ARTICLE AD BOX

The recent approval of spot Bitcoin ETFs (exchange-traded funds) marked a pivotal moment in the cryptocurrency market. These ETFs commenced trading with record volumes. Concurrently, Coinbase experienced its highest volumes in over-the-counter (OTC) desk transfers.

Despite these milestones, Bitcoin ETFs are trading at a premium compared to spot Bitcoin, indicating a unique market trend.

Bitcoin Price Correction Has Just Begun

The approval of spot Bitcoin ETFs did not receive the expected optimism. Analysts at CryptoQuant shared with BeInCrypto in an exclusive report that such a milestone acted as a “sell-the-news” event. The result was a Bitcoin price drop – a 15% decline since January 11, from $48,700 to a low of $41,500.

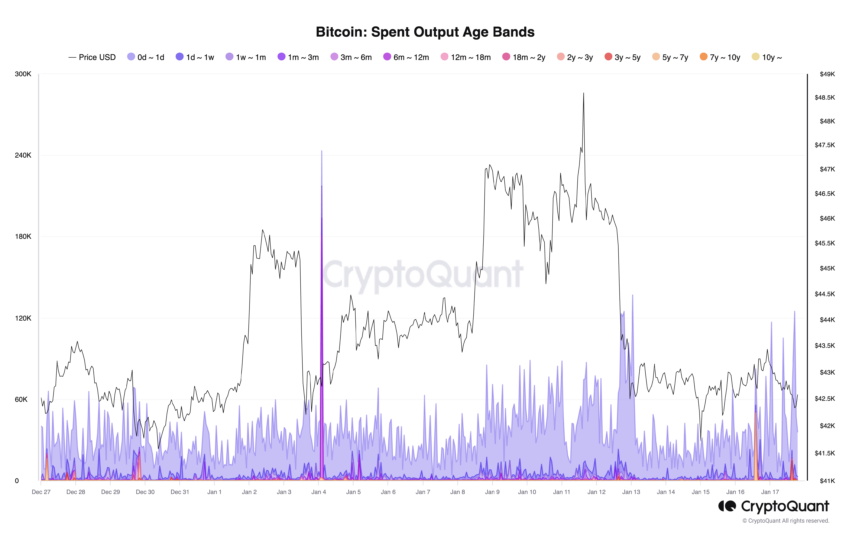

According to CryptoQuant, the current Bitcoin price correction might continue. Indeed, short-term traders and prominent Bitcoin holders continue to sell, reflecting a broader “risk-off” attitude within the market. This selling pressure is compounded by the fact that unrealized profit margins have not fallen sufficiently to indicate that sellers are exhausted.

“Several on-chain metrics and indicators still suggest the price correction may not be over or at least that a new rally is still not on the cards… On-chain data shows high selling activity from short-term traders/investors. This type of selling activity has remained high after the price sell-off,” analyst at CryptoQuant said.

Bitcoin Spent Output Age Bands. Source: CryptoQuant

Bitcoin Spent Output Age Bands. Source: CryptoQuantNotably, Coinbase exchange’s OTC trading desks witnessed record-high volumes on the day of the Bitcoin ETF launch. Over 443,000 Bitcoin, equivalent to $19 billion, were traded. For the first time since March 2021, Bitcoin funds are trading at a premium compared to spot Bitcoin, primarily due to the conversion of Grayscale Bitcoin Trust into a spot Bitcoin ETF.

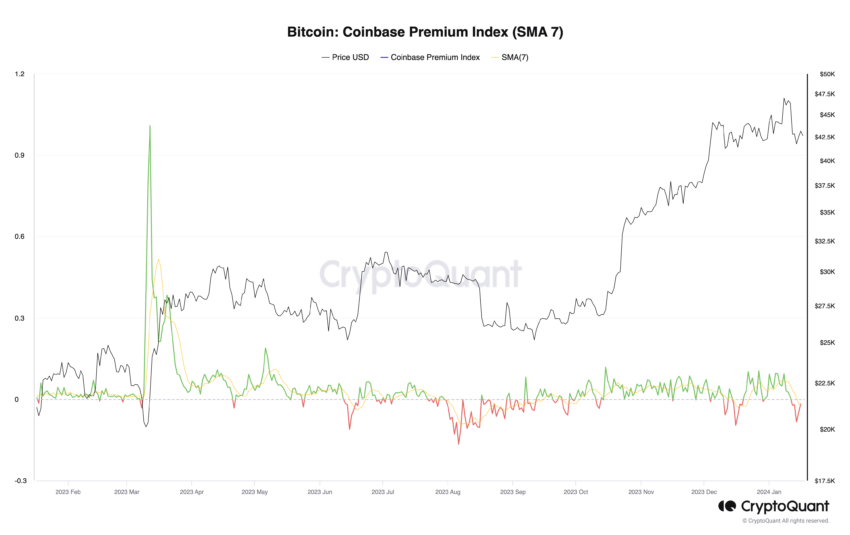

However, post-ETF approval, investor demand for Bitcoin in the US has waned, as evidenced by the negative turn of the Coinbase premium for the first time in 2024.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

Bitcoin Coinbase Premium. Source: CryptoQuant

Bitcoin Coinbase Premium. Source: CryptoQuantFrom a short-term valuation perspective, Bitcoin prices have declined to more sustainable levels. The unrealized profit of short-term holders dropping from 48% in December 2023 to 16% after the recent price decline. However, analyst at CryptoQuant told BeInCrypto that a further drop in profit margins below 0% may be necessary to signal a price bottom officially.

Lastly, the Inter-Exchange Flow Pulse (IFP) has dipped below its 90-day moving average for the first time since August 2021. This indicates a halt in Bitcoin flows to derivative exchanges, which often signals caution and has historically preceded Bitcoin bear markets or price corrections.

The post Bitcoin Price Correction Might Not Be Over Yet appeared first on BeInCrypto.

.png)

9 months ago

5

9 months ago

5

English (US)

English (US)