ARTICLE AD BOX

The Australian Taxation Office (ATO) is increasing its oversight of crypto users. Approximately 1.2 million accounts are being scrutinized for potential tax discrepancies.

This significant action comes as interest in crypto continues to rise, prompting the ATO to examine personal data and transaction details provided by crypto exchanges.

How Australia Investigates Crypto Tax Evasion

In an effort to combat tax evasion, the ATO’s latest initiative aims to uncover any unreported exchanges of crypto assets for currency or other goods and services. Due to the complexity of the crypto industry, there is often a genuine lack of awareness about tax obligations.

Consequently, the ATO seeks to both regulate and educate traders on their fiscal duties.

“Also, the ability to purchase crypto assets using false information may make them attractive to those seeking to avoid their tax obligations”, ATO said.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

For taxation, Australia treats crypto as assets, not as foreign currency. This classification means investors must pay capital gains tax on profits made from selling crypto assets and when trading digital assets. The ATO’s reinforced efforts underline a commitment to ensuring all taxable activities are transparent and properly reported.

The popularity of crypto assets in Australia is on the rise, as indicated by a treasury report. It revealed that over 800,000 taxpayers had transacted in digital assets over the past three years, with a significant 63% increase in 2021.

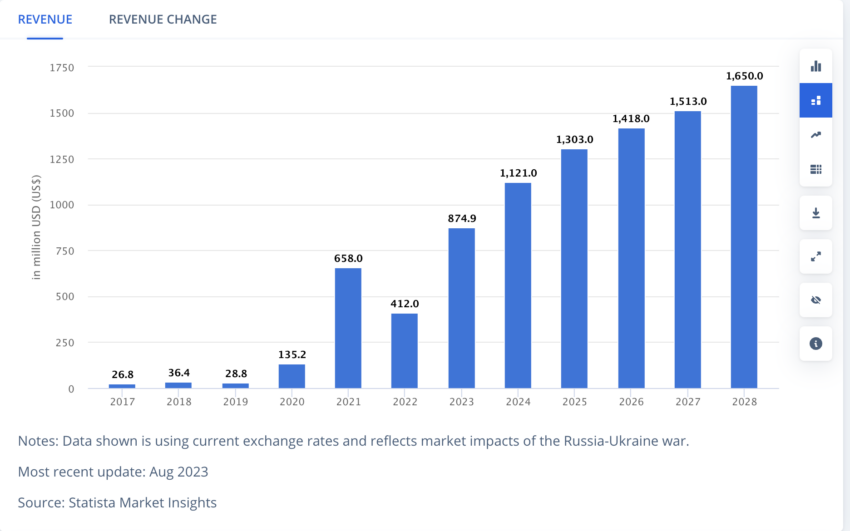

According to Statista, crypto revenue in Australia is expected to grow at a compounded annual growth rate of 10.15%, reaching a projected total of $1.6 billion by 2028.

Australia Crypto Revenue Forecast. Source: Statista

Australia Crypto Revenue Forecast. Source: StatistaSimultaneously, the Australian Securities Exchange (ASX Ltd.) is preparing to expand its offerings with Bitcoin exchange-traded funds (ETFs). These approvals could see the introduction of the first spot Bitcoin ETFs in Australia before the end of 2024.

Companies like BetaShares and DigitalX Ltd. are preparing to launch their ETF products, which are pending regulatory approval.

VanEck, a veteran in the ETF sphere, has reentered the Australian market with a renewed application for Bitcoin ETFs. This move signals growing institutional interest in crypto investments.

Read more: Complete Guide to Filing Cryptocurrency Taxes in 2024

The potential infusion of capital from Australia’s robust $2.3 trillion pension sector into these new financial instruments could significantly support the crypto ETF market. Particularly, self-managed superannuation funds offer a promising opportunity for diversification into cryptocurrencies.

The post Australian Taxation Office Targets 1.2 Million Accounts in Major Tax Crackdown appeared first on BeInCrypto.

.png)

6 months ago

2

6 months ago

2

English (US)

English (US)