ARTICLE AD BOX

Bitcoin soared past the $64,000 mark, reaching a high of $64,268 and setting a new annual record. This spike coincides with the Tether Treasury’s creation of 1 billion USDT.

This move has ignited widespread speculation and keen interest across the crypto sector.

Is the Latest USDT Mint Pumping the Crypto Market?

Whale Alert, a blockchain analytics platform, reported the fresh batch of minted USDT on Sunday. Consequently, it sparked a debate about its potential effects on Bitcoin’s price. Historically, there’s been a link between Tether’s minting actions and significant increases in Bitcoin’s value.

In January, Tether released 2 billion USDT over ten days, coinciding with a notable rise in Bitcoin’s price. This was also driven by spot Bitcoin exchange-traded fund (ETF) anticipations. This trend has led some to speculate about future Bitcoin price volatility.

“$1,000,000,000 USDT got minted. Which coin are they planning to pump?” Crypto investor Elja wrote.

Amid the market’s speculation, Paolo Ardoino, Tether’s CEO, provided some clarity. He explained that the $1 billion USDT is earmarked for future issuance requests and chain swaps, not for immediate market impact.

Read more: A Guide to the Best Stablecoins in 2024

“1 billion USDT inventory replenished on the Ethereum Network. Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period’s issuance requests and chain swaps,” Ardoino wrote.

Ardoino’s clarification highlights the operational intricacies of blockchain technology. It shows how digital assets can move across multiple blockchains to meet market demands and enhance liquidity.

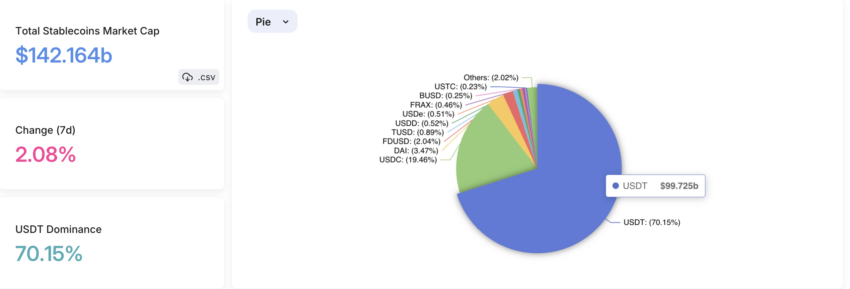

Tether is on the brink of reaching a $100 billion market cap. Its dominance in the stablecoin market is clear, with over 70% market share, according to DefiLlama.

Tether (USDT) Market Dominance. Source: DefiLlama

Tether (USDT) Market Dominance. Source: DefiLlamaNonetheless, Tether’s position has faced scrutiny. Last month, JPMorgan Chase & Co. expressed concerns over Tether’s growing market share.

Read more: 8 Best Crypto Wallets to Store Tether (USDT)

They cited issues with regulatory compliance and transparency. The critique from JPMorgan underscores the ongoing discussions about the role of stablecoins in the financial ecosystem.

The post Bitcoin Briefly Surpasses $64,000 Amid Tether’s 1 Billion USDT Mint appeared first on BeInCrypto.

.png)

8 months ago

5

8 months ago

5

English (US)

English (US)