ARTICLE AD BOX

Bitcoin, Ethereum, and Solana experienced significant rebounds following the latest Federal Reserve announcement by Chair Jerome Powell.

Bitcoin, Ethereum, and Solana saw a significant price increase, coinciding with Powell’s insights from the Federal Open Market Committee’s meeting.

Crypto Market Soars as Jerome Powell Speaks

The Federal Reserve maintained the current benchmark interest rate, opting for a wait-and-see approach despite persistent inflation concerns. Powell highlighted the ongoing challenges in reducing inflation to the Fed’s 2% target, stating that the central bank’s next move is unlikely to be a rate hike.

Instead, the focus will remain on a cautious monetary strategy, echoing the committee’s readiness to adapt as necessary to safeguard economic stability.

“So far this year, the data have not given us that greater confidence, in particular and as I noted earlier, readings on inflation have come in above expectations. t is likely that gaining such greater confidence will take longer than previously expected,” Powell said.

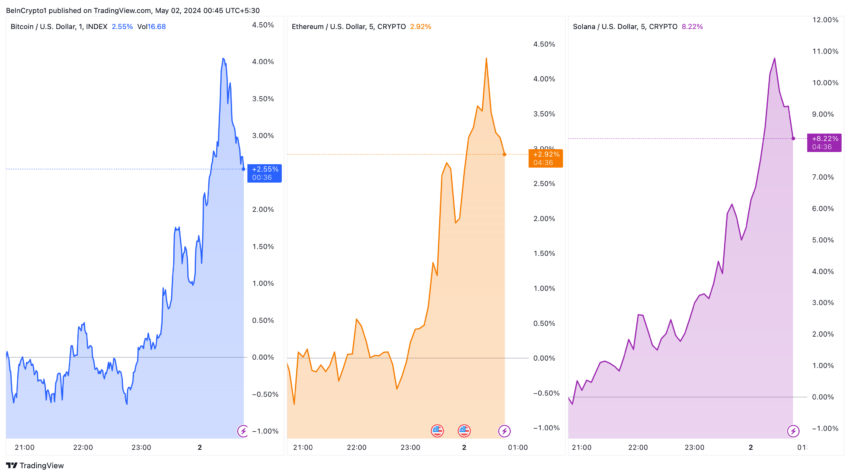

Amid these developments, the cryptocurrency market reacted positively, signaling investor optimism about a stable interest rate environment. Bitcoin surged by 5% to $59,440, Ethereum climbed 5.02% to $3,015, and Solana saw an 11% increase to $136.

Such interest rate stability often translates into increased investment in riskier assets like cryptocurrencies, as seen in the significant upticks across major digital currencies.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Bitcoin, Ethereum, Solana Price Performance. Source: TradingView

Bitcoin, Ethereum, Solana Price Performance. Source: TradingViewMoreover, the Fed announced a slowdown in the pace of its balance-sheet reduction, set to commence in June. The adjustment aims to prevent market volatility similar to that experienced in September 2019.

Starting June 1, the Fed will reduce the monthly runoff of Treasuries to $25 billion, down from $60 billion. Still, it will continue to allow $35 billion a month in mortgage-backed securities to run off, redirecting excess into Treasuries.

This strategic shift reflects a broader intention to transition towards primarily holding Treasuries, aiming to streamline the central bank’s balance sheet operations and enhance its response capability to market dynamics. As Powell concluded his address, he reiterated the Fed’s vigilance towards inflation risks and its commitment to a restrictive policy stance to pressure economic activity downward.

The post Bitcoin, Ethereum, Solana Rebound as Fed Chair Jerome Powell Speaks appeared first on BeInCrypto.

.png)

6 months ago

7

6 months ago

7

English (US)

English (US)