ARTICLE AD BOX

Bitcoin (BTC) has soared to $57,000, reaching heights unseen since December 2021. Ethereum is not far behind, nearly hitting $3,300. With the rapid price increase, a veteran trader has given a bold target for Bitcoin price.

On Monday, massive inflows into the spot Bitcoin exchange-traded funds (ETFs) pushed the price to yearly highs.

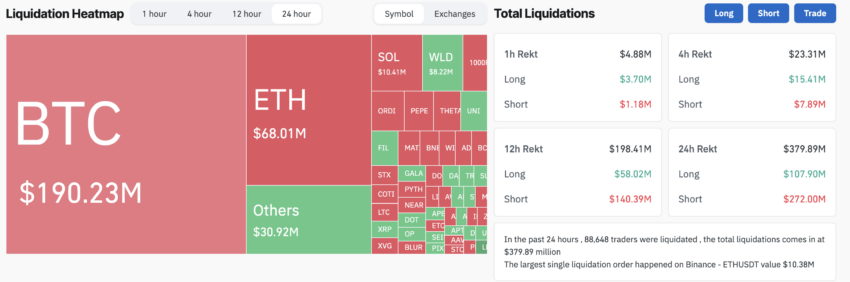

Bitcoin, Ethereum Lead $380 Million Liquidation Spree

The recent surge in value triggered over $380 million in crypto liquidations within 24 hours. Specifically, long trades worth $109 million were liquidated, while short trades saw a higher toll, with $271 million lost.

Consequently, a total of 89,163 trades were wiped out. Bitcoin trades suffered the most, with $190 million liquidated, followed by Ethereum at $68 million.

Read more: Bitcoin Price Prediction 2024/2025/2030

Crypto Liquidations. Source: Coinglass

Crypto Liquidations. Source: CoinglassInterestingly, this price rally coincided with a significant influx into spot Bitcoin ETF products during US trading hours. Notably, Grayscale’s ETF saw a slowdown in net outflows for the third consecutive day, hitting a record low of $22.4 million. Meanwhile, other funds enjoyed a surge in inflows, reaching a two-week peak.

Further analysis reveals that the Grayscale Bitcoin Trust (GBTC) experienced a halving in outflows on February 26. This was a sharp decrease from the daily net outflow of $44.2 million on Friday at the week’s end.

In addition, the combined net inflows of all Bitcoin ETFs soared to $519.9 million, the highest in two weeks. Bloomberg analyst Eric Balchunas pointed out that nine Bitcoin ETFs recorded record-high volumes, aligning with Bitcoin’s approach to $57,000 levels.

| February 21 | 154.3 | 71.7 | 11.1 | 27.4 | 0.0 | 0.0 | 0.0 | 5.9 | 2.2 | (137.0) | 135.6 |

| February 22 | 96.5 | 52.5 | 0.0 | 10.7 | 1.0 | 3.0 | 0.0 | 0.0 | 0.0 | (199.3) | (35.6) |

| February 23 | 125.1 | 158.9 | 7.9 | 6.7 | 0.0 | 0.0 | 1.2 | 2.9 | 4.4 | (55.7) | 251.4 |

| February 26 | 167.5 | 52.5 | 12.0 | 34.5 | 0.0 | 1.5 | 0.0 | 8.7 | 0.0 | (44.2) | 232.5 |

| February 26 | 111.8 | 243.3 | 37.2 | 130.6 | 4.4 | 7.9 | 0.0 | 6.2 | 0.9 | (22.4) | 519.9 |

As of writing, Bitcoin’s price has risen by approximately 8.77% in 24 hours, standing at $56,000. This resurgence aligns with veteran trader Peter Brandt’s prediction. He targets $200,000 for Bitcoin in the current bull market cycle, which is expected to peak between August and September 2025.

“With the thrust above the upper boundary of the 15-month channel, the target for the current bull market cycle scheduled to end in Aug/Sep 2025 is being raised from $120,000 to $200,000,” Brandt explained.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Bitcoin Price Performance. Source: TradingView

Bitcoin Price Performance. Source: TradingViewStill, Brandt warned that a close below the previous week’s low, at around $50,500, would invalidate the bullish outlook. Such a downswing may trigger a steeper correction toward $46,500 or lower.

The post $380 Million in Cryptos Liquidated as Bitcoin Targets $200,000 appeared first on BeInCrypto.

.png)

8 months ago

4

8 months ago

4

English (US)

English (US)