ARTICLE AD BOX

- Alan Santana highlights a potential market correction for Bitcoin, drawing comparisons to price patterns in 2021.

- Over 320,000 active Bitcoin addresses interact near its previous all-time high, signaling strong holder sentiment.

Popular trader Alan Santana’s recent analysis on TradingView shows an interesting trend for Bitcoin, making connections between its price swings in 2021 and the present activity in October 2024. Santana notes that the sessions or candles in April and November 2021 tracked a similar trajectory to what is currently developing.

October 2024’s pattern looks to reflect those of past times, thereby indicating perhaps another significant change in the market.

Bitcoin Bearish Patterns Resemble 2021, Signals Major Downturn

Santana remembers how April 2021 started off on a positive note, with prices rising only to become negative by the end of the month when bearish attitude seized. The bull market came to an end with this change, then saw a robust downturn.

November 2021 also started green, with growing prices, but by the end of the month everything turned red, signifying the start of a protracted bear market.

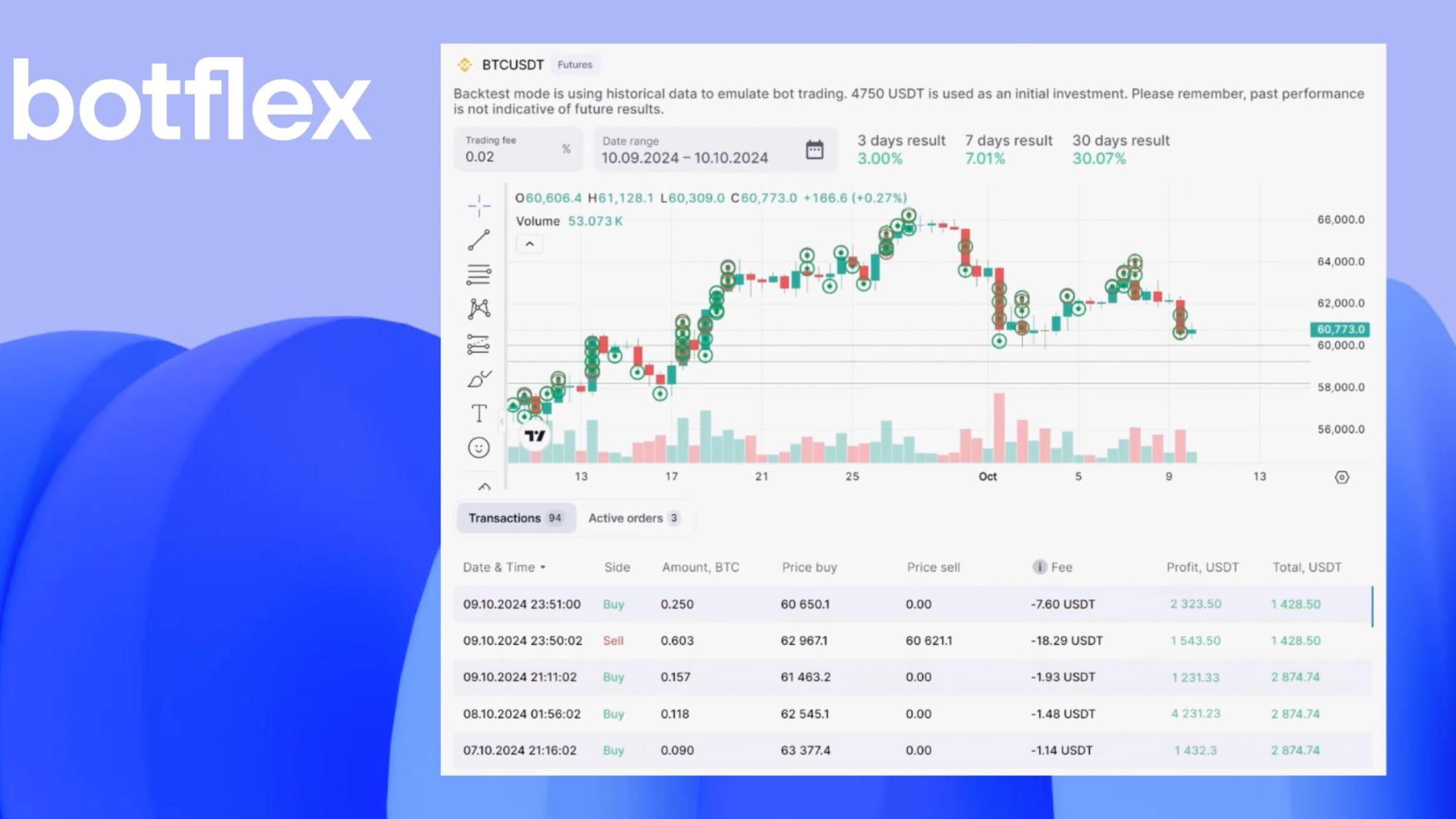

Source: Alan Santana on Trading View

Source: Alan Santana on Trading ViewBy March 2024, when Bitcoin peaked once more, fast forward. A similar trend is seen now in October 2024: a green beginning to the month but red prices are now visible. Like in April and November 2021, a doji candlestick has developed.

Santana claims that if October finishes with a red session, it would confirm a large long-term declining high and maybe start a massive market downturn.

Santana further points out that this adjustment would indicate the continuance of an already existing bearish trend, not only as a fresh occurrence.

Santana says key support levels are $55,000, $44,000, and $36,000. Although Bitcoin might drop even more, he advises that we should watch how the month finishes to render a more firm assessment.

Adding to the gloomy view, Santana also underlines that although Bitcoin and other major altcoins like Ethereum are displaying weakness, many mid-sized and lesser altcoins are seeing amazing gains, some breaking out with 2-3 digit percentage increases despite the general market decline.

Beside that, a prior CNF report shows over 320,000 active Bitcoin addresses are interacting with the price range near to Bitcoin’s past all-time high (ATH). Furthermore, Bitcoin reserves on exchanges are already almost at five-year lows, suggesting that despite market dips, traders are choosing to keep rather than sell.

Meanwhile, having dropped 1.01% over the last 24 hours, BTC is swapped hands about $66,415.74 as of writing.

.png)

2 weeks ago

8

2 weeks ago

8

English (US)

English (US)