ARTICLE AD BOX

- Proposed legislation could position Argentina as a pioneer in government-level crypto adoption and economic strengthening.

- Bitcoin’s potential integration into national reserves mirrors global shift towards cryptocurrency acceptance by governments.

Argentine lawmaker Martín Yeza announced on the social platform X a proposed amendment to the Central Bank of Argentina’s (BCRA) charter. The amendment would allow the BCRA to purchase, hold as reserves, and mine Bitcoin (BTC). This proposal represents a strategic shift in Argentina’s financial asset management strategy, enabling the central bank to directly engage with cryptocurrency.

Martín Yeza presented a bill for Argentina’s central bank (BCRA) to invest 1% of its reserves in Bitcoin and mine Bitcoin, an idea by @santisiri, who proposed this 10 years ago https://t.co/8nYIT3FhOp

— BowTiedMara (@BowTiedMara) November 16, 2024

Currently, the BCRA is prohibited from acquiring or holding unregulated assets like cryptocurrencies as reserves. Yeza’s bill, if passed, would not only allow the bank to include Bitcoin in its reserves but also to participate actively in mining operations.

Yeza referenced an article by crypto advocate Santiago Siri from 2014, suggesting that Argentina allocate 1% of its reserves to Bitcoin. This, he argues, could strengthen Argentina’s position in the global financial system.

However, Yeza acknowledged the bill’s low probability of passing this year and emphasized the necessity of support from President Javier Milei, who has expressed a favorable stance toward Bitcoin, as we have previously reported on CNF.

The proposal would require substantial investment in both technology and energy infrastructure to facilitate Bitcoin mining. This includes the setup of facilities equipped with advanced ASIC hardware, which is known for its significant energy consumption.

There is a suggestion that renewable energy sources or decentralized energy models could offset some of these energy demands, but these options would still require substantial capital outlay.

This legislative push coincides with Argentina’s ongoing energy challenges. Energy Secretary María Tettamanti has highlighted the severe limitations due to years of underinvestment in the energy sector, with a declared emergency in energy generation, transportation, and distribution. The proposed Bitcoin mining operations would necessitate careful consideration of their potential impact on the already strained energy grid.

Additionally, this announcement was made shortly after President Milei’s appearance at Argentina’s inaugural Tech Forum, attended by key figures in the cryptocurrency industry. During the forum, Milei praised the potential of technological advancements to yield substantial returns and expressed his desire for Argentina to become a sanctuary for technological innovation.

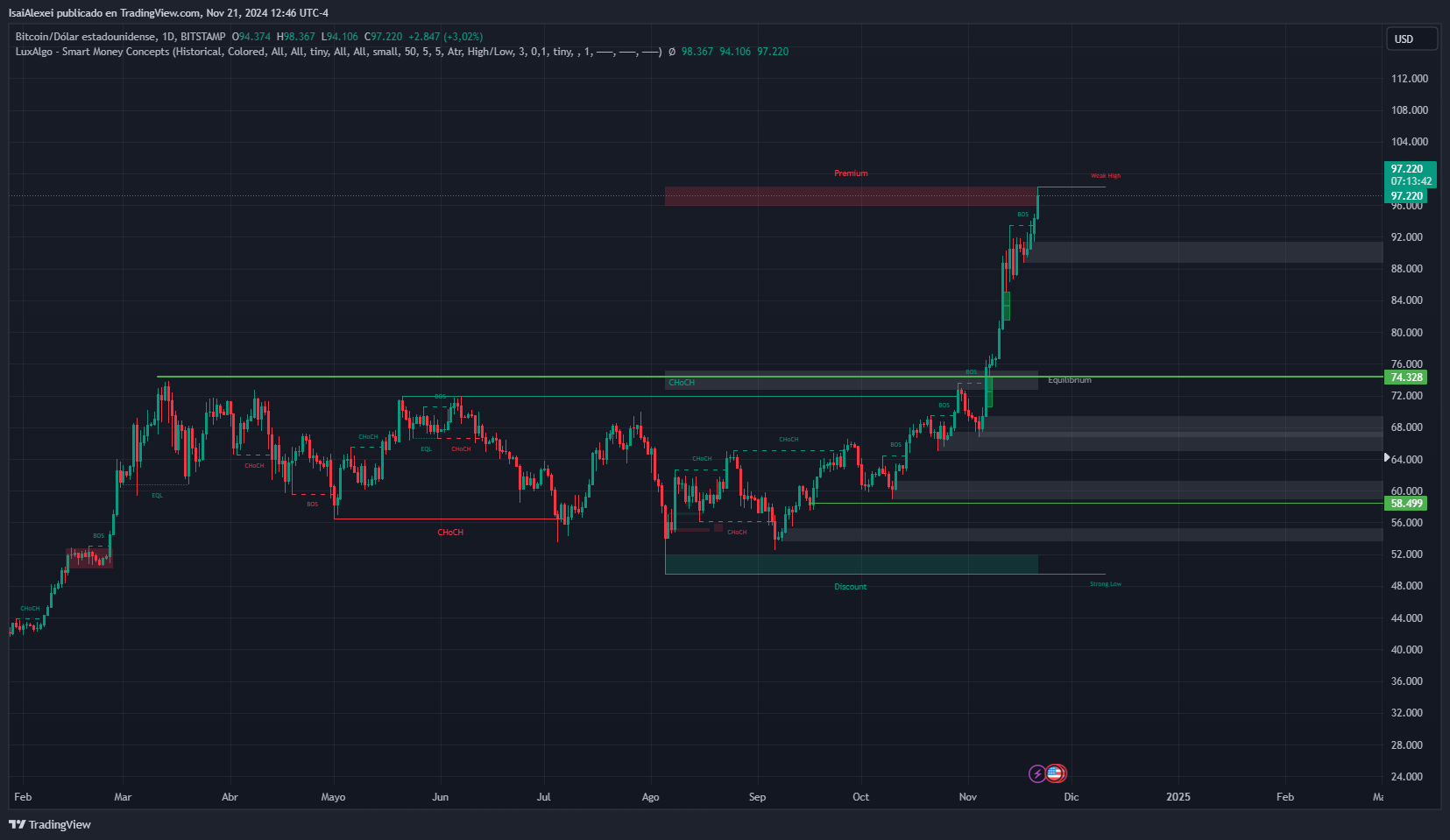

Bitcoin (BTC) is currently trading at $97,112 USD, reflecting a daily gain of 2.90%. Over the past week, Bitcoin has risen by 7.30%, while its monthly growth stands at 44.19%, underscoring significant bullish momentum. Year-to-date, Bitcoin has surged by 129.78%, demonstrating sustained interest and confidence from investors.

Technical Analysis:

Source: Tradingview

Source: TradingviewBitcoin is nearing the critical psychological milestone of $100,000 USD. Breaking past this level could signal the start of another significant leg upward, with analysts suggesting a potential climb toward $120,000 – $130,000 USD. Key support is observed at $90,000 USD, providing a safety net against short-term corrections.

.png)

4 hours ago

1

4 hours ago

1

English (US)

English (US)