ARTICLE AD BOX

The post Big Secret: Why BTC ETF Holders Stay Confident in Front Of Volatility appeared first on Coinpedia Fintech News

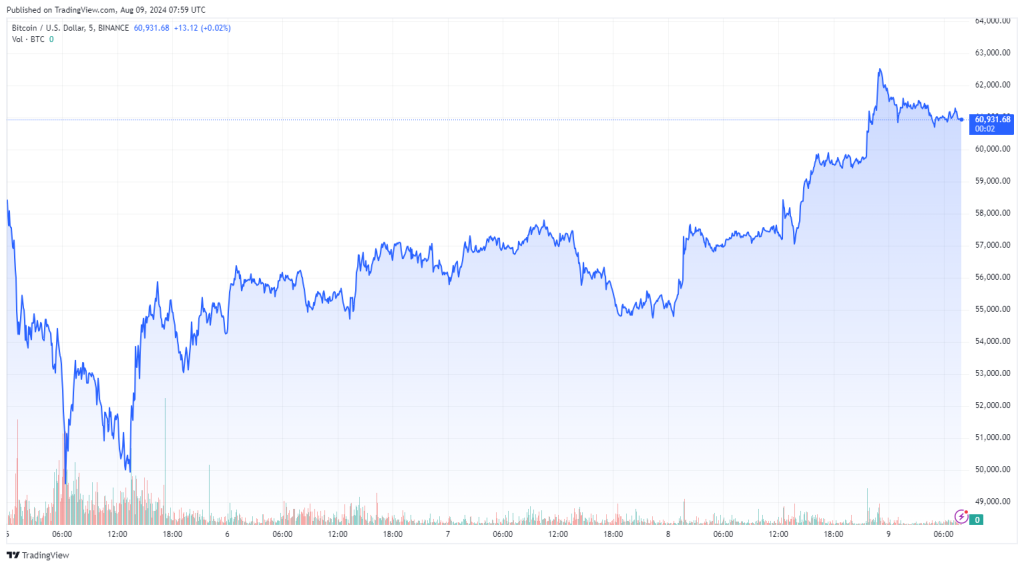

Despite a nearly 20% drop in Bitcoin (BTC) and worsening conditions for other cryptocurrencies, Bitcoin ETF holders like IBIT and ARKB remained calm, with zero net flows. This stability reflects their deep faith in Bitcoin’s (BTC) long-term potential, viewing current volatility as a step toward future growth and there are market-wide implications to this.

Bitcoin ETF Options Could Shake Up the Market

Breaking news: the Chicago Board Options Exchange (CBOE) has just refiled its application for Bitcoin (BTC) ETF options, bulked up to a comprehensive 44-page package that covers all the ground.

This revised filing tackle’s critical issues head-on, singling out position limits and market manipulation, which suggests a well-known regulator may have had a hand in shaping the new rules.

As Bloomberg analysts predict a potential launch of these ETF options by the fourth quarter of this year, the crypto market is on edge, anticipating how this could attract more institutional interest and offer new strategies for managing risk.

Big Possibilities for Big Changes?

Interestingly, amid recent market volatility, Bitcoin (BTC) ETF holders have remained unfazed. While Bitcoin (BTC) saw a near 20% drop, these ETF holders showed zero net flows, demonstrating a level of confidence that suggests a belief in Bitcoin (BTC)’s long-term potential.

This calm amidst the storm reflects a mature approach to the market, often attributed to seasoned players with ‘diamond hands‘ who view dips as buying opportunities rather than reasons to panic.

With Bitcoin (BTC) currently trading in the $56,932 to $62,490 range, the market seems to be in a consolidation phase, with an RSI of 48 indicating neutral sentiment. A Bitcoin (BTC) ETF approval could be the spark that sets Bitcoin (BTC) on a collision course with its resistance levels.

Minotaurus (MTAUR): Visions of Long-Term Success?

Should big-money players continue to jack up Bitcoin (BTC), the digital coin could witness an unprecedented price jump, closing in on the dizzying heights of $73,737.94.

The clock is ticking, and all eyes are on regulators as their upcoming decisions are poised to send Bitcoin’s (BTC) price into a tailspin or spark a rocket ship rally.

That rally will impact not just the main crypto coin, but also altcoins of all stripes. We did our best to analyze the current situation to figure out which projects seem to hold the most potential for fast-paced ascend and one specific presale kept coming up – Minotaurus (MTAUR).

With a -74% presale special, Minotaurus (MTAUR) presents a unique pick for those looking to ride the wave of potential growth. Long-term upside possibilities favour early adopters as prices are anticipated to rise, similar to what we’re seeing with Bitcoin (BTC).

Conscious Development + Safe and Effective

- Combining blockchain with casual gaming, Minotaurus (MTAUR) provides bespoke avatars, in-game bonuses, and special events.

- At the core of this project, there’s a brilliant game that enables never-ending labyrinth exploration as well as fun, challenging battles.

- Designed for long-value appreciation, the $MTAUR token is priced at $0.0000516 during presale and $0.00020 upon listing.

- There are strong vesting and referral incentives available for all participants.

- Minotaurus (MTAUR) is backed by verified smart contracts and a seasoned staff with an eye on long-term progress and security.

Conclusion

Amid BTC’s 20% drop and ETF stability, institutional confidence remains. As the CBOE refiles its Bitcoin ETF application, the market awaits a potential boost. For those seeking growth, MTAUR offers a compelling opportunity with a 74% presale deal, promising long-term upside and unique benefits in blockchain gaming.

Learn more about Minotaurus:

- Website: http://minotaurus.io/

- Announcements: https://t.me/minotaurus_official

- Chat: https://t.me/minotaurus_chat

- Twitter: https://twitter.com/minotaurus_io

.png)

4 months ago

3

4 months ago

3

English (US)

English (US)