ARTICLE AD BOX

After a rally in the first quarter of 2024, most altcoins appear to have peaked. They are struggling significantly from their March 2024 highs, with reductions in value ranging between 70% and 90%.

According to the latest data, the total market capitalization for crypto, excluding Bitcoin and Ethereum, has receded to December 2023 levels. This regression has effectively nullified all gains accrued year-to-date.

Why Crypto Analysts Believe Meme Coins Can Still Make New Highs

Crypto investor Andrew Kang believes that nearly all altcoins have reached their peak for the current bull cycle. Nonetheless, he retains a positive outlook on meme coins, which could defy the broader market downtrend.

“I believe 98%+ of altcoins topped for the cycle except for maybe a handful of coins that may make some new highs in Q4 2024/Q1 2025. Memes probably constitute a majority of the coins that have a chance of making new highs,” Kang revealed on X (Twitter).

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

In contrast to the faltering performance of most altcoins, meme coins exhibit peculiar resilience. Meme coin expert Murad Mahmudov anticipates that the sector will dominate the next altcoin season.

“People are slowly waking up to the black pill that all altcoins have always been meme coins with a bit of techy obfuscation on top. This will cause tens of thousands of people to (1) Sell tech altcoins for pure memes, (2) Buy pure memes instead of tech altcoins with fresh fiat this cycle,” Mahmudov boldly remarked.

Mahmudov’s analysis suggests a shift in investor sentiment. Institutional investors focus largely on Bitcoin (BTC) and, to a lesser extent, Ethereum (ETH), while retail investors gravitate towards meme coins.

“This is why tech altcoins are underperforming. No one wants them,” Mahmudov noted.

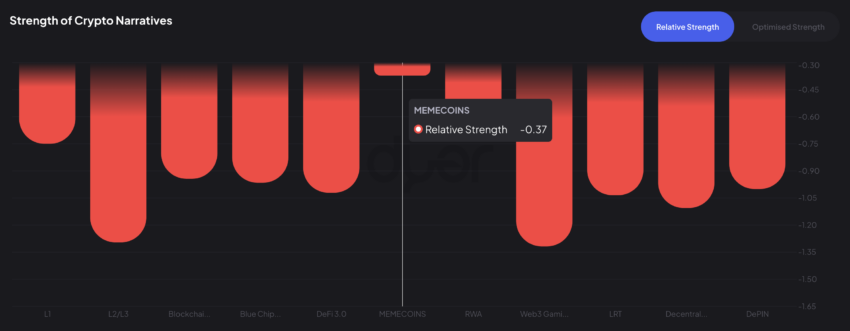

Furthermore, data from the crypto analysis platform DYOR highlights the outperformance of meme coins over the last 90 days during market volatility. With a relative strength of -0.37, meme coins have shown remarkable resilience compared to sectors like Web3 gaming and Layer-2/Layer-3 technologies, which recorded much lower strengths of -1.32 and -1.30, respectively.

Relative strength calculates the performance of a particular sector against the broader market.

Relative Strength of Crypto Narratives. Source: DYOR

Relative Strength of Crypto Narratives. Source: DYORHitesh Malviya, founder of DYOR, provided a critical view of the altcoin ecosystem, particularly those backed by venture capitalists (VCs). He argued that many VC-backed projects, despite their initial promise, often do not survive the long term.

“90% of these so-called projects backed by top-tier VCs are essentially white-collar grifters who promise shiny things, raise funds, run the project for three or four years, and eventually die,” Malviya explained.

This pattern, Malviya warns, usually benefits the founders and VCs financially while leaving retail investors at a loss. Malviya’s remarks highlight the need to focus more on community-aligned altcoins.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

“If we fail at that, the community will keep trading meme coins, which isn’t good for the larger section of the community, as the greed factor is always high and lacks fundamental backing,” Malviya concluded.

The post Altcoins Have Topped, But Meme Coins Can Still Make New Highs appeared first on BeInCrypto.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)