ARTICLE AD BOX

- Binance Nigeria has facilitated transactions exceeding $26 billion from unidentified sources within a year.

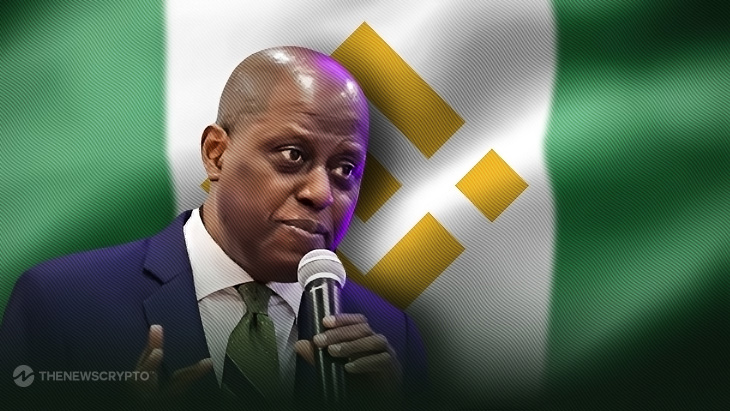

- Olayemi Cardoso highlighted illicit and suspicious flows on certain platforms that caused the depreciation of the naira.

In a tumultuous period for cryptocurrency exchanges in Nigeria, Binance Nigeria has come under intense scrutiny as it facilitated transactions exceeding $26 billion from unidentified sources within the past year. The digital assets platform, known for its peer-to-peer trading model, allows users to engage in buying and selling cryptocurrencies with relative ease.

According to the local media channel, Governor Olayemi Cardoso of the Central Bank of Nigeria (CBN) revealed that $26 billion flowed through Binance Nigeria from “inadequately identified sources” and accounts over the past 12 months. This revelation comes amidst mounting pressure on the CBN due to the depreciation of the local currency, the naira, and persisting inflation, both of which continue to strain the nation’s economy.

Nigeria Plans to Begin Strict Restrictions

Further, in response to concerns about unregulated cryptocurrency trading, the CBN instructed the Nigerian Communications Commission (NCC) to ban access to crypto trading sites, including Binance and Kraken, in mid-February. However, despite the ban, many users reported continued access to these platforms, highlighting the challenges of enforcing such measures effectively.

Additionally, Cardoso also mentioned that they plan to adjust market regulations to prevent manipulation by imposing stricter charges and ensuring fairness and integrity in market operations.

Moreover, the controversy surrounding Binance deepened as its former CEO, Changpeng Zhao, faces legal action for serious violations, including anti-money laundering and sanctions breaches. As part of a plea deal, Binance has agreed to pay a record-breaking $4.3 billion in penalties, marking a significant chapter in US legal history.

Meanwhile, the sentencing of CZ, the former CEO of Binance, on money laundering charges has been postponed until April 30, according to the announcement made by the Seattle Federal Court. Originally scheduled for February 23, the reasons for the delay remain undisclosed.

.png)

9 months ago

4

9 months ago

4

English (US)

English (US)