ARTICLE AD BOX

Remember Covid-19? The virus that brought the world to its knees within months and some of the consequences can be felt four years later?

Well, it was this time in March 2020 when the World Health Organization declared the unknown virus that supposedly stemmed from bats in China as a pandemic. This led to a chain of events that harmed people’s lives, the global economy, and even relationships between countries.

We will stand aside from the health and economic effects of Covid-19 on the world’s population, and we will focus on Bitcoin instead. Because the primary cryptocurrency slumped hard four years ago today, and the nay-sayers were quick to dismiss it as a viable alternative asset. But they were too quick to judge (again).

What Happened Back Then?

The cryptocurrency market was already in a relatively tough spot as it was trying to recover from the 2018 bear cycle. 2019 saw some positive price movements, with BTC exceeding $10,000 briefly, but overall, the asset had stalled below that five-digit territory.

However, there was optimism on the horizon as the third halving was slated to take place in May, and the permabulls were already hyping the crowd about the possibility of upcoming price increases.

But then news started to emerge about a mysterious virus coming from China that was spreading like wildfire and was quite deadly. Then it got worse when it was named Coronavirus (Covid-19) and reached a few European countries as well as the US in early 2020.

Once more and more cases started to appear in the Western hemisphere, the WHO stepped up and declared it as a global pandemic. Bitcoin and most riskier assets reacted with immediate price declines. In the case of BTC, being a 24/7-tradable asset from a small market, the drop was sudden and violent, shedding 50% of its value and dumping to $4,000. You can check some of the reasons behind the decline known at the time – here.

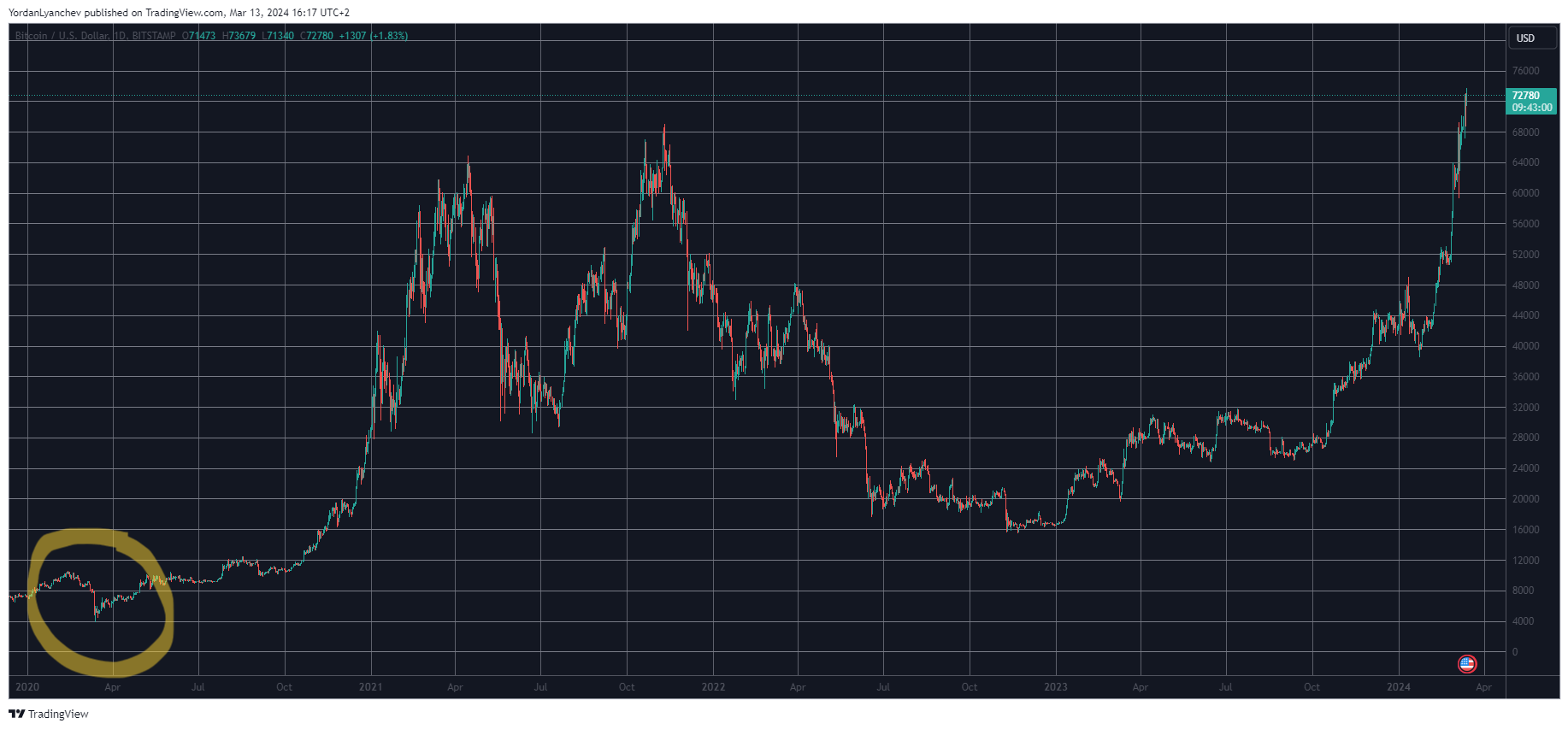

BTCUSD Covid-19 Crash. Source: TradingView

BTCUSD Covid-19 Crash. Source: TradingViewThe Recovery

Although many bashers, like Peter Schiff, used the opportunity to call Bitcoin ‘dead’ (again and again), the cryptocurrency didn’t go down without a fight. Actually, it didn’t go down at all. It started to recover almost immediately after this drop and had bounced off to over $10,000 by May. Then came the third halving, and BTC has never gone into four-digit price territory since.

Just the opposite, it started to gain traction and was all the way up to roughly $20,000 by the year’s end. It doubled its price within the next month and soared to over $60,000 by April. After a brief retracement in the summer, Bitcoin was back at it again in October and November and charted a then-all-time high of $69,000.

2022 was painful with multiple industry bankruptcies, blatant scams, global inflation, as well as a few wars. BTC dumped once more, but its lowest price tag (around $16,000) was still four times higher than the low after the Covid-induced crash.

Fast-forward to March 2024, BTC’s price reached a new all-time high today of over $73,000. This means that its valuation against the dollar has soared by more than 1,700% in the past four years. Not too shabby for a “dead” asset.

BTCUSD. 1-Day Chart. Source: TradingView

BTCUSD. 1-Day Chart. Source: TradingViewThe Covid crash from four years ago was among the most painful events in BTC’s history. Zooming out, though, and looking from today’s perspective, it was nothing but a minor daily glitch.

What Else Changed?

Bitcoin’s mind-blowing price surge in the past four years is just the cherry on top for all believers, investors, supporters, maxis, and yes – HODLers. Just a few months after that aforementioned crash, BTC was recognized by several legendary legacy investors like Stan Druckenmiller and Paul Tudor Jones III.

Later on, Bitcoin was adopted by a Wall Street giant called MicroStrategy. The NASDAQ-listed business intelligence software, spearheaded at the time by Michael Saylor, who became among the most vocal BTC supporters, started purchasing massive amounts of the primary cryptocurrency. As of today, MicroStrategy is the largest corporate holder of the asset, with 205,000 BTC (valued at roughly $14 billion).

2021 also saw a few substantial developments on the Bitcoin front as the US SEC greenlighted the first futures ETFs tracking its performance. Additionally, El Salvador became the first country to adopt Bitcoin as a legal tender officially. A move that was later mimicked by the Central African Republic.

January 2024 saw another massive milestone for Bitcoin – the approval of spot BTC ETFs in the States after several such products were already live in countries like Brazil and Canada.

Oh, Bitcoin also managed to sway quite a few doubters who went from bashing it to supporting it.

Although these are not all BTC accomplishments in the past four years, it’s safe to say that Bitcoin had a wild ride. There were some downs along the way, but being valued 1,700% higher than four years ago, being adopted by a few countries, and being recognized by household names like BlackRock, Fidelity, and MicroStrategy definitely means there were a lot more ups at least in my book.

The post Bitcoin Price Is Up 1,700% Since the Covid-19 Crash 4 Years Ago Today, What Else Has Changed? appeared first on CryptoPotato.

.png)

9 months ago

3

9 months ago

3

English (US)

English (US)