ARTICLE AD BOX

Both chambers of Congress are locked in fierce battles over spending legislation.

A “supplemental” package has found bipartisan support in the Senate after the removal of flawed border and immigration provisions. However, its $95 billion price tag—$60 billion of which would go to Ukraine—means there will be stiff resistance in the House.

Meanwhile, Congress is also working on regular spending bills (known as appropriations) that fund national defense and federal agencies. The most recent deal funds part of the federal government through March 1 and the rest through March 8.

It remains to be seen whether these bills will be honest—or loaded with gimmicks, such as phony “emergency” spending in an attempt to trick the public about what’s going on.

The spending bills aren’t happening in isolation. Decades of budget gimmicks, spending sprees and handouts to far left institutions have put America in an unsustainable position as these new charts show.

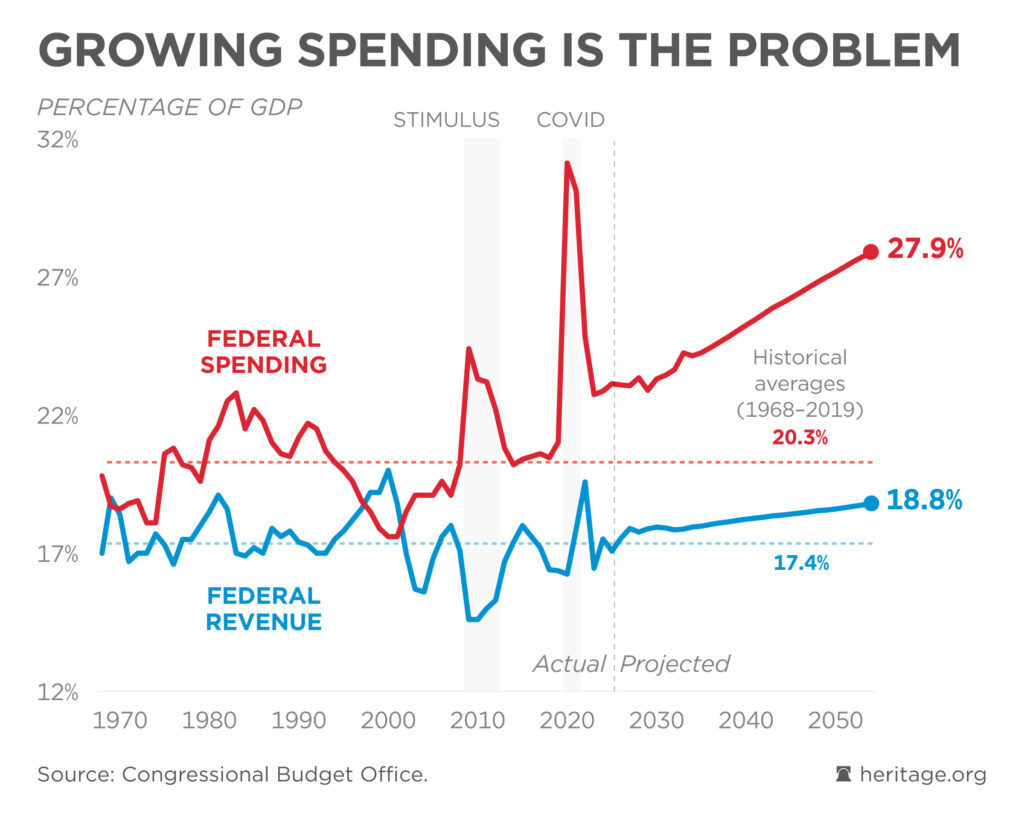

While the federal government has a sorry track record of running deficits most of the time, the size of the gap is also important. When deficits get too high, as happened during the COVID-19 pandemic, it adds to inflationary pressures on the economy.

If current trends continue, driven by the growth of spending as a share of the economy, deficits will balloon even in years without a recession or a major war.

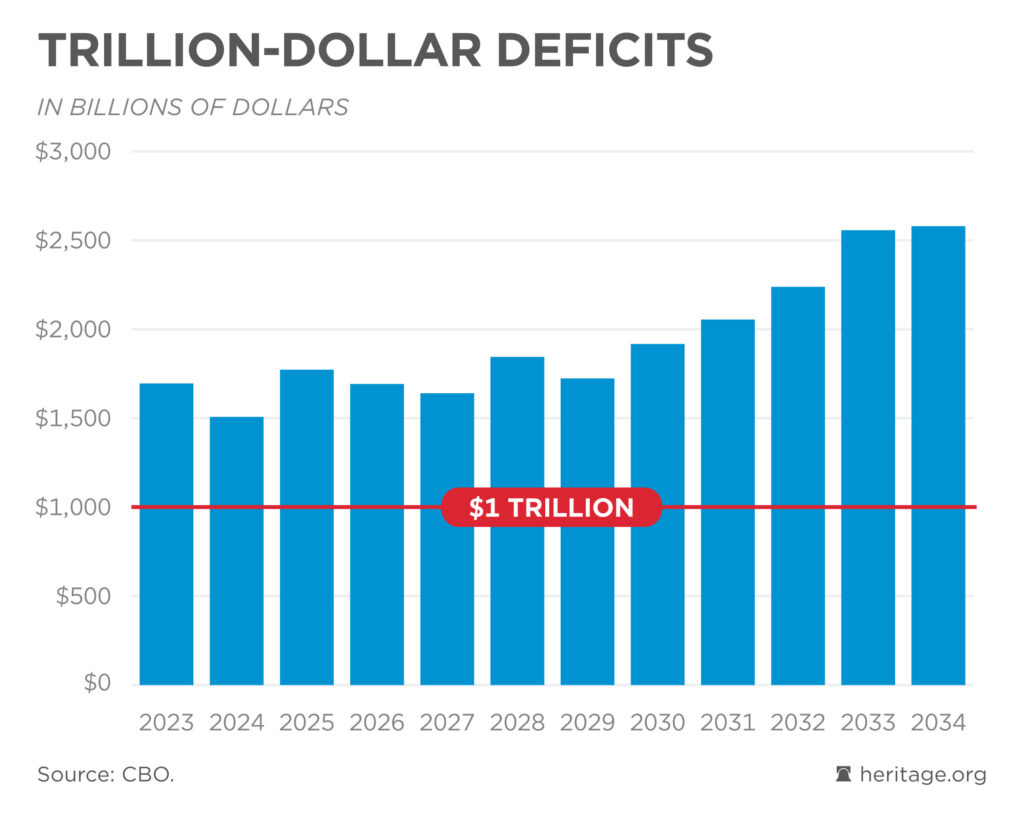

The first-ever $1 trillion deficit happened in fiscal year 2009 and helped fuel the tea party movement in response.

Incredibly, not only are $1 trillion deficits now standard operation procedure, but the federal government is set to crack $2 trillion deficits every year as soon as 2031—even sooner if any new legislation expands the swamp.

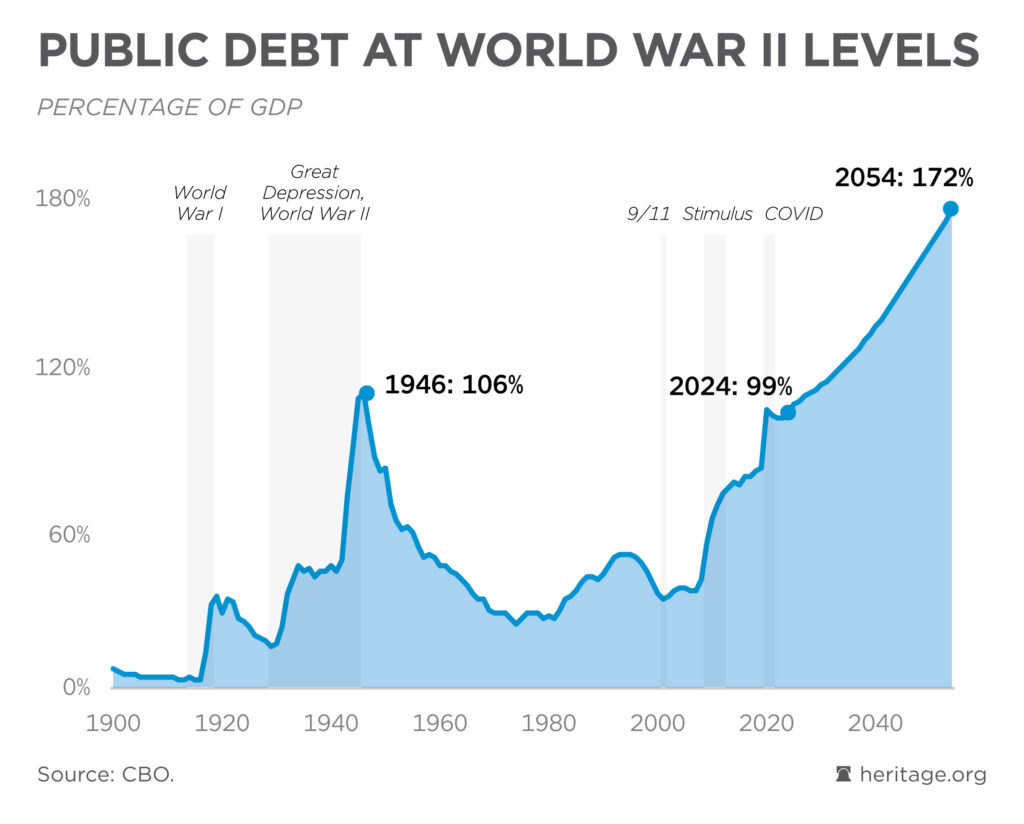

Years of hefty deficits have added to the national debt. Relative to the size of the economy, the public national debt is now nearly as large as it was during World War II. However, there’s a vital difference between then and now: Once the war was over and civilization was saved, federal spending came down and the debt receded.

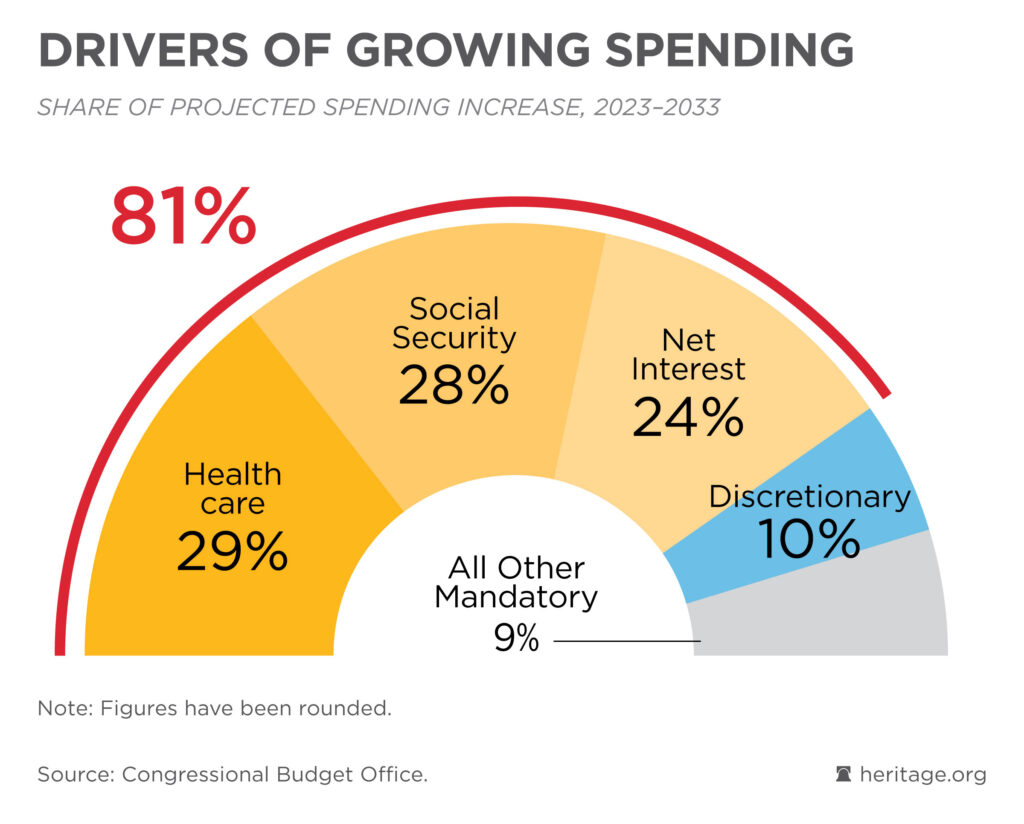

In contrast, most current federal spending is for categories where Uncle Sam has made firm commitments in the future, such as Social Security, Medicare and interest on the debt. In turn, these categories represent the vast majority of expected spending growth, which is what drives long-term debt and deficits.

Both the Social Security and Medicare trust funds are on pace to go bust within the next decade, a reality that most of Washington would rather not talk about. While there are ways to save money on the programs that would retain the core safety-net aspect for seniors, addressing these imbalances will require political courage.

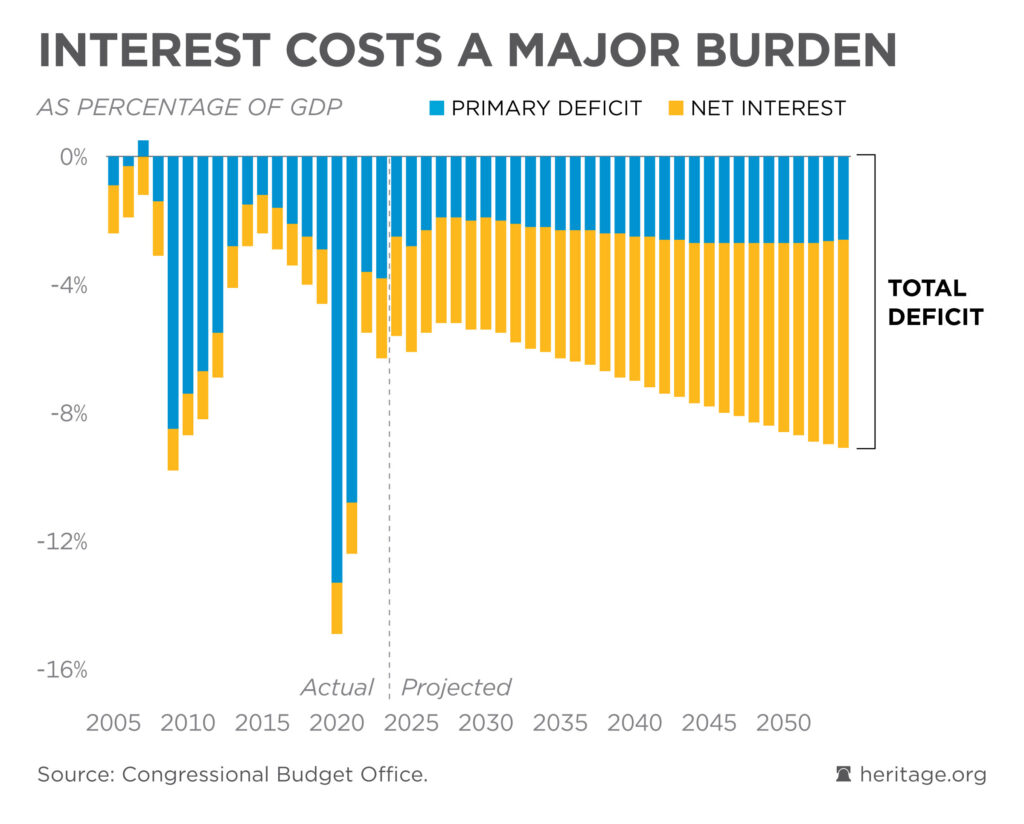

While the growth of the national debt is an important factor behind the recent rise of interest payments, the spike in interest rates is especially concerning.

Incredibly, the Congressional Budget Office revealed that the federal government will likely spend more on interest payments in 2024 than on national defense. And if debt and deficits continue to grow out of control, that will remain the case.

Interest payments don’t help protect the nation or fund public investments. Instead, they represent the bill coming due on big-government spending from the past.

If Congress remains asleep at the wheel, rising interest costs will continue to snowball and threaten the fundamentals of the entire economy.

Legislators will have important opportunities over the next few weeks to start the process of tapping the brakes on deficits. That means:

- Saying “no” to new deficit spending, which includes balancing any potential increases in one area with real cuts somewhere else.

- Getting rid of earmark boondoggles that waste taxpayer money on political cronies and white elephant projects.

- Cutting subsidies for unnecessary government operations, especially those captured by activists.

With Washington’s culture used to easy money, going the other direction will not be easy. However, it is absolutely necessary for America’s fiscal health and prosperity.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

The post 5 Charts Show Why Congress Must Stop Deficit Spending appeared first on The Daily Signal.

.png)

1 year ago

26

1 year ago

26

English (US)

English (US)