ARTICLE AD BOX

According to market analysts, Ethereum ETFs could make their debut by mid-June.

The newly approved funds aim to broaden Ethereum investment by allowing shares to be traded on stock exchanges, mirroring the cryptocurrency’s price movements.

Analysts Predict Ethereum ETF Debut by Mid-June

Eight ETF applicants, including VanEck, BlackRock, and Fidelity, received regulatory approval on May 23. Hashdex was the only issuer not green-lighted that day. However, the approval doesn’t mean the instruments will be available on the exchanges tomorrow: applicants must secure approved S-1 registration statements before trading begins.

Bloomberg analyst James Seyffart suggests this process could take a few weeks, potentially up to five months. Another Bloomberg analyst, Eric Balchunas, predicts a mid-June launch.

“My guess is there’s only one round of comments on the S-1s. And during BTC one round took two weeks ish. So I this mid-June is certainly poss. Just a guess, tho. We will see,” Balchunas said.

Read more: Ethereum ETF Explained: What It Is and How It Works

VanEck quickly filed its amended S-1 after the 19b-4 approval, with other applicants expected to follow. Gabriel Shapiro from Delphi Labs notes that the SEC’s approval came from its Trading and Markets unit. A SEC commissioner can challenge this decision within ten days.

Expectations for spot Ethereum ETFs are high. Seyffart predicts they could attract 20% of spot Bitcoin ETFs’ flows, while Balchunas estimates a conservative 10-15%. Since their launch, spot Bitcoin ETFs have accumulated $13.3 billion in net inflows. Capturing 20% would mean spot ETH ETFs could see around $2.66 billion in inflows.

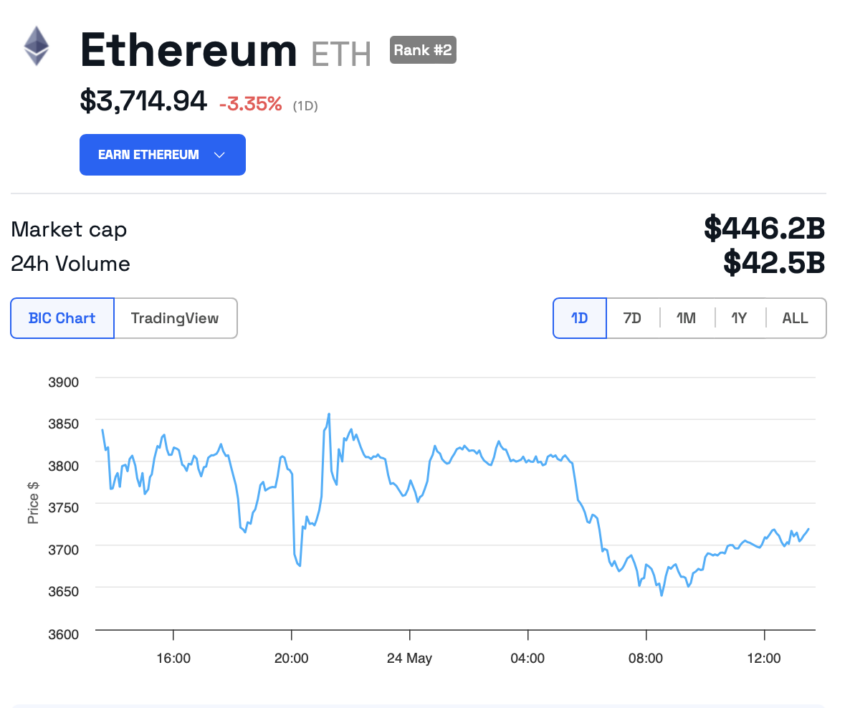

However, the dynamics of the second most capitalized cryptocurrency are still far from bullish. Following the SEC decision, Ethereum’s price increased by just 1%. At the time of the approval, ETH was trading at $3,840. According to BeInCrypto, it has since dropped 3.5% to $3,714.

Read more: How to Invest in Ethereum ETFs?

Ethereum 1D Chart. Source: BeInCrypto

Ethereum 1D Chart. Source: BeInCryptoThis situation exemplifies the “sell the news” phenomenon. Ethereum’s price surged 10% minutes after rumors of an imminent ETF approval began circulating. Now that the news is confirmed, the market has started to sell off.

Bitcoin had a similar response when spot Bitcoin ETFs were approved in January. It took a full month of volatility before BTC returned to pre-approval price. Once it did, it climbed to a new all-time high.

The post Analysts Predict Ethereum ETFs to Launch by Mid-June appeared first on BeInCrypto.

.png)

5 months ago

2

5 months ago

2

English (US)

English (US)