ARTICLE AD BOX

- At the time of writing, Bitcoin is trading at $43,682, up 0.15% in the last 24 hours.

- If the price manages to climb above $44,590 level then it will likely test $45,260 level.

The asset manager VanEck plans to compensate the Bitcoin core developers once its spot Bitcoin exchange-traded fund application is approved by the U.S. SEC.

Ahead of any potential approval of their spot Bitcoin ETF application, VanEck announced on January 5th via Twitter that it would be contributing 5% of its spot Bitcoin ETF revenues to the BTC core developers via the nonprofit Brink for at least 10 years.

The Ethereum core developers will also get 10% of VanEck’s Ether futures ETF earnings for the next decade upon approval, as the company pledged in September.

Highly Anticipated Approval

With the new year comes renewed optimism for cryptocurrency investors and the several organizations who have submitted applications to the SEC in the hopes of launching the first U.S spot Bitcoin ETF.

In the last two days, the cryptocurrency market has shown signs of improvement, perhaps due to the favorable sentiment around Bitcoin ETFs.

All of the contenders have already submitted 19b-4 revisions to the U.S SEC. The US securities regulator is likely expected to authorize the first batch of Bitcoin exchange-traded funds (ETFs) and enable trading by January 11, according to Bloomberg analyst Eric Balchunas.

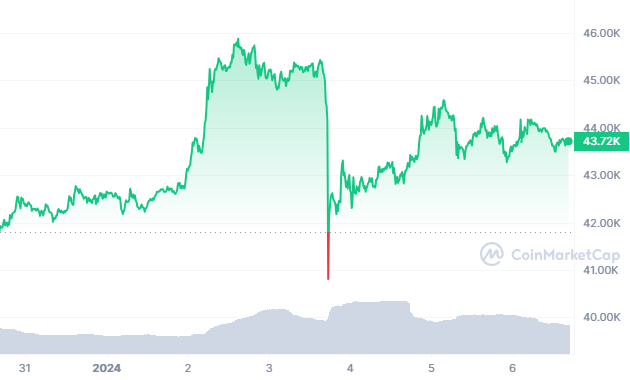

At the time of writing, Bitcoin is trading at $43,682, up 0.15% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is down 28.13%.

Source: CoinMarketCap

Source: CoinMarketCapIf the price manages to climb above $44,590 level then it will likely test $45,260 resistance level. On the other hand, if the price manages to go below $43,280 level then it will likely decline further to test $42,200 support level.

.png)

11 months ago

3

11 months ago

3

English (US)

English (US)