, totaling $164 million across funds offered by Grayscale and BlackRock. This trend of institutional adoption is likely to have significant implications for the future trajectory of the cryptocurrency market.

In summary, Millennium Management’s substantial investment in Bitcoin ETFs highlights the growing institutional interest and confidence in cryptocurrency. As more professional firms and hedge funds increase their exposure to Bitcoin, the market is poised for further growth and mainstream acceptance.

Also Read: Grayscale’s Ethereum Futures ETF Bid Withdrawal: SEC Update

.png)

6 months ago

3

6 months ago

3

English (US)

English (US)