ARTICLE AD BOX

XRP transactions on exchanges recorded an uptick on Monday, coming amid elevated fear levels in the market.

Traders show a general lack of conviction as altcoins follow Bitcoin’s lead. Despite the bearish sentiment, data indicates heightened interest in Ripple.

XRP Transactions on Exchanges Increase

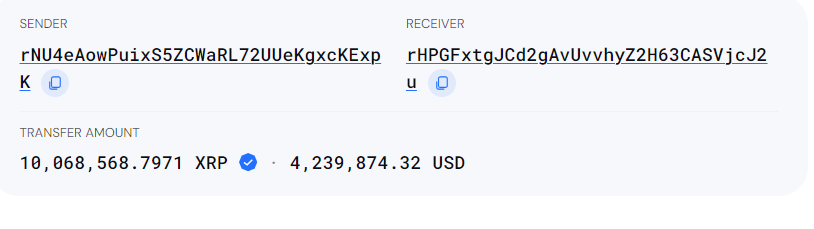

Data platform Blockchair reported a series of XRP transactions on exchanges on Monday. In one transaction, over 10 million XRP tokens worth at least $4.2 million moved from Binance to an unknown wallet.

In another transaction, more than 3.6 million XRP tokens worth at least $1.45 million moved from Bitstamp to Binance.

Read more: How To Buy XRP and Everything You Need To Know

XRP Transaction. Source: Blockchair

XRP Transaction. Source: BlockchairWhen traders move their assets to a wallet, it suggests an intention to HODL. On the other hand, moving crypto between centralized exchanges suggests plans to explore different trading features, lower fees, or a wider variety of trading pairs. It may also be a strategic move to arbitrage between exchanges, as traders exploit price differences to make a profit.

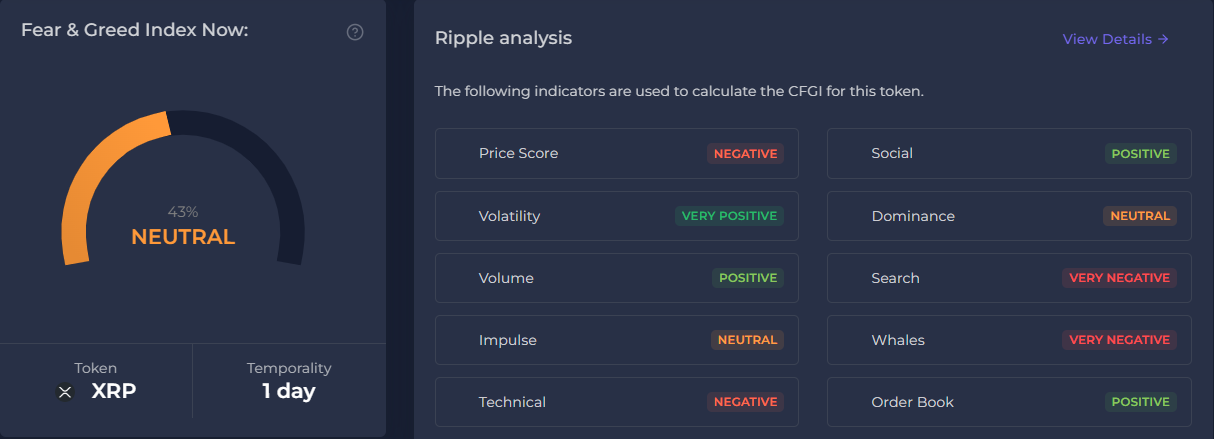

Increased XRP trading activity coincides with changing social sentiment. According to CFGI.io, sentiment has improved from fear to neutral. This indicates that the market is currently neither overly optimistic nor excessively pessimistic.

XRP Social Sentiment. Source: CFGI.io

XRP Social Sentiment. Source: CFGI.ioAlong with it, the investment suggestion remains to hold on amid “very positive” volatility, suggesting the need for caution. Nevertheless, Ripple’s Chief Technology Officer suggests the market needs to focus on XRP’s utility rather than its investment potential.

“Still costs $1 to buy enough XRP to make a $1 payment,” Schwartz noted.

The expression came as community members showed concern over how the ongoing market crash would impact the Ripple token. XRP has been subdued below the $0.6 price threshold over the past several months.

Focus on the Primary Function of Ripple, David Schwartz Says

Ripple CTO suggests that XRP holders can take advantage of the current price to purchase more tokens. He believes this highlights XRP’s primary function as a medium of exchange, facilitating fast and cost-effective cross-border transactions despite the bearish market.

However, some say Schwartz is deviating from his 2017 comment and is trying to manipulate the narrative.

“It can’t be dirt cheap. That does not make any sense. If XRP costs $1, they would need a million XRP, which would cost $1 million. If XRP costs a million dollars, they would need one XRP, which would, again, cost $1 million. Except that, higher prices make payments cheaper. Right now, you can buy a million-dollar house with bitcoins. When bitcoins were $300, it would move the market too much and be too expensive to be practical. So higher prices make payments cheaper,” the Ripple executive said in X post.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Nevertheless, Schwartz shot down the allegation that he was deviating and manipulating, reiterating his stance on XRP’s main purpose. This emphasis suggests the Ripple network’s commitment to promoting XRP for its utility in cross-border payments, not as an investment tool.

During Token2049 in Singapore, Ripple CEO Brad Garlinghouse also said the network is now more focused on what utility they are building than on speculative trading.

“Bitcoin ETF volumes have been soaring, we’re due for a halving, and the broader crypto market is following BTC’s lead. As someone who has experienced multiple cycles of ‘crypto is back,’ this bullishness must go hand in hand with real-world utility. That’s the real march of progress,” Garlinghouse explained.

The post $4 Million in XRP Exit Binance as Sentiment Shifts appeared first on BeInCrypto.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)