ARTICLE AD BOX

- Crypto analyst Poppe predicts that the market is just getting ready for a mega Bitcoin bull run along with a strong altcoin rally.

- Many altcoins are still in the accumulation phase relative to BTC, indicating a potential for significant breakouts.

As Bitcoin’s price reached a new all-time high above $108,000 this week, market analysts have become ultra-bullish about the current cycle. Popular crypto analyst Michaël van de Poppe believes Bitcoin’s potential gains in this cycle could far exceed its current progress. He shared with his 753,500 followers on the social media platform X that Bitcoin could reach $500,000 during this cycle.

According to the Bitcoin rainbow chart, the previous cycle failed to reach the expected “extreme” phase, suggesting that Bitcoin’s price should have risen much higher. Analysts indicate that if this cycle extends over a longer period, the price of Bitcoin is likely to increase automatically. Amid the surge in institutional purchases, asset manager Bitwise also expects BTC price to rally to $200K by 2025, reported CNF.

Source: Michael van de Poppe

Source: Michael van de PoppeFurthermore, in his message on the X platform, Michael van de Poppe stated that the market is preparing for the next wave. He wrote:

The game plan is to stick into the positions as this is the time to maximize your returns. This might mean that your positions, depending on your risk appetite, will result in a potential return of 3-5x in BTC valuations.

Michaël van de Poppe explains that many altcoins have yet to experience significant breakouts as they remain in the accumulation phase in relation to Bitcoin. This, he suggests, is a positive sign for those who are already invested and ready for the next major market movement. However, Poppe advises caution, emphasizing that the upcoming rally is expected to be volatile amid the Fed rate cut decision during the ongoing FOMC meeting.

Bitcoin Price Prediction for the Short-Term

Following an all-time high past $108,000 levels yesterday, Bitcoin price is seeing some pullback, dropping 3% today and slipping under $105,000 levels. Well, this has triggered a greater correction in the altcoins space, with Ethereum, Cardano, Dogecoin, and others correcting by 5-6% each.

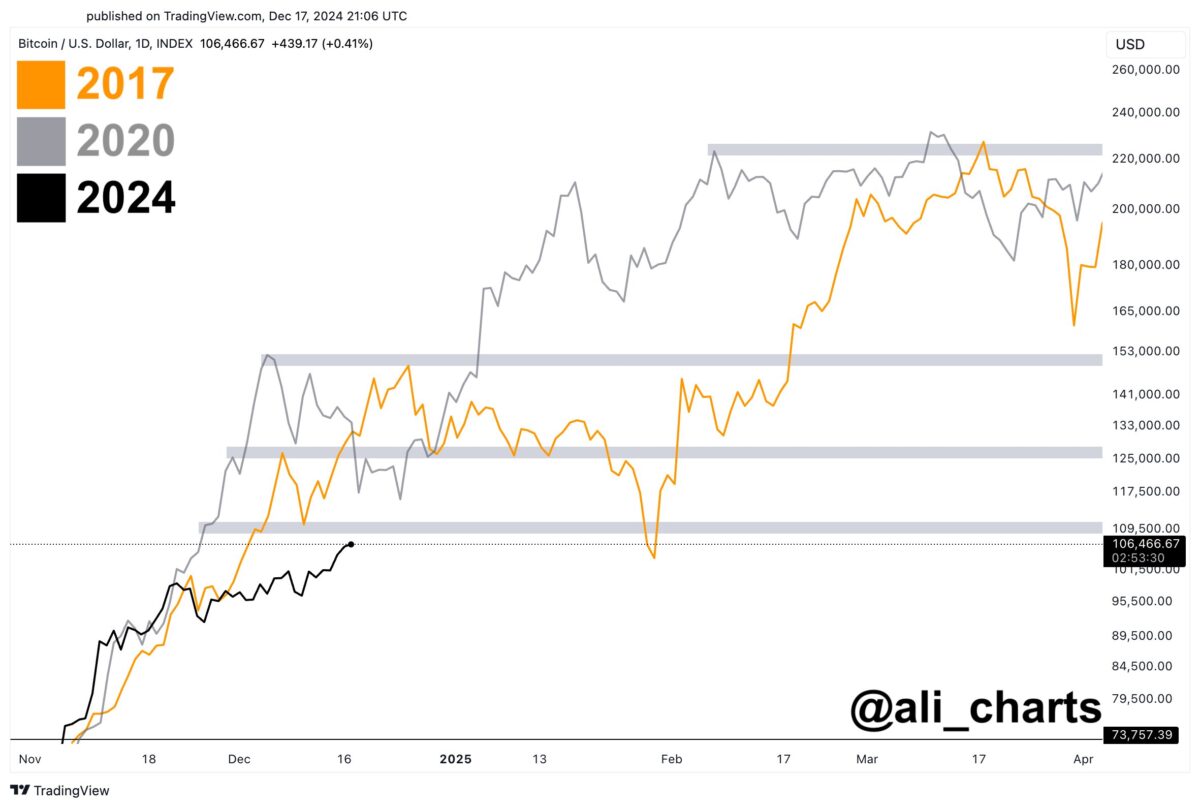

Some crypto market analysts believe that today’s retracement is part of the Bitcoin bull run, calling it a healthy correction. Crypto analyst Ali Martinez predicts that if Bitcoin ($BTC) follows a pattern similar to previous bull markets in 2017 and 2020, it could experience a series of corrections as it reaches key price levels. Martinez forecasts a brief correction at $110,000, followed by a steep decline at $125,000, a major correction at $150,000, and ultimately the end of the bull market around $220,000.

Source: Ali Charts

Source: Ali ChartsOn the other hand, inflows into spot Bitcoin ETFs have remained strong, with BlackRock’s IBIT seeing the most inflows. Bitcoin ETFs have seen continuous buying activity for the past two weeks, marking the third-longest streak of inflows since their launch in January. This sustained demand indicates strong investor interest, suggesting that Bitcoin could maintain its upward momentum.

.png)

3 hours ago

5

3 hours ago

5

English (US)

English (US)