ARTICLE AD BOX

- Avalanche (AVAX) faces a token unlock of 9.54 million tokens on August 20.

- Whales show accumulation behavior, while derivatives traders express bearish sentiment.

- AVAX price consolidates between $20.43 and $22.79, with technical indicators suggesting continued sideways movement.

Avalanche (AVAX) stands at a critical juncture as it approaches a major token unlock event scheduled for August 20. This impending release of 9.54 million tokens, valued at approximately $251 million, has the potential to introduce substantial volatility into AVAX’s price action.

As market participants brace for this event, an intriguing divergence in sentiment between key stakeholder groups has emerged, painting a complex picture of AVAX’s near-term prospects.

On-chain analysis reveals a striking contrast between the behavior of large holders (whales) and the sentiment expressed in the derivatives market.

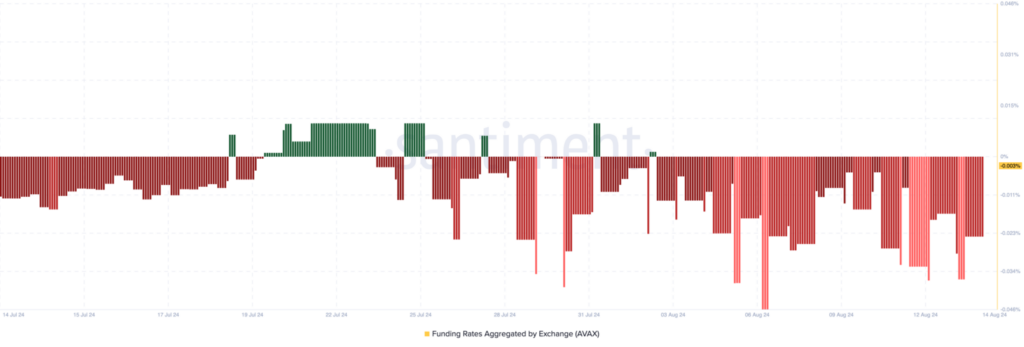

Avalanche shows negative funding rate

Santiment data indicates a negative Funding Rate for AVAX, suggesting a bearish outlook among traders in the futures market. This metric, which represents the cost of maintaining an open position, typically signals expectations of price declines when they are negative.

Source: Santiment

Source: SantimentConversely, whale activity paints a more optimistic picture. IntoTheBlock’s Large Holders Netflow metric has surged by 33.66% over the past week, indicating major accumulation by AVAX’s largest stakeholders.

This divergence between whale behavior and derivatives trader sentiment creates an intriguing dynamic, potentially setting the stage for increased volatility as these conflicting forces play out in the market.

From a technical perspective, AVAX’s price action reflects this uncertainty, with the token consolidating around $21.27 at the time of writing. The cryptocurrency briefly dipped below the psychologically important $20 level on August 8, but has since stabilized within a narrow range.

The Moving Average Convergence Divergence (MACD) indicator currently leans bearish, suggesting that a significant breakout may face challenges in the near term.

The Fibonacci retracement tool provides additional context for AVAX’s potential price movements, delineating key support and resistance levels.

Current price action suggests that AVAX may continue to oscillate between a swing low of $20.43 and a swing high of $22.79, reflecting the market’s indecision in the face of conflicting signals.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)