ARTICLE AD BOX

- Binance’s market share shrank in 2024, with Bybit and Bitget emerging as key competitors in the CEX space.

- Spot and derivatives trading volumes surged in 2024, with Crypto.com and Bitget leading impressive growth.

According to Wu Blockchain’s “2024 Cex Annual Report: Binance’s lead narrowed, while Bybit spot and Bitget contracts grew significantly,” the space of cryptocurrency changed dramatically in December 2024. The research clarifies exchange website traffic as well as the changing dynamics in spot and derivative trading volumes.

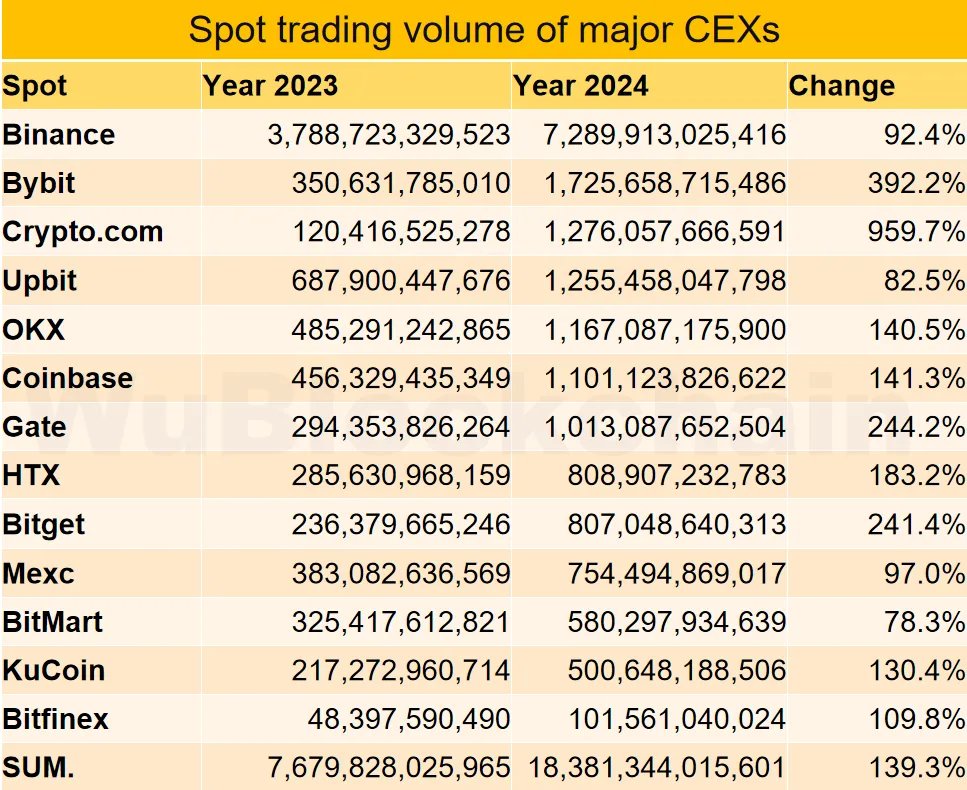

December alone showed a notable 14% rise in spot trading volumes; Bitget led the rise at an amazing 102%. The annual rise, when compared to 2023, was astonishingly 139%. With a huge 960% increase, Crypto.com came out as the top among the main participants, followed by Bybit at 392% and Gate at 244%.

Exchanges such as BitMart, Upbit, and Binance, meanwhile, showed relatively modest rises of 78%, 83%, and 92%, respectively.

Source: Wu Blockchain

Source: Wu BlockchainShifting Dynamics in CEX: Derivatives and Traffic Trends

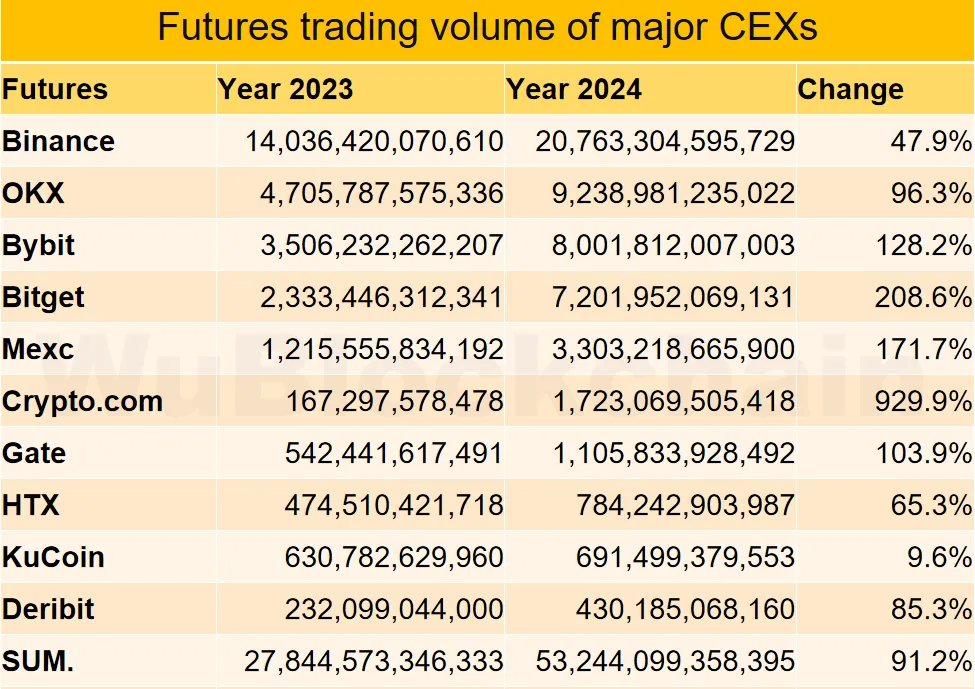

Following a similar upward path, the derivatives market saw a 6% growth in December and a year-over-year rise of 91%. With a 930% increase, Crypto.com once more dominated this market, followed by Bitget at 209% and Mexc at 172%. Conversely, exchanges like KuCoin and Binance had quite slow expansion at 10% and 48%, respectively; HTX managed a 65% rise.

Source: Wu Blockchain

Source: Wu BlockchainWith a 22% increase across exchanges in 2024 compared to the previous year, website traffic also underlined changing customer tastes. Bitget, with a 103% rise, stood out among the others in this category, followed by Mexc and Bybit with 57% and 54% growth, respectively.

Especially some exchanges had major difficulties; HTX observed a catastrophic 99% drop in traffic, and Bitfinex and Deribit saw declines of 56% and 10%, respectively.

The analysis highlighted a major change in the competitive environment. Long considered as the main player in crypto exchanges, Binance’s market share dropped really dramatically. Binance’s share in the spot market plummeted from 49% to 39%, while its contract market share dipped from 50% to 38%.

This loss of control opened the path for rivals like Bybit, whose spot market has expanded quickly, therefore confirming its second-largest player status following Binance.

.png)

12 hours ago

3

12 hours ago

3

English (US)

English (US)