ARTICLE AD BOX

Arbitrum, a layer 2 network built on the Ethereum blockchain, is witnessing a robust performance as the new year unfolds. Notably, the platform has experienced significant upswings in trading volume and the valuation of its native token, ARB.

Indeed, this positive momentum signals a promising trajectory for Arbitrum in the early stages of the year.

Arbitrum’s Thriving DeFi Ecosystem

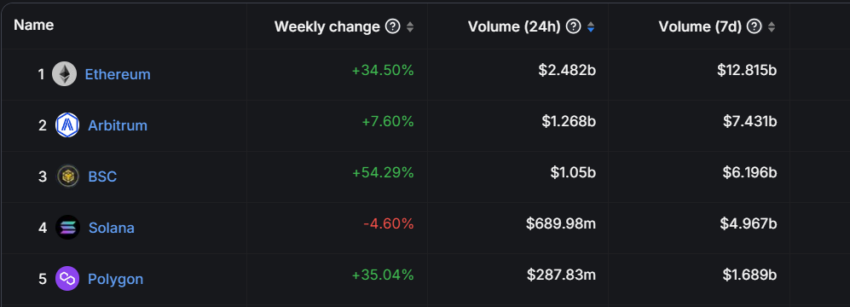

On-chain data from DeFiLlama shows that trading volume on decentralized exchanges (DEX) on the Arbitrum network has surpassed other blockchains, including Binance Smart Chain, Solana, and Polygon, over the past week. Remarkably, on January 5, the DEX volume on Arbitrum briefly outpaced that of Ethereum’s mainnet, marking a noteworthy milestone.

This accomplishment can be largely attributed to a surge in crypto investors leveraging the network’s cost-effective transaction fees.

According to data from L2Fees, Arbitrum is one of the most economical networks to transact, boasting an average fee of $0.26. In stark contrast, the average transaction fee on the Ethereum network exceeds $5. This could be the reason why DEXes on the Arbitrum have experienced a significant increase in trading volume.

Top 5 Chains by Trading Volume. Source: DeFiLlama

Top 5 Chains by Trading Volume. Source: DeFiLlamaWhile Ethereum’s DEX volume has reclaimed its leading position, this data underscores the rapid growth of the layer 2 blockchain since its inception.

Moreover, on-chain data from L2Beat indicates that Arbitrum’s average of 12.85 daily transactions per second positions it among the top three Ethereum-based layer 2 networks. It trails only zkSync Era’s 18.34 transactions per second and Ethereum’s 14.00 transactions per second. This reflects the substantial traction Arbitrum has gained in the competitive landscape of layer 2 solutions.

Total Value Locked Skyrockets

The surging DEX volume and heightened network activity have resulted in a spike in the total value of assets locked (TVL) within the blockchain. TVL is a crucial metric for gauging the capital invested in a blockchain or decentralized finance (DeFi) protocol.

Since the beginning of the year, the blockchain has witnessed a notable positive net flow exceeding $250 million. This surge has propelled Arbitrum’s TVL to an impressive all-time high, reaching $2.64 billion on January 12.

Arbitrum’s TVL. Source: DeFiLlama

Arbitrum’s TVL. Source: DeFiLlamaSimultaneously, Arbitrum’s ARB has demonstrated remarkable performance, marking a more than 20% increase this year. ARB has outperformed leading cryptocurrencies such as Bitcoin and Ethereum.

However, in the wake of the recent broader crypto market downturn, the ARB token faced a notable impact, experiencing a decline of approximately 10% to $2.13 at the time of reporting.

The post Arbitrum (ARB) Dominates Ethereum Layer 2 Networks appeared first on BeInCrypto.

.png)

10 months ago

40

10 months ago

40

English (US)

English (US)