ARTICLE AD BOX

Bitcoin’s current market behavior is drawing notable comparisons to the 2015-2017 bull market, capturing the attention of investors.

With historical parallels drawing optimistic projections, the outlook for Bitcoin remains promising as it mirrors patterns from its formative bull market years.

Bitcoin Investors Continue to Accumulate

Bitcoin recorded a correction of over 20% after hitting an all-time high of nearly $74,000 in March 2024. This is the sharpest market correction on a closing basis since the FTX collapse in November 2024.

However, Bitcoin has almost recovered from this drawdown, hitting $72,000 on May 21. As of writing, it is trading at around $69,000.

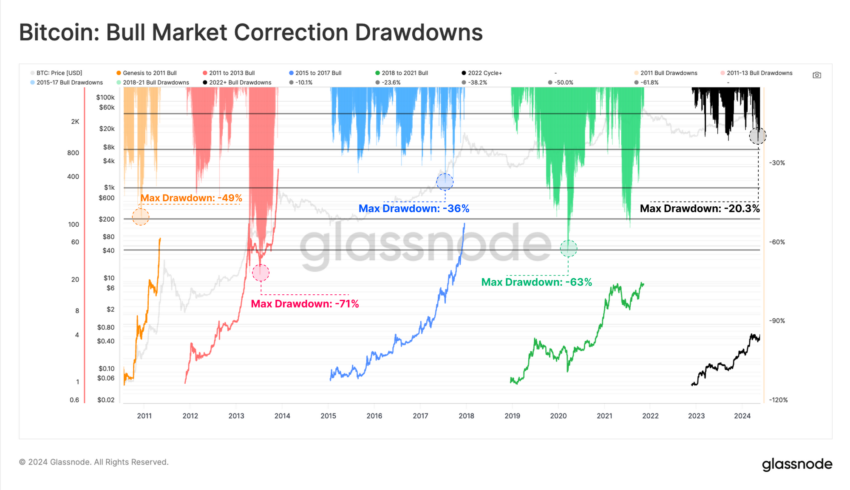

“From a comparative point of view, the drawdowns pattern across the 2023-24 uptrend appears to be remarkably similar to the 2015-17 bull market,” on-chain analysis platform Glassnode explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Bull Market Correction Drawdowns. Source: Glassnode

Bitcoin Bull Market Correction Drawdowns. Source: GlassnodeAt that time, Bitcoin lacked derivative instruments, and the market was primarily driven by fundamental spot transactions. The introduction and inflows into US spot Bitcoin exchange-traded funds (ETFs) have reinforced a strong market foundation similar to earlier times.

The comparison gains significance considering the past. In its early days, Bitcoin’s market infrastructure was underdeveloped, emphasizing organic growth driven by core demand rather than speculative trading. Today’s reliance on spot transactions suggests a return to these basic dynamics, potentially signaling a more sustainable growth trajectory.

In the past week, ETF inflows soared to an average of $210 million per day. This dramatic change highlights a strong re-accumulation phase, in stark contrast to the selling pressures exerted by Bitcoin mining, which imposes a daily sell pressure of about $32 million due to the halving event.

Although recent weeks have seen a slight slowdown in ETF inflows, the overall trend remains positive. According to data from Farside investors, ETFs have seen a net inflow of $122.1 million so far this week. This ongoing influx of capital indicates robust buy-side demand that supports the Bitcoin market.

On-chain analysis by Santiment further supports this trend, showing that Bitcoin wallets holding at least 10 BTC have increased their holdings by 154,560 BTC over the past five months. This pattern of accumulation among larger wallet holders is a critical indicator of market sentiment, typically associated with bullish phases.

Read more: Who Owns the Most Bitcoin in 2024?

Accumulation of Bitcoin Wallets Holding at Least 10 BTC. Source: Santiment

Accumulation of Bitcoin Wallets Holding at Least 10 BTC. Source: Santiment“Historically, one of crypto’s top leading indicators is the collective holdings of wallets with at least 10 Bitcoin (exchanges or otherwise). When they accumulate, cryptocurrencies rise. When they dump, extended bear markets come,” Santiment explained.

The post Bitcoin Mirrors 2015-2017 Bull Market as Investors Accumulate appeared first on BeInCrypto.

.png)

5 months ago

4

5 months ago

4

English (US)

English (US)