ARTICLE AD BOX

Balaji Srinivasan, former Coinbase Chief Technology Officer (CTO) and prominent angel investor, recently shared his insights on the future interplay between cryptocurrency and artificial intelligence (AI) on his X (Twitter) account.

Srinivasan posits that cryptocurrency will become the predominant form of money as AI and robotics increase due to its inherent scarcity and security. This viewpoint has sparked a debate within the crypto community.

Scarcity and Security: The Pillars of Future Money

Srinivasan outlined several reasons for this viewpoint. He emphasized that in an era of AI-driven abundance, cryptocurrency represents a form of digital scarcity that will retain its value and importance.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

He explained that cryptocurrency is uniquely suited to proving human authenticity in a world where AI can easily mimic human behavior. Additionally, while robots owned by individuals do not require monetary exchange for operation, robots operated by different economic actors will necessitate financial transactions. Cryptocurrency can facilitate these transactions efficiently and securely.

Srinivasan highlighted that while AI might create digital abundance, it does not eliminate all forms of scarcity. Critical resources, such as the supply chains for manufacturing robots and the infrastructure for AI data centers, remain limited. These resources, predominantly located in Asia, underscore the continuing need for a valuable and secure medium of exchange, which he argues is cryptocurrency.

One of Srinivasan’s key points focused on the private keys necessary for controlling robots in the AI age. He stated that these keys will likely be based on crypto technology due to its superior security compared to traditional Web2 systems.

“AI is digital abundance, but it doesn’t make everything abundant. Crypto is digital scarcity and complements AI’s abundance,” he concluded.

Crypto Meets AI: Expert Insights on Future Integration

Srinivasan’s comments were in response to a query from Emad Mostaque, former CEO of Stability AI, who asked about the future of money and economic policy in a world populated by robots and AI agents. This discussion ignited a debate within the crypto community, with some members advocating for a more Bitcoin-centric view, asserting that Bitcoin’s scarcity makes it a more viable candidate than other cryptocurrencies.

“Balaji replaced ‘crypto’ with ‘Bitcoin,’ and everything looks fine because money converges to one. I can bet no autonomous AI agent/robot will accept Vitalik Buterin [and] Ethereum in charge of their monetary policy and hence their purchasing power,” a crypto community replied.

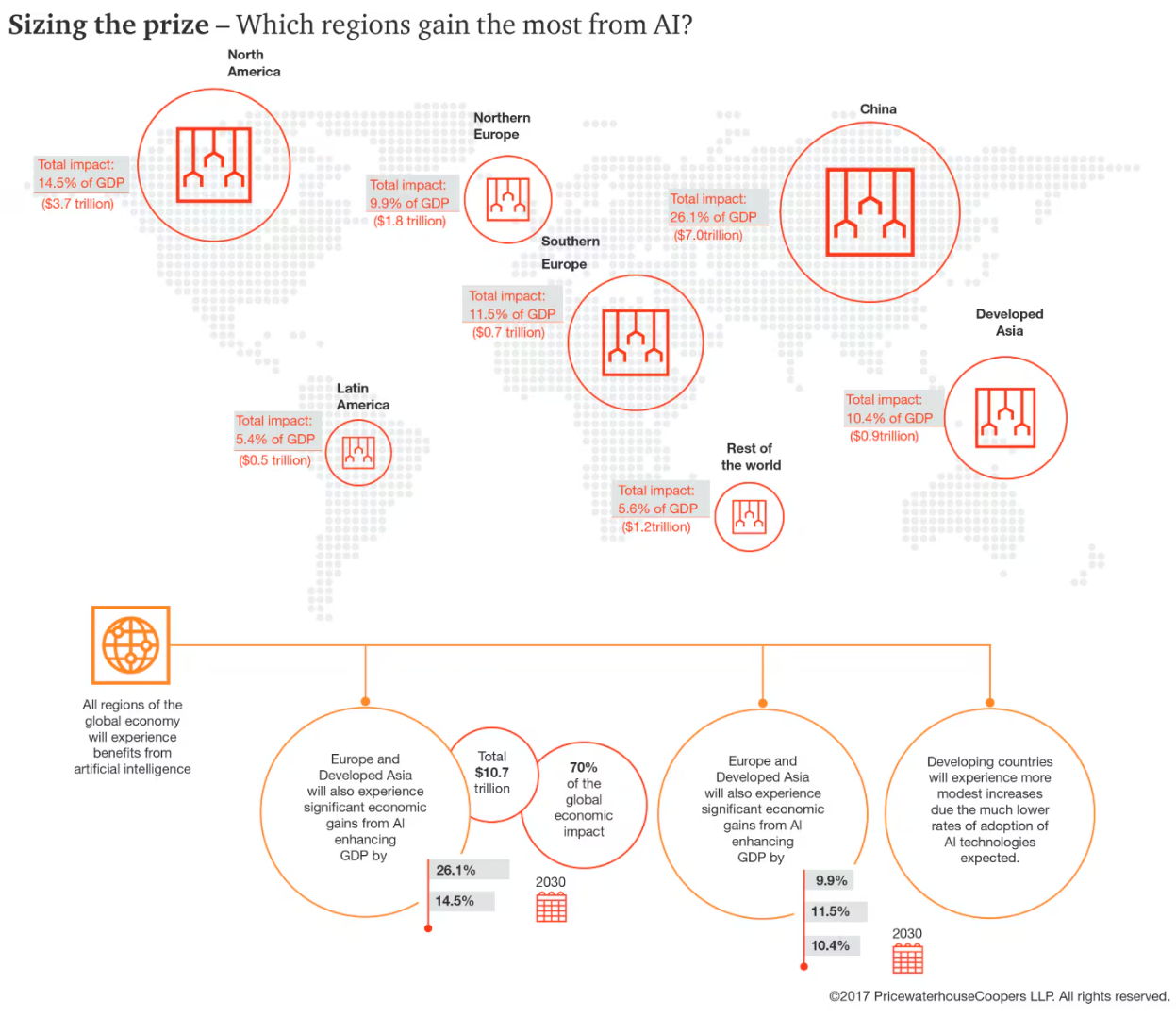

Despite differing opinions within the community, Srinivasan’s broader point about the synergy between AI and cryptocurrency has garnered attention. Industry reports like Bitwise predict that integrating AI and the crypto industry could add as much as $20 trillion to the global GDP by 2030. This potential for economic growth shows the importance of understanding and leveraging this emerging technological convergence.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

Global AI Impact by 2030. Source: PwC

Global AI Impact by 2030. Source: PwCDominic Williams, founder and chief scientist of DFINITY, shared his perspective on the potential of AI-crypto synergy. He noted that AI running on blockchain-based smart contracts could revolutionize various sectors, from decentralized finance (DeFi) to Web3 social media.

Additionally, Williams emphasized that smart contracts’ inherent security, autonomy, and composability make them ideal for deploying AI applications on the blockchain. He also pointed out that decentralized AI could offer significant regulatory advantages, enhancing privacy and reducing the risks of bad actors.

“They are tamper-proof, ensuring security and correct operation; unstoppable, as they are resilient and always running; autonomous, requiring no trusted intermediary; and composable, making them easy to integrate with other blockchain systems and services,” he explained to BeInCrypto.

As AI evolves, its intersection with crypto will likely shape the next phase of technological and economic development. Srinivasan’s vision of a crypto-dominated monetary system in the AI era reflects the growing recognition of cryptocurrency’s potential to address advanced AI technologies’ unique challenges and opportunities.

The post Balaji Srinivasan Explains Why Crypto is the Future of Money in an AI-Driven Era appeared first on BeInCrypto.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)