ARTICLE AD BOX

Australia’s competition regulator has raised alarms over the rampant spread of cryptocurrency scams on Facebook, claiming that more than half of the crypto-related ads on the platform are fraudulent or violate Meta’s policies.

Australian Regulator Flags Facebook for Crypto Ad Scams

The Australian Competition and Consumer Commission (ACCC) has spotlighted Facebook’s alarming role in the proliferation of crypto scams. According to preliminary research conducted by the ACCC, an estimated 58% of cryptocurrency advertisements on Facebook either breach Meta’s advertising guidelines or are outright scams. This revelation comes amid ongoing legal action against Meta, Facebook’s parent company, over allegations that it facilitated deceptive crypto ads.

In 2022, the ACCC initiated a lawsuit against Meta, accusing the tech giant of “aiding and abetting” fraudulent crypto ads featuring prominent Australian celebrities. These ads often used the likenesses of well-known figures such as entrepreneur Dick Smith, billionaire James Packer, and actors like Chris Hemsworth, Nicole Kidman, and Russell Crowe to lure unsuspecting investors into fraudulent schemes. Despite the ongoing legal battle, a hearing date has yet to be set.

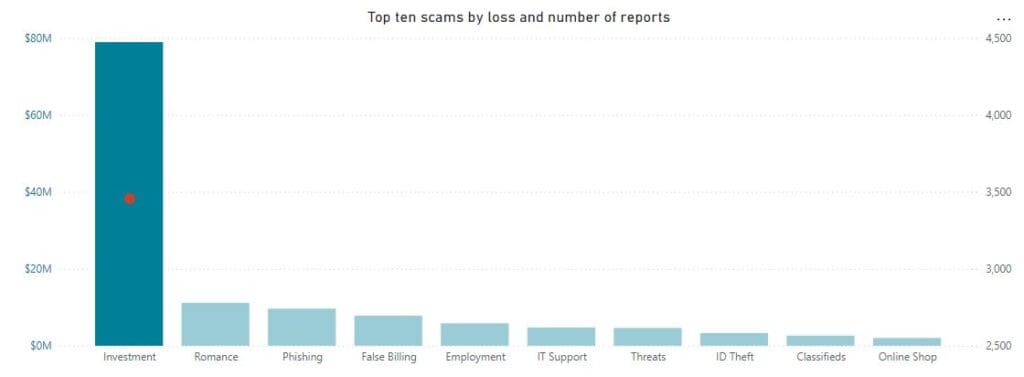

Source: Scamwatch

Source: ScamwatchThe Scale of Crypto Fraud on Facebook

The ACCC’s latest court filing details its investigation into the scale of the problem. The commission’s preliminary analysis identified 600 crypto ads on Facebook, with 234 of those being the focus of their current scrutiny. These ads, which frequently employed misleading tactics, are part of a broader issue that has led to significant financial losses for Australians.

According to Scamwatch, a government initiative tracking fraud, investment scams remain the leading cause of financial losses in Australia, with over $78 million lost in 2024 alone from 3,456 reported cases.

The commission argues that Meta has been aware of these fraudulent practices since at least January 2018 but has failed to take adequate measures to curb the spread of such ads. The ACCC suggests that Meta has the technological capability to flag and warn users about suspicious ads but has not fully utilized this potential.

Instead, Meta’s response has largely been reactive, taking down ads only after receiving complaints, while similar ads continue to appear and generate revenue for the platform.

Also Read: FBI Warns of Rising Crypto Exchange Scams: Key Signs to Watch For

Meta’s Response and the Ongoing Legal Battle

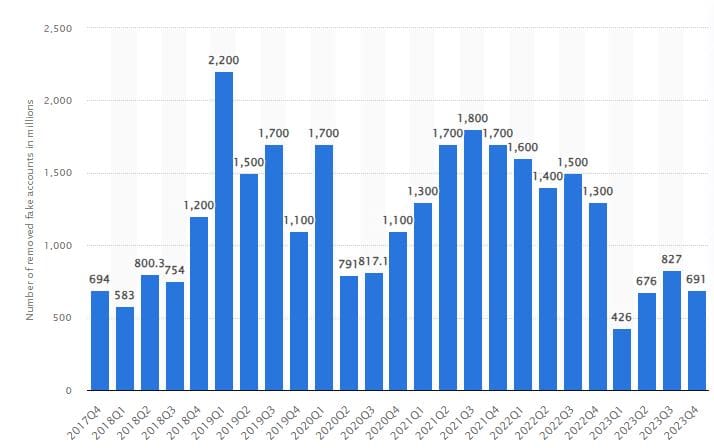

Meta, on its part, claims it is actively working to combat scams through its safety center, investing in technology to detect and remove fake accounts. Statista data shows that in the fourth quarter of 2023, Facebook took action against 691 million fake accounts, a significant number but still lower than the 827 million in the previous quarter.

Source: Statista

Source: StatistaDespite these efforts, the ACCC’s findings suggest that much more needs to be done. The commission’s case is bolstered by a parallel lawsuit from billionaire Andrew Forrest, who is suing Meta for allowing deepfake ads that used his image to promote scam crypto schemes. Although the case was initially dismissed, a U.S. judge recently allowed it to proceed, adding further pressure on Meta.

As the legal proceedings unfold, the ACCC remains steadfast in its claim that Meta’s lax oversight has contributed to a widespread problem that continues to exploit vulnerable investors.

.png)

4 months ago

4

4 months ago

4

English (US)

English (US)