ARTICLE AD BOX

- CFTC Court Decision: Highlight the U.S. District Court’s approval of the settlement against Binance and its former CEO CZ, underscoring the significant financial penalties imposed by the CFTC.

- Enforcement and Regulatory Compliance: Discuss the enforcement action details, CZ’s guilty plea, the imposed restrictions, and the emphasis on regulatory compliance moving forward, signalling changes in Binance’s operations post-settlement.

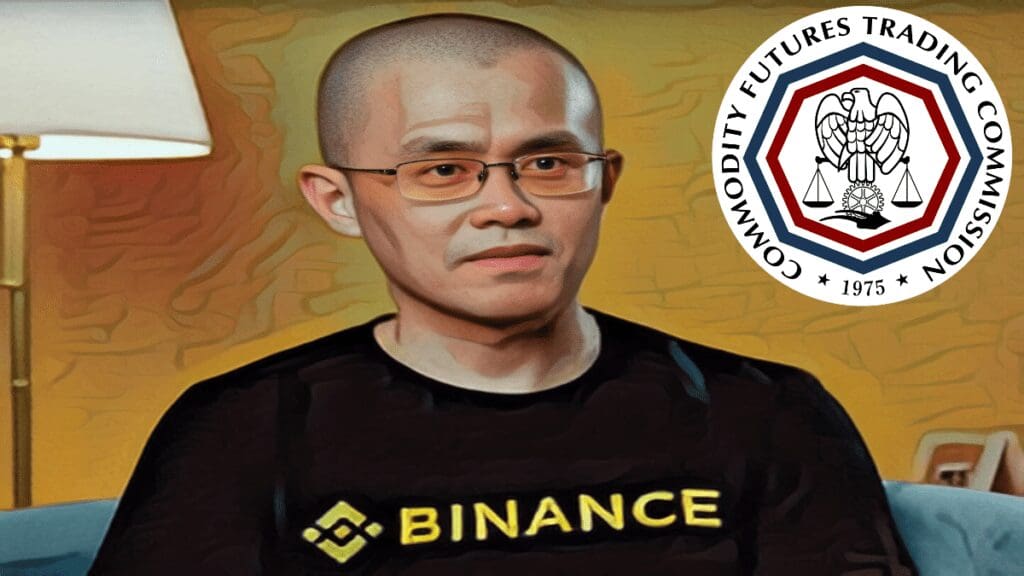

The United States District Court for the Northern District of Illinois has officially approved a settlement involving Binance, the renowned crypto exchange, and its former CEO Changpeng Zhao (CZ), ordering Binance to pay a staggering $2.7 billion while CZ faces a $150 million penalty in response to the Commodity Futures Trading Commission’s (CFTC) enforcement action.

In a recent statement on December 18, the CFTC disclosed that the court’s approval marked the conclusion of a protracted legal dispute initiated by the CFTC back in November. According to the CFTC, the court found both CZ and Binance guilty of violating the Commodity Exchange Act (CEA) and CFTC regulations.

This ruling demanded CZ to personally pay $150 million as a civil monetary penalty while requiring Binance to disgorge $1.35 billion from ill-gotten transaction fees and pay another $1.35 billion as a penalty to the CFTC.

Federal Court Enters Order Against Binance and Former CEO, Zhao, Concluding CFTC Enforcement Action: https://t.co/YJD1lglbsZ

— CFTC (@CFTC) December 18, 2023

This settlement puts an end to the prolonged legal battle between CZ, Binance, and the CFTC, commencing when the CFTC sued CZ and Binance on allegations of evading federal law and operating an illegal derivatives exchange on March 27.

As part of the settlement, CZ agreed to step down from his position at Binance, aligning with the broader settlement made with the U.S. Department of Justice, the Treasury Department, and the CFTC on November 21.

Additionally, CZ pleaded guilty to civil charges and a criminal charge related to Anti-Money Laundering (AML) laws. Subsequently, the court ordered CZ to stay in the U.S. until his sentencing date scheduled for February 23, 2024, facing a potential 18-month prison term on money laundering charges.

Also Read: Binance’s Ex-CEO ChangPeng Zhao (CZ) Could Face 10 Years Behind Bars

The settlement outlines stringent measures for both Binance and CZ, mandating robust Know Your Customer (KYC) measures on the exchange and necessitating Binance to adopt a formalized corporate governance structure. This structure involves the establishment of a board of directors with independent members, a compliance committee, and an audit committee.

The court also imposed a separate order, penalizing Binance’s former chief compliance officer, Samuel Lim, with a $1.5 million civil monetary penalty for aiding and abetting Binance’s violations and engaging in activities to evade U.S. law.

Following CZ’s departure, Binance’s former global head of regional markets, Richard Teng, assumed the CEO role. In a recent interview, Teng assured stakeholders of Binance’s reformed approach, emphasizing the elimination of compliance gaps and the commitment to stringent compliance with regulatory authorities worldwide.

It is an honour and with the deepest humility that I step into the role of Binance’s new CEO.

We operate the world's largest cryptocurrency exchange by volume. The trust placed on us by our 150m users and thousands of employees is a responsibility that I take seriously and hold…

— Richard Teng (@_RichardTeng) November 21, 2023

Over the past 18 months, Binance has faced the closure or significant modification of its core services across various global jurisdictions, including the Netherlands, Cyprus, Australia, and Canada, signalling the intensified regulatory scrutiny surrounding its operations.

.png)

1 year ago

7

1 year ago

7

English (US)

English (US)