ARTICLE AD BOX

Bitcoin’s (BTC) price fell to $69,000 after Friday’s mixed US job data release, leading to over $411 million in liquidations.

This decline followed the crypto market’s reaction to new economic indicators, which showed both positive and concerning signs for the US economy.

Economic Indicators and Market Sentiment Set the Stage for Bitcoin’s Next Move

Non-farm payrolls expanded to 272,000 for May, significantly above April’s 165,000 and the Dow Jones estimate of 190,000. However, the unemployment rate rose to 4% for the first time since January 2022.

Job gains were notable in health care, government, leisure, and hospitality. Analysts see this report as hawkish, suggesting it may delay interest rate cuts.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

According to the CME FedWatch Tool, futures indicate a 50.5% chance of a rate cut by September. The market remains uncertain, leading to increased volatility in the crypto market, especially for Bitcoin.

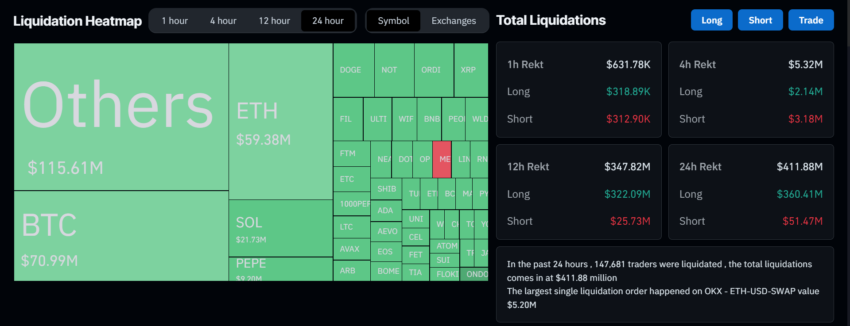

Coinglass data shows total crypto liquidations in the past 24 hours reached $411.88 million, affecting nearly 148,000 traders. Long positions accounted for $360.41 million, while short positions made up $51.47 million.

Total Crypto Liquidations. Source: Coinglass

Total Crypto Liquidations. Source: CoinglassDespite the recent dip, renowned analyst Markus Thielen offers a positive outlook for Bitcoin in the longer term. In his latest report, Thielen highlights the potential for Bitcoin to reach $83,000, driven by a bullish head-and-shoulders formation and supportive macroeconomic factors.

He emphasizes the role of the global central bank easing cycle, with recent interest rate cuts in Canada, Denmark, and Europe, and further easing expected in the US due to weakening economic indicators. Thielen explains that while the Federal Reserve historically avoids rate cuts during the May-November period before presidential elections, market sentiment and the perceived likelihood of rate cuts are crucial for risk assets like Bitcoin.

He also notes Ethereum’s (ETH) potential impact on Bitcoin, particularly if its price declines sharply. Thielen discusses the importance of money flow indicators, pointing out that substantial inflows are necessary to drive significant price movements for Bitcoin.

“To reach the $83,000 head-and-shoulders target (+17%), we would need to see $13 billion of inflows across various verticals—that’s what it takes. A breakout above the $71,600 trend line will naturally result in more upside buying through multiple products, but $13 billion requires quite some commitment. Nevertheless, we think this is possible as a weaker US employment market (unemployment rate at 4%) and lower inflation data next week (3.3%) will likely provide the macro backdrop for new all-time highs,” he elaborated.

Growing interest from institutional investors further strengthens Bitcoin’s long-term outlook. Significant acquisitions from institutions and steady inflows into US spot Bitcoin exchange-traded funds (ETFs) illustrate this trend.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Total US Spot Bitcoin ETFs Flows. Source: SoSo Value

Total US Spot Bitcoin ETFs Flows. Source: SoSo ValueETFs have recorded inflows for 19 consecutive days, surpassing the previous record of 17 days. According to SoSo Value data, these ETFs’ cumulative total net inflow as of June 7 is $15.69 billion, with BlackRock’s iShares Bitcoin Trust (IBIT) dominating at $21.07 billion in net assets.

The post Bitcoin Plunges to $69,000 After Mixed US Job Data, $411 Million in Liquidations Follow appeared first on BeInCrypto.

.png)

5 months ago

10

5 months ago

10

English (US)

English (US)