ARTICLE AD BOX

The post Bitcoin (BTC) Eyes $78,500, Bearish Pattern Signals Trouble appeared first on Coinpedia Fintech News

After a bullish start to March 2025, its close appears to have ended in a market crash. Today, March 28, 2025, the overall market witnessed a significant price decline. Amid this, Bitcoin (BTC), the world’s largest digital asset, has finally lost its support and is now poised for a massive price drop.

Bitcoin (BTC) Technical Analysis and Upcoming Levels

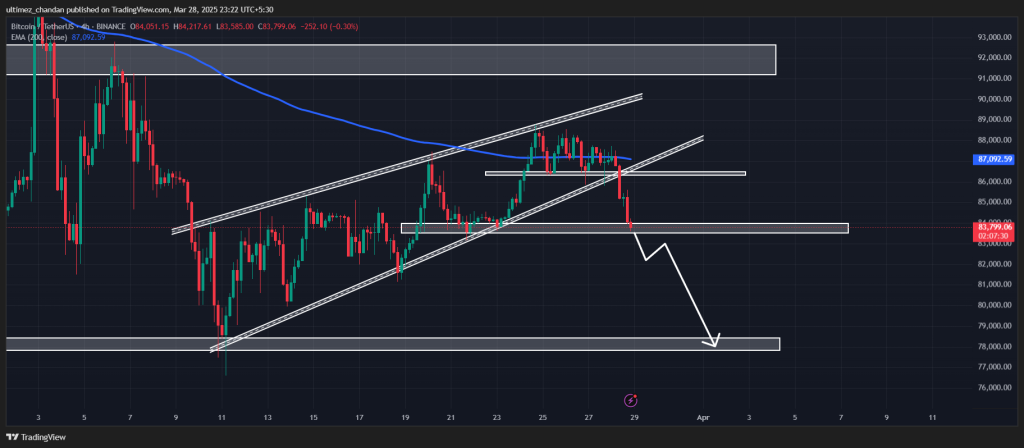

According to expert technical analysis, between late February and early March 2025, BTC witnessed impressive upside momentum while forming a bearish rising price action pattern on the daily timeframe. The BTC price has now broken out of the pattern, partially confirming its bearish outlook and opening the path for further price decline.

Source: Trading View

Source: Trading ViewBased on historical price momentum, if the BTC price continues to fall and closes a four-hour candle below the $83,500 mark, there is a strong possibility that it could drop by 6%, reaching the $78,500 level.

Following the breakdown, the asset has also fallen below the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating a weak and bearish trend.

Current Price Momentum

Bitcoin is currently trading near $83,850 and has recorded a 4% price decline in the past 24 hours. However, during the same period, its trading volume surged by 25%, indicating heightened participation from traders and investors compared to the previous day.

Traders Bearish Outlook

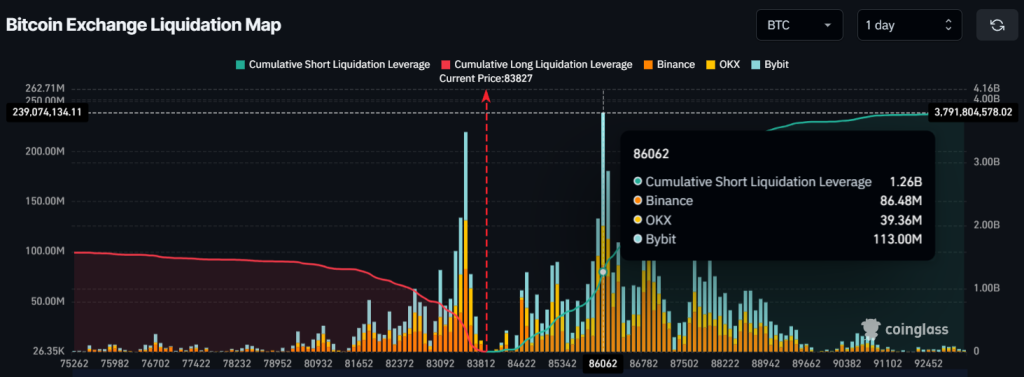

Meanwhile, looking at the bearish market trend and continuous price decline, traders strongly capitalizing on the trend appear to be betting on the short side, as reported by the on-chain analytics firm Coinglass.

Data reveals that traders are currently over-leveraged at $86,000, where they have built $1.26 billion worth of short positions, hoping that the BTC price won’t cross this level anytime soon. Meanwhile, $83,500 is another over-leveraged level where traders have built $345 million worth of long positions, which are on the verge of liquidation and will be liquidated if the BTC price crosses this level.

Source; Trading View

Source; Trading ViewThis on-chain metric highlights that bears, who believe the market will fall, are currently dominating, while bulls seem to be exhausted.

.png)

2 days ago

3

2 days ago

3

English (US)

English (US)