ARTICLE AD BOX

Leading crypto analysts emphasize the importance of not fixating on Bitcoin’s price fluctuations in light of the potential approval of a Bitcoin exchange-traded fund (ETF).

Both analysts acknowledge uncertainty about Bitcoin’s price outcome if the US SEC approves Bitcoin ETFs on January 10.

Analysts Indicate Difficulty in Predicting Bitcoin’s Price

Meltem Demirors posted a Reddit link titled “everything is priced in.”

In a post to her 257,900 followers on X (formerly Twitter), she bolstered the argument that neither she nor other analysts can accurately predict the price or foresee the developments post the potential approval of the Bitcoin ETF next week.

“I have no idea what’s going to happen and I’m comfy not having a short term outlook because the only trend that matters is higher highs higher lows,” she commented on the Reddit post:

“Don’t even ask the question. The answer is yes, it’s priced in. Think Amazon will beat the next earnings? That’s already been priced in.”

Meanwhile, prominent Bitcoin ETF analyst Eric Balchunas commended the reddit statement. He expressed uncertainty to his 173,000 followers regarding the potential price of Bitcoin in the event of approval for a spot Bitcoin ETF.

“My sentiments exactly, I get asked a lot and I just say I’ve no idea. Aside, I think this reddit post should be nominated for the Nobel prize in economics.”

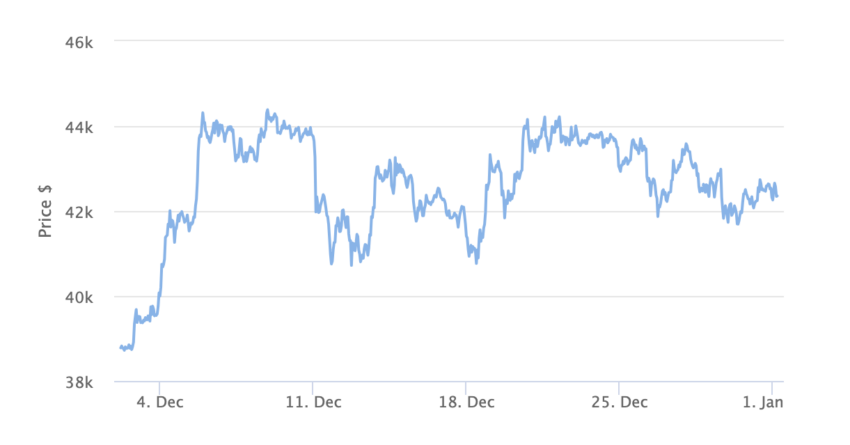

At the time of publication, Bitcoin’s price stands at $42,324.

Bitcoin Price Chart 1 Month. Source: BeInCrypto

Bitcoin Price Chart 1 Month. Source: BeInCryptoRead more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Bitcoin ETF Analyst Recent Developments

Meanwhile, BeInCrypto recently reported that analysts have refuted speculations suggesting that spot Bitcoin funds would rely on ‘paper Bitcoin’ or fractional reserves.

However, instead, these funds will have complete backing from the actual asset. This will require issuers to acquire and hold the asset, Bitcoin, in full.

Rumors regarding the backing of Bitcoin exchange-traded funds have been circulating, adding to the apprehension before the projected January launch.

Deezy founder Danny Kroeger said:

“If the Bitcoin ETFs are just “cash in, cash out,” it seems like they are just paper Bitcoin no? Probably the worst thing that could happen and may result in endless price suppression.”

Read more: Top 7 Platforms To Earn Bitcoin Sign-Up Bonuses in 2024

Top crypto platforms in the US | January 2024

The post Analysts Uncertain on Bitcoin Price Post-ETF Approval appeared first on BeInCrypto.

.png)

10 months ago

2

10 months ago

2

English (US)

English (US)