ARTICLE AD BOX

- Large holders have transferred significant amounts of six altcoins (WLD, MOVE, MKR, stETH, OM, RSR) to exchanges, potentially signaling upcoming price drops.

- While some tokens saw intraday gains, the overall market remains cautious of further sell-offs by major holders.

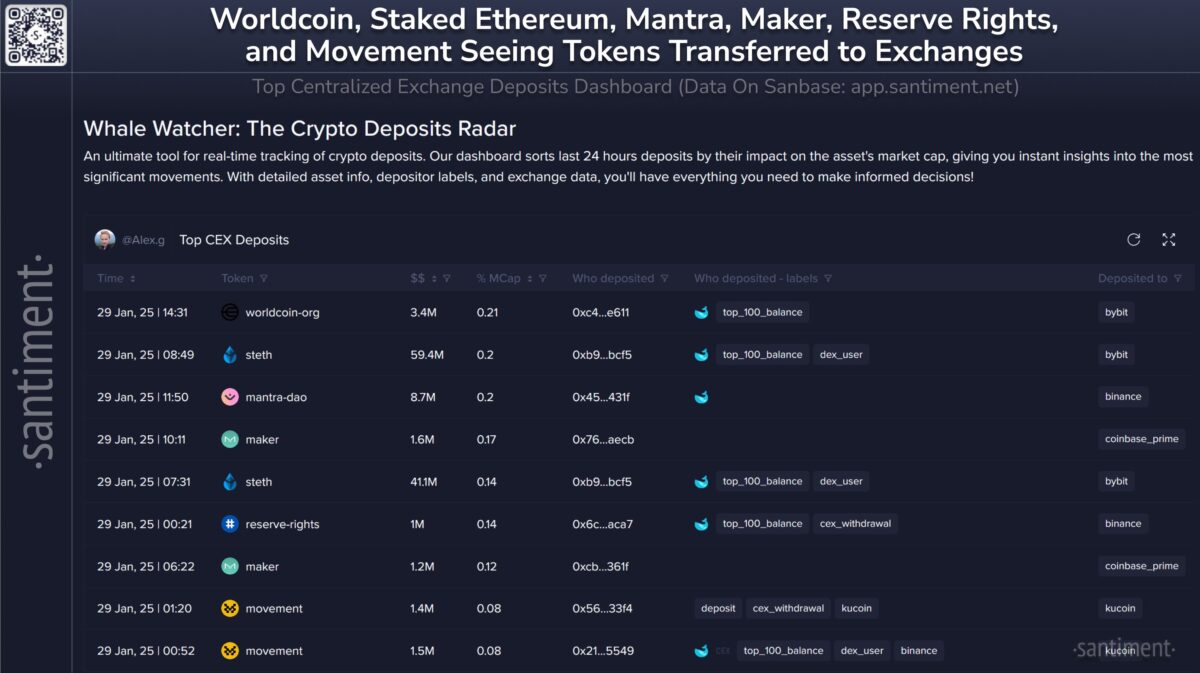

A sudden shift in the crypto market has put six altcoins under the spotlight, raising concerns about potential price drops. Data from Santiment on January 30 revealed that major holders of Worldcoin (WLD), MOVE, Maker (MKR), staked Ethereum (stETH), Mantra (OM), and Reserve Rights (RSR) have offloaded substantial amounts of their holdings onto exchanges, signaling possible bearish momentum.

Source: Santiment

Source: SantimentDeposits of these tokens to platforms like Bybit, Binance, Coinbase, and KuCoin have surged. Such large transfers often indicate that investors are preparing to sell, increasing supply and potentially driving prices lower. As traders navigate these sudden moves, many are keeping a close watch on market reactions.

WLD, a token that has already been struggling, saw 0.21% of its total supply dumped on Bybit. Meanwhile, 0.20% of stETH’s supply followed suit on the same exchange. Other significant transfers included 0.20% of OM to Binance, 0.14% of RSR to Binance, 0.12% of MKR to Coinbase, and 0.08% of MOVE to KuCoin.

WLD and OM Short-term Gains — Potential Reversals Loom?

While deposit surges often foreshadow selling pressure, some of these tokens have shown mixed intraday performance. At the time of reporting, WLD gained 5.70% to trade at $1.78, while OM jumped 8.25% to $4.95. However, not all tokens were in the green—MOVE gained 4.50% to $0.8240, and MKR slightly gained 0.80% to $1,120.

The 200-day moving average of WLD stands at $2.15, while its 50-day moving average hovers at $1.93. If WLD continues trading below these levels, the downtrend that started in December is expected to persist. Its Relative Strength Index (RSI) at 44 suggests the token has yet to enter oversold territory, leaving room for further declines.

Mantra (OM), which recently hit a new all-time high surpassing $5, is also facing scrutiny. Analysts have warned that large investors may soon cash in profits after accumulating below $4, triggering potential volatility. Retail traders remain cautious, fearing a price reversal.

Mantra $OM just made a new ATH

Warned you about whale accumulation happening while the price was below 4$.

Enjoy your gains  #ta https://t.co/5WlKZz3E3K pic.twitter.com/tLvRgnoi7K

#ta https://t.co/5WlKZz3E3K pic.twitter.com/tLvRgnoi7K

— Open4profit (@open4profit) January 26, 2025

Maker (MKR) More Drop Likely?

Maker (MKR) has drawn specific caution from analysts, with some urging patience before jumping in. One analyst warned, “Don’t make rush to enter now. It’s already loss at support, will down to our buying range below $1040. The best entry would be $1025 to $1000 area.”

Meanwhile, stETH saw a 4.30% increase to $3,240, and RSR gained 5.30% to reach $0.01313, signaling that not all tokens are facing immediate downturns. However, the broader market remains wary of further whale-driven sell-offs.

Despite recent bearish signals, Bitcoin (BTC) managed to trade near the $105K level, reflecting some market resilience. The wider crypto landscape has mirrored a recovery, though traders remain on edge about further market-shaking events.

Trump-Linked Purchase Fuels MOVE Buzz

Adding an unexpected twist, Donald Trump’s World Liberty reportedly acquired 2.4 million Movement (MOVE) tokens, according to Lookonchain on X. The move has stirred speculation around the token’s future, sparking discussions about its potential trajectory despite its recent dip.

Trump's World Liberty(@worldlibertyfi) bought another 3,191 $ETH($10M) and 2.4M $MOVE($1.88M) in the past 12 hours.

The 8 tokens purchased by World Liberty are currently all in a loss, with a total loss of $21.78M.

The biggest loss came from $ETH, totaling $14.9M.… pic.twitter.com/pbrbdkPpAD

— Lookonchain (@lookonchain) January 29, 2025

On a technical level, the altcoin market cap, excluding Bitcoin and Ether, is showing signs of bullish sentiment. The Relative Strength Index (RSI) stands at 55, suggesting that buyers still hold some control. A recent MACD indicator confirmed a bullish divergence, hinting potential rally ahead if momentum maintains.

Source: TradingView

Source: TradingView.png)

5 hours ago

4

5 hours ago

4

English (US)

English (US)