ARTICLE AD BOX

The Australian Securities and Investments Commission (ASIC) has scored a significant legal victory in the crypto sector. The court found that the Sydney-based start-up Block Earner had been offering unlicensed financial products to retail investors.

This ruling underlines the regulatory challenges faced by the crypto industry in Australia and highlights the government’s continued efforts to bring clarity and control to this evolving domain.

Block Earner Rolls with the Punches

Justice Ian Jackman ruled that Block Earner’s fixed-yield crypto products should have been registered as a managed investment scheme, aligning with ASIC’s stance on crypto regulation.

Block Earner, founded by Jordan Momtazi and Charlie Karaboga, has been in the spotlight for its innovative approach to linking investors with decentralized finance (DeFi) lending protocols. This approach, offering returns for staking a stablecoin, ventured beyond typical crypto exchange and app offerings.

However, in a twist to the proceedings, the court gave the green light to another Block Earner product, “DeFi Access.” Unlike its fixed-yield products, DeFi Access does not involve investing customer funds in other protocols for a fixed return. Instead, it connects customers directly to protocols that offer variable yields. Justice Jackman dismissed ASIC’s claim that this product was also a managed investment scheme.

Block Earner’s response to the judgment was swift and clear. James Coombes, the company’s head of business, asserted:

“This judgment doesn’t affect our operations, we moved on from the Earner product over a year ago.”

This response indicates the company’s agility in adapting to changing regulations.

Read more: Identifying & Exploring Risk on DeFi Lending Protocols

A Broad DeFi Industry Overhaul

The case against Block Earner is part of a broader push by ASIC to regulate the crypto industry. The regulator’s current actions include a lawsuit against Gold Coast-based BPS Financial over a product known as Qoin and allegations against Finder.com for offering its Finder Earn product without the necessary license.

These cases demonstrate ASIC’s determination to apply existing financial services frameworks to new crypto technologies, including DeFi products and decentralized autonomous organizations (DAOs).

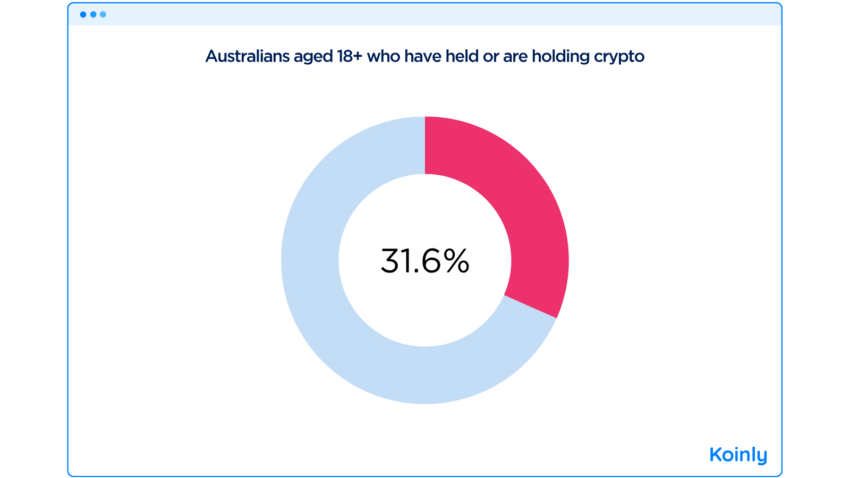

This aggressive regulatory stance poses significant challenges for the crypto industry in Australia. And these rule changes affect a growing population of crypto holders. According to a 2023 study, nearly 32% of Australians aged 18 and older are currently holding or have owned crypto.

Australians aged 18+ who have held or are holding crypto. Source: Koinly

Australians aged 18+ who have held or are holding crypto. Source: KoinlyCompanies in the space are now grappling with the complexities of a regulatory environment that is still taking shape.

The Block Earner case serves as a cautionary tale for other crypto firms operating in or planning to enter the Australian market, underscoring the need for compliance with existing financial services laws.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post Australian Court Sets Crypto Licensure Precedent in Block Earner Case appeared first on BeInCrypto.

.png)

9 months ago

1

9 months ago

1

English (US)

English (US)