ARTICLE AD BOX

- Bitcoin funding rate on various centralised exchanges, including Binance and OKX, reaches Zero, signalling an upcoming rally.

- Bitcoin’s potential surge is also validated by the recent break out of Gold against the digital asset.

Bitcoin (BTC) marginally bounces back into the $98k territory as its 30-day gains rise by 4%. However, its 24-hour trading volume takes a nosedive to $31.9 billion as it declines by 16%. Fascinatingly, an analyst believes that a major indicator hints at a possible big move.

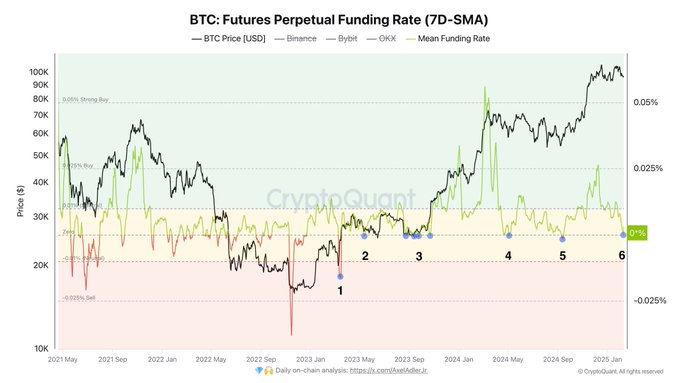

According to a recent thesis by macro research specialist Alex Adler Jr., the Bitcoin funding rate on major exchanges like Binance, Bybit, and OKX has declined to zero. Historically, Bitcoin records a massive surge whenever the funding rate reaches this level. This also aligns with a recent prediction that the asset could hit $250k this cycle, as outlined in our recent blog post.

In an accompanying chart titled “BTC: Futures Perpetual Funding Rate (7D-SMA)”, the analyst explained that the average funding rate usually measures the balance between long (bullish) and short (bearish) positions in the trading of Bitcoin futures.

Source: Alex Adler Jr.

Source: Alex Adler Jr.Shedding more light on this, he pointed out that a positive funding rate implies that more traders expect the Bitcoin price to rise. However, a negative funding rate suggests that more traders are betting on a price decline. For zero rate, it implies that there is a level of uncertainty in the market. In other words, there is a balance between long and short positions.

Yesterday, the average funding rate across the three top exchanges dropped to zero. In this cycle, every such occurrence has ultimately led to a macro bull rally. It’s unclear how long we will stay at these levels, but one thing is certain-during the consolidation phase, the price never fell below $89K, despite bearish pressure. Essentially, bulls are buying the dip around the $90K level.

Bitcoin Could Follow Gold

Gold has recently reached $2,942 per ounce, marking a seventh consecutive week of price appreciation. Meanwhile, Bitcoin has recently been consolidating after hitting a new all-time high of $109k.

As we covered in our latest report, the two assets showed a direct correlation until Analyst Daink pointed out recently that the two had decoupled.

Source: Daink

Source: DainkGold is making new ATHs forming HHs and HLs- $BTC range bounding between 91k – 105k. Each time Gold displaces away from BTC, BTC plays catch up as highlighted in black circles.

Per his observation, the two could mend this relationship in the future based on historical trends. Historically, Bitcoin has always caught up with the trend whenever Gold displaces it to record an upsurge. In 2022, for instance, Gold broke out against Bitcoin to reach a new high. Interestingly, Bitcoin caught up in 2023.

A similar scenario happened in 2024 after Bitcoin had peaked at $73k. Gold recorded an incredible run against Bitcoin, but the broken correlation was later mended. With this at display, analysts believe that Bitcoin could soon record another upsurge, as indicated in our earlier discussion.

.png)

4 hours ago

5

4 hours ago

5

English (US)

English (US)