ARTICLE AD BOX

- Bitcoin faces weakening inflows and increased sell-side pressure, signaling potential market corrections in coming weeks.

- Altcoins and equities exhibit similar bearish trends, with key resistance levels indicating potential for further decline.

According to DataDash’s Nicholas Merten, Bitcoin’s price behavior has signaled market fragility. Merten underlined in his January 13, 2025, video important developments that investors should pay great attention to in the next weeks.

Apart from showing resistance at important moving averages, the larger crypto market and even US stocks clearly show similar declining trends.

Source: DataDash on Youtube

Source: DataDash on YoutubePreviously a support level, Merten pointed out that Bitcoin’s 21-day moving average has since become a main source of opposition. This shift, along with bearish engulfing candles and diminishing inflows from big buyers like MicroStrategy, points to a possible correction.

Should the 21-day average not be reclaimed soon, BTC’s price might slide to the 100-day or perhaps the 200-day moving average, spanning $75,000 to $85,000.

Red Flag: Slowing Institutional Inflows

Especially from MicroStrategy, institutional involvement has also reduced greatly. MicroStrategy made aggressive purchases of up to 50,000 Bitcoin at one session during the first phases of the Bitcoin boom.

But this tendency has reversed; recent acquisitions now count less than 5,000 BTC. This change suggests declining buy-side pressure, which is essential to maintain the present price of Bitcoin.

Source: DataDash on Youtube

Source: DataDash on YoutubeMerten clarified that the declining activity of MicroStrategy is related to the diminishing premium on its convertible notes, which formerly let the business raise large amounts of money for Bitcoin acquisitions.

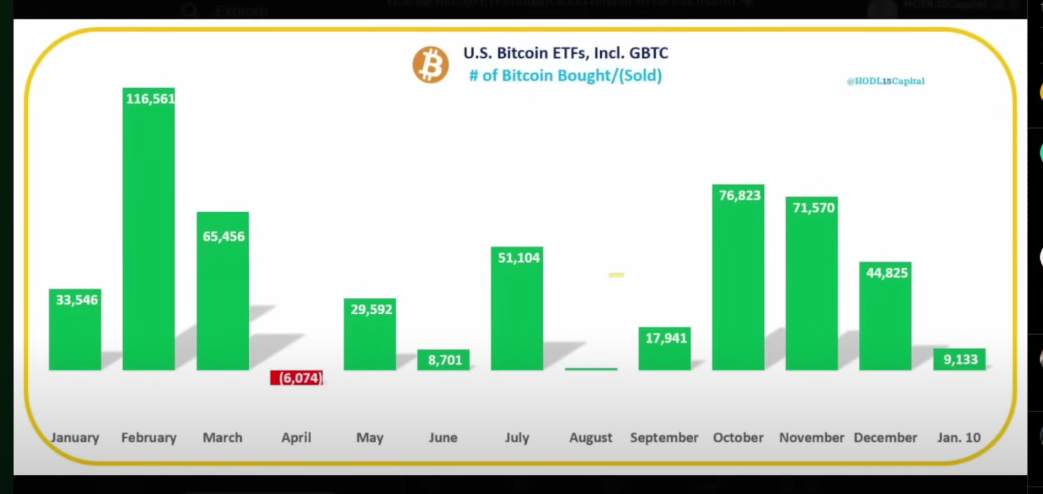

Furthermore, underperforming are Bitcoin ETFs, which were supposed to generate huge influxes. The market struggles to offset growing sell-side pressure given declining inflows of thousands of Bitcoin every week.

Altcoins and Stocks Show Signs of Significant Weakness

Once briefly rallying in late 2024, altcoins are under great demand right now. Merten underlined that facing opposition at the 200-day moving average, altcoin market power has been progressively falling. With certain values possibly below important psychological thresholds, this pattern indicates more negative potential for cryptocurrency.

Merten also noted that US stocks clearly exhibit indicators of a possible correction. While small-cap indices like the Russell 2000 already nearly meet the 200-day average, the S&P 500 and Nasdaq are rejecting their 21-day moving averages.

Merten claims these trends point to a more significant fall in equities, including cryptocurrencies, which are due.

Viewing Corrections as Opportunities in Crypto and Beyond

Merten stressed the need of seeing corrections as opportunities even though the study presents a pessimistic image. To take advantage of good buying conditions amid market declines, he counseled investors to keep cash reserves. Emphasizing historical trends, Merten pointed out that regular Bitcoin corrections usually follow significant rises.

Merten advised his special magazine, the Dash Report, which offers thorough market research across crypto, stocks, and developing industries for individuals seeking more in-depth knowledge.

He also promoted a more general investment strategy, implying that many new prospects—especially in fast-expanding sectors ready for major development—lie outside cryptocurrency.

.png)

12 hours ago

3

12 hours ago

3

English (US)

English (US)