ARTICLE AD BOX

- Bitcoin surpassed $100K before stabilizing at $99,900, marking an 8% weekly gain, despite $50M liquidations and persistent market volatility.

- Analysts project Bitcoin reaching $145K-$249K by 2025, fueled by $520B in capital inflows and pro-crypto reforms boosting investor confidence.

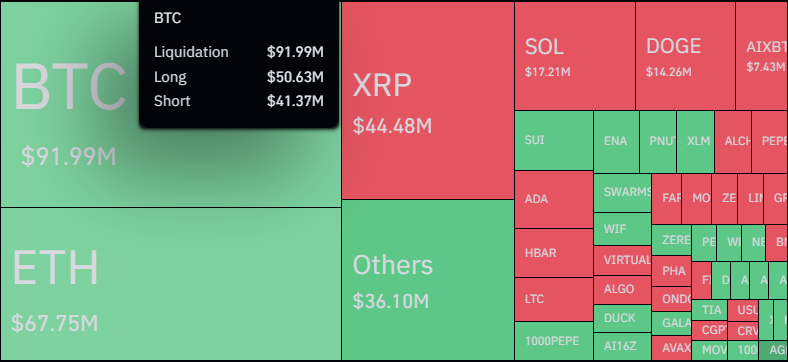

Bitcoin’s price recently surpassed $100K before stabilizing at $99,900, reflecting a 1.25% daily increase. After flirting the 100K mark, the cryptocurrency has gained 8% in the last week. Despite this growth, volatility persisted, with over $50 million in positions liquidated within 24 hours, predominantly from short positions.

Source: CoinGlass

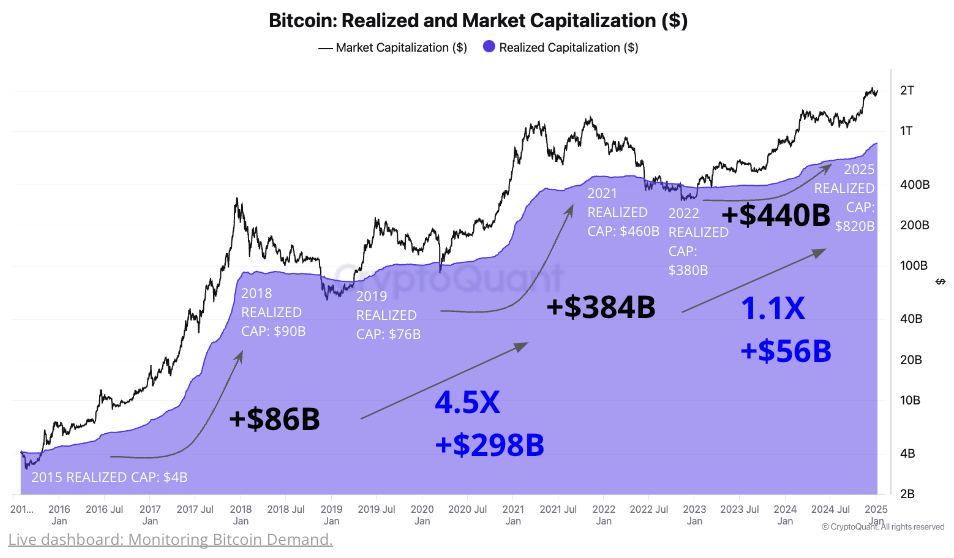

Source: CoinGlassThe upward trend aligns with optimistic forecasts from CryptoQuant analysts, projecting a potential price range of $145,000 to $249,000 by the end of 2025. The firm anticipates $520 billion in new capital inflows under favorable regulatory and monetary conditions. Historical analysis of previous market cycles suggests similar trends could support this forecast.

Source: CryptoQuant

Source: CryptoQuant“Historical analysis of capital inflows during past cycles suggests that if inflows follow the same trend as the previous cycle, 2025 could see $520 billion in new capital,” stated CryptoQuant in a report.

Further reinforcing the positive outlook, technical analyst Gert Van Lagen highlighted Bitcoin’s move beyond the “Re-Accumulation zone” in the Wyckoff Market Cycle. He emphasized that the “Bull Market parabola” remains intact, indicating sustained upward momentum and market strength.

Source: Gert van Lagen

Source: Gert van LagenPro-crypto Reforms and CPI Data Fuels Market Rally

The crypto community’s optimism is partially driven by the much anticipated pro-crypto reforms. Incoming U.S. President Donald Trump reportedly plans to implement major changes in the cryptocurrency sector. These adjustments aim to establish the United States as a dominant player in the global crypto economy, boosting confidence in Bitcoin’s future prospects.

The crypto market’s expansion aligns with broader macroeconomic developments. December’s Consumer Price Index (CPI) aligned with forecasts at 2.9%, while core CPI fell slightly short at 3.2%. This data fueled a widespread market rally, pushing the S&P 500 up by more than 100 points and adding $900 billion to market capitalization. Bitcoin’s rise mirrors this momentum as both institutional and retail investors re-engage with the market.

VanEck CEO Jan van Eck has advocated for Bitcoin as a safeguard against inflation and economic instability. He encouraged investors to allocate more resources to Bitcoin and gold through 2025, highlighting their strategic importance in a global economy shifting away from the U.S. dollar.

Institutions continue driving Bitcoin’s ascent, with significant global interest in Bitcoin ETFs, according to Hunter Horsley, CEO of Bitwise Invest. Horsley emphasized increasing inquiries from multiple countries, reflecting rising demand for regulated cryptocurrency products.

Meanwhile, the crypto market’s inherent volatility underscores its unpredictable nature. Bitcoin’s rapid price fluctuations demand cautious navigation by traders. Currently, crypto traders and analysts focus on the potential for unprecedented highs, with projections suggesting $250,000 as a plausible milestone.

.png)

7 hours ago

6

7 hours ago

6

English (US)

English (US)