ARTICLE AD BOX

- Bitcoin’s exchange inflows hit a 5-year high, signaling potential market shifts as whale activity may precede a price rally.

- The surge in active addresses aligns with Bitcoin’s price rise, suggesting growing market interest could drive further momentum.

Bitcoin’s exchange inflows have reached their highest point in five years, raising a possible shift in the crypto market. The Exchange Whale Ratio, a metric that divides the top 10 inflows to spot exchanges by total inflows, has surged since late 2024. Despite a slight dip in momentum over the last two weeks, as noted by CNF, this trend is drawing attention from market analysts as it may point to future price movements for Bitcoin (BTC).

Historically, reducing whale activity on exchanges has signaled bullish price movements. Therefore, the focus is now on whether large holders will continue to move their assets into exchanges or scale back their inflows, as such a change could indicate a broader market recovery.

The Exchange Whale Ratio provides valuable insight into the behavior of large Bitcoin holders. When this ratio rises, as reported by CNF, it signals that whales, or large institutional investors, are actively moving their Bitcoin onto exchanges, possibly in anticipation of a price rally or a shift.

This was evident in mid-2021 when an increase in whale activity coincided with Bitcoin’s price surge. The trend continued in late 2024, with rising whale inflows accompanying Bitcoin’s climb to around $94,900.

Source: CryptoQuant

However, the situation changed in 2023, when whale activity began to wane, leading to a slowdown in Bitcoin’s price growth. Therefore, the current spike in exchange inflows is closely watched by investors, as it could anticipate the beginning of another upward price movement if these inflows lead to a market rally.

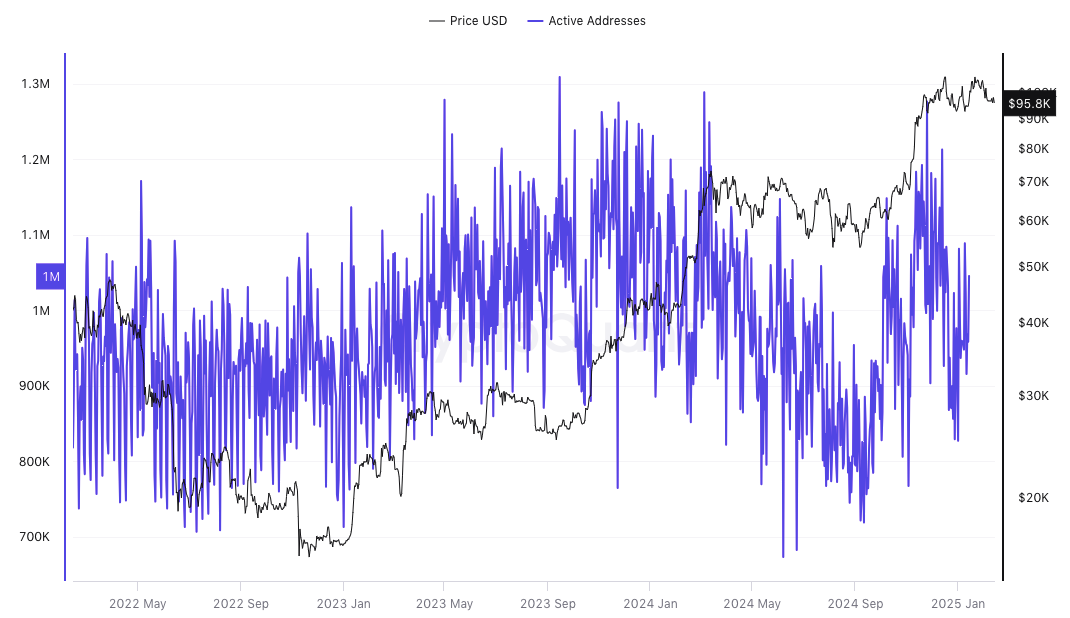

Active Addresses Reflect Growing Market Interest

Additionally, the surge in active addresses on the Bitcoin network is another key factor influencing its price dynamics. As Bitcoin’s value climbed to new highs in late 2023 and early 2025, the number of active addresses increased, showing growing user engagement.

Source: CryptoQuant

Moreover, in early 2025, Bitcoin saw an approaching $95,900 price point, accompanied by an uptick in active addresses. This implies that heightened interest and engagement could drive the price momentum, offering additional context for Bitcoin’s price fluctuations.

Bitcoin Price Holds Steady Amid Market Shifts

At the time of writing, Bitcoin’s price was trading at $96,088.73, showing a slight increase of 0.23% in the past 24 hours. This stable price comes after a brief dip followed by a swift recovery, with support levels around $96,000 remaining strong.

Despite this, the 24-hour trading volume has surged by 32.01%, indicating growing interest in Bitcoin. The total market capitalization stands at $1.9 trillion, reflecting Bitcoin’s ongoing dominance in cryptocurrency.

However, technical indicators such as the MACD and RSI provide a more nuanced view of Bitcoin’s price action. The MACD is currently showing a bearish divergence, with a value of -446.81 below both the signal and zero lines.

Source: TradingView

This indicates a weakening bullish momentum, suggesting that downward pressure could continue. Additionally, the RSI stands at 43.01, indicating that Bitcoin is in a mild bearish phase, with the possibility of a price pullback before a potential recovery.

.png)

3 hours ago

6

3 hours ago

6

English (US)

English (US)