ARTICLE AD BOX

In the wake of the latest Bitcoin halving event, a significant shift in the cryptocurrency mining landscape is emerging, according to a recent report by CoinShares.

As the halving reduces the rate of Bitcoin supply growth by 50%, miners are confronted with soaring operational costs, prompting some to consider alternative revenue streams such as artificial intelligence (AI).

Post-Halving Spike: Bitcoin Mining Costs to Reach $53,000

The report highlights a nearly doubling of mining costs, projecting that the average cash cost of production will jump from $29,500 to approximately $53,000 per Bitcoin. Similarly, it expects electricity costs to rise from $16,300 in the fourth quarter of 2023 to $34,900 per Bitcoin mined post-halving. These increased expenses are driving mining companies to explore more economically viable options.

Companies like BitDigital, Hive, and Hut 8 have already begun to generate income from AI technologies, leveraging their computational capabilities beyond cryptocurrency mining. CoinShares points out that TeraWulf and Core Scientific are not only active in the sector but are also planning to expand their AI operations.

“Companies like TeraWulf and Bitdeer are actively expanding their capacities. Core Scientific, for instance, is hosting Coreweave under a multi-year contract. At the same time, BitDigital plans to double its capacity, aiming to reach an estimated annual run rate of approximately $100 million.” The report states.

Read More: What Is Bitcoin Halving?

Miners Adapt to Halving: New Focus on Stranded Energy and AI Tech

James Butterfill, lead author of the CoinShares report, suggests that Bitcoin mining operations might gravitate towards locations with stranded energy resources. At the same time, investment in AI could proliferate in more stable environments.

This strategic shift could help mitigate the financial strain caused by the halving as miners seek to optimize energy costs, enhance mining efficiency, and invest in cost-effective hardware.

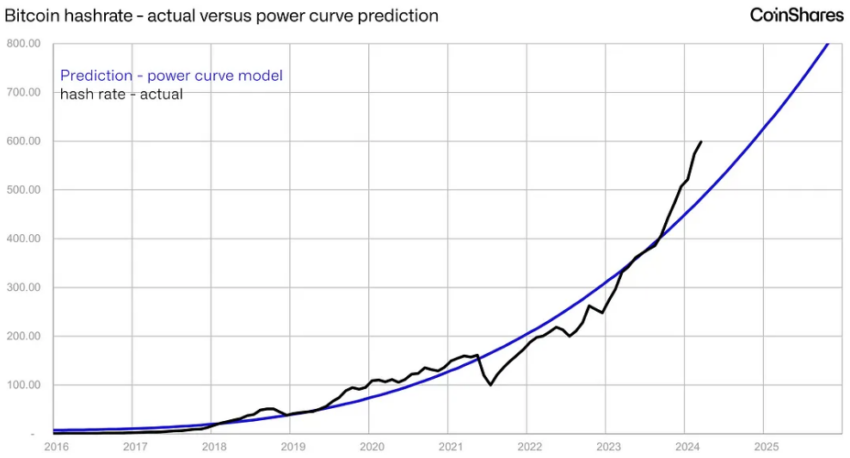

Fluctuations in the hashrate—the combined computational power used in mining and processing Bitcoin transactions—further complicate the mining landscape. Post-halving forecasts predict that the hashrate will eventually climb to 700 exahash by 2025, although an immediate 10% drop is expected as less profitable mining operations go offline.

Concurrently, we anticipate that hash prices, which reflect the earnings per unit of hashrate, will decline.

Bitcoin Hashrate Prediction Chart. Source: Coinshares

Bitcoin Hashrate Prediction Chart. Source: CoinsharesStrategic adaptations mark this transition period as miners navigate the new economic realities post-halving. With the integration of AI, mining companies not only diversify their operations but also enhance their resilience against the cyclical nature of cryptocurrency markets.

Read More: Bitcoin Halving Cycles and Investment Strategies: What To Know

This dual focus on cryptocurrency and AI could herald a new era in the digital economy, blending blockchain technology with machine learning and other AI applications for optimized profitability and innovation.

The post Bitcoin Post-Halving: Miners Could Move to AI, CoinShares Report appeared first on BeInCrypto.

.png)

6 months ago

3

6 months ago

3

English (US)

English (US)