ARTICLE AD BOX

The crypto market has not been the same for every asset. Bitcoin (BTC) has had a good run, but top coins like Ethereum (ETH) and Ripple (XRP) are still suffering. The chances of altcoins picking up pace and rallying rely on Bitcoin’s performance.

Identifying the altcoin season is important as it can estimate when and how much growth alts could experience.

The Potential of an Altcoin Season

Juan Pellicer, Senior Researcher at IntoTheBlock, states multiple signals dictate the altcoin season’s arrival.

“In previous market cycles, altcoin seasons often begin with a sustained downtrend in BTC dominance, indicating a shift in market sentiment towards altcoins. While this trend is a useful leading signal, identifying potential winners in the next altcoin season requires analyzing advanced on-chain metrics,” Pellicer stated.

“For instance, the average holding time of an asset by its holders can indicate its resiliency. Assets held longer by investors may experience more sustained price rallies during bull markets. Additionally, on-chain data related to whale behavior is invaluable,” he added further.

Secondly, the market’s growth also relies on the overall demand for crypto assets. The recent rise is a sign confirming this demand. However, stability is the next concern. Expanding on the same, Julio Moreno, Head of Research at Cryptoquant, told BeInCrypto,

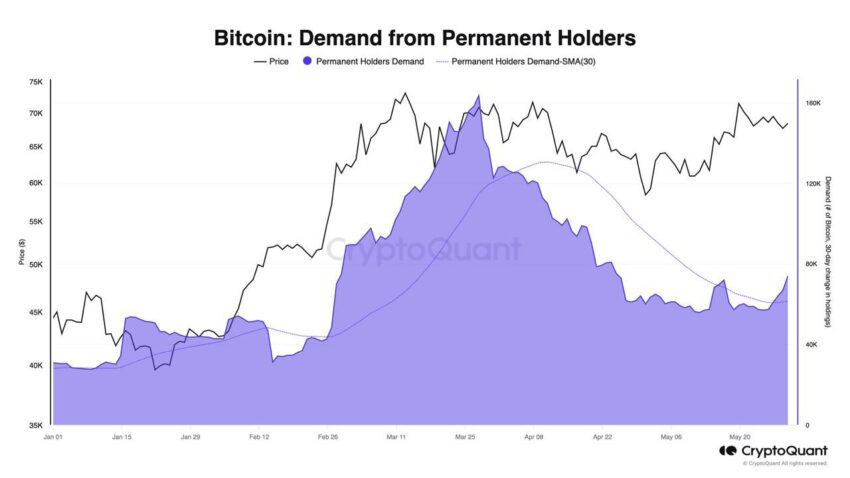

“The stabilization and then slight increase in Bitcoin demand from Permanent holders and large holders (whales). This indicates higher demand growth this month compared to April. Permanent holders have bought 74K Bitcoin in the last 30-days, while demand from whales is growing at 5% MoM now. See second and third chart. We still need to see higher demand growth from these investor cohorts for the price rally to be sustainable.”

Bitcoin Permanent Holders Demand. Source: CryptoQuant

Bitcoin Permanent Holders Demand. Source: CryptoQuantThus, these cues are key when looking for a guide to the altcoin season.

Price Prediction for BTC, ETH, XRP: Growth Likely, Though Slow

Bitcoin (BTC)

Bitcoin’s price exceeded the market’s expectations as it charted a 5% growth over the week. This rise brought the trading price to $71,160, close to the critical resistance of $71,800. The broader market cues are still bullish, with BTC moving within a flag pattern, indicating a 45% rally on the cards.

However, the more practical outlook is a rise to the current all-time high of $73,650. Breaching it would establish a new ATH for BTC.

Read More: Bitcoin Halving History: Everything You Need To Know

On the other hand, the barrier of $71,800 has been unbroken for nearly three weeks now. A failed breach of this level could subdue the rally, leaving Bitcoin’s price falling back to $68,500.

Ethereum (ETH)

While Etherueum’s price is not acting bullish at present, it is sustaining the rally it noted last month. The altcoin broke out of the descending wedge and rose to $3,980 at one point but slid down soon.

ETH is struggling to close above the 61.8% Fibonacci Retracement of $3,829. This level is also known as a bull run support floor, and reclaiming above it would raise $4,000.

Read More: Who Is Vitalik Buterin? An In-Depth Look at Ethereum’s Co-Founder

But if Ethereum’s price does not succeed in securing this level as support, a drawdown cannot be ruled out. ETH could thus drop on the daily chart to test the support at $3,695 or the 50% Fib line at $3,582.

Ripple (XRP)

XRP’s price has had a disappointing run, trading at $0.52. The altcoin is forming an ascending triangle pattern and awaiting a breakout. This bullish chart formation features a horizontal resistance line and a rising support line. It indicates increasing buying pressure, suggesting a potential breakout above the resistance level.

However, this theoretical rise has yet to be observed since, at present, the altcoin has barely closed above the 23.6% Fibonacci Retracement. This is a good sign since this Fib level is known as the bear market support floor. Securing it would prevent further drawdown in XRP price.

Read More: Everything You Need To Know About Ripple vs SEC

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewBut losing it could send the altcoin to $0.50 or lower to test the critical support of $0.47, invalidating the bullish thesis completely.

The post Bitcoin, Ethereum, Ripple Weekly Wrap: June 7, 2024 appeared first on BeInCrypto.

.png)

5 months ago

9

5 months ago

9

English (US)

English (US)