ARTICLE AD BOX

- Bitcoin (BTC) is expected to continue its downward trend as analysts predict a fall to $70k after a decline below a crucial support level.

- Another analyst has predicted that Bitcoin usually corrects by 30% in January after every halving event.

Bitcoin (BTC) trades at $91.2k at press time after declining by 8% in the last seven days and 10% in the last 30 days. Meanwhile, analysts expect this downtrend to continue till the asset finds support at $70k once it plunges below $92k.

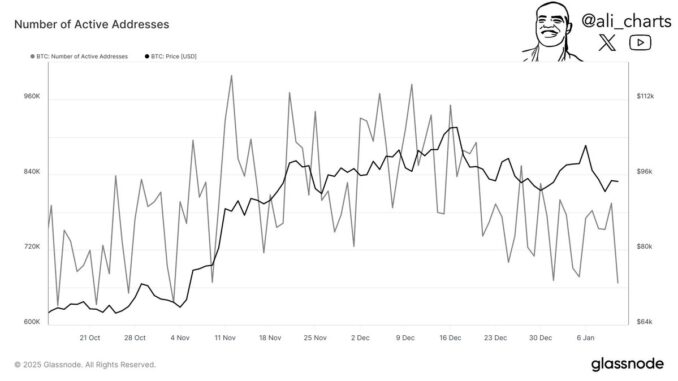

[mcrypto id=”19649″]Taking a critical look at the market, we find some on-chain activities gearing towards this prediction as network activities significantly decline to the lowest level since November 2024. Fascinatingly, this is marked by the decline of Bitcoin active addresses by 667,100.

Throwing more light on this, analyst Ali Martinez explained that this underscores the steady decline of network engagement. Meanwhile, other market metrics, including the seven-day moving average of the Short-Term Holders’ SOPR (Spent Output Profit Ratio), confirm a bearish trend.

Speaking on the upside, Martinez believes that there is a crucial resistance at the $97,000 and $99,500 range. Per his observation, 1.22 million BTC was accumulated by 1.26 million addresses.

Source: Ali Martinez

Source: Ali MartinezLikening the current movement to historical market behavior, analyst Benjamin Cowen highlighted that Bitcoin usually corrects by up to 30% in January of the post-halving years. Meanwhile, the bull market support band continues to surge as its 20-week estimate was found at $81,000. The analyst also noted that the 21-week EMA has trended above the $84,000 level. Concluding his thesis, Cowen pointed out that Bitcoin could continue this consolidation for some months before bouncing back.

Other Analysts Speak on Bitcoin

A renowned analyst and YouTuber, Alessio Rastani, have also pointed out that Bitcoin has currently moved to wave five of the Elliott Wave Theory, signalling the last stage of the bull tendencies per the CNF report.

Analyst Crypto Patel also believes that Bitcoin could likely fall to between $70K-$75K. From this level, the asset could make a significant surge to hit $150K-$160K. Meanwhile, Davinci Jeremie also thinks Bitcoin could hit $350k before the end of the cycle.

Source: Crypto Patel

Source: Crypto PatelUnlike Cowen, who based his analysis on historical trends, Jeremie’s prediction was based on the correlation between the cost of Bitcoin mining and the eventual market value. According to him, Bitcoin has historically been surpassing its mining cost by 5x in the previous cycle. With that, he estimated that the cost of mining one Bitcoin is around $70,000.

Analyzing other aspects of the market, Martinez highlighted that the crypto market inflow has declined by more than 56%, from $134 billion to just $38 billion in a month. This implies that investors have lost the willingness to invest in digital assets. Even so, the number of Bitcoin wallets continues to soar, per a CNF report.

According to Finbold Research, a daily average of 154 addresses holding BTC crossed the $1 million mark between December 31, 2023, and December 31, 2024. As earlier mentioned by CNF in a report, these numbers fell short of the Bitcoin millionaires recorded in 2023.

.png)

5 hours ago

2

5 hours ago

2

English (US)

English (US)