ARTICLE AD BOX

- Analysts suggest tightening dollar-denominated liquidity and declining equity markets are influencing Bitcoin price’s recent downturn.

- Despite current selling pressure, metrics like Bitcoin’s MVRV ratio indicate the market has yet to reach “extreme euphoria.

Bitcoin price dropped slightly on Wednesday, pulling back over 1.59% as the activity of selling continues to increase among holders. Over $123.74 million in liquidations occurred, per Coinglass, as the BTC price plunged below the $94,000 mark.

Key Metrics For Bitcoin Price

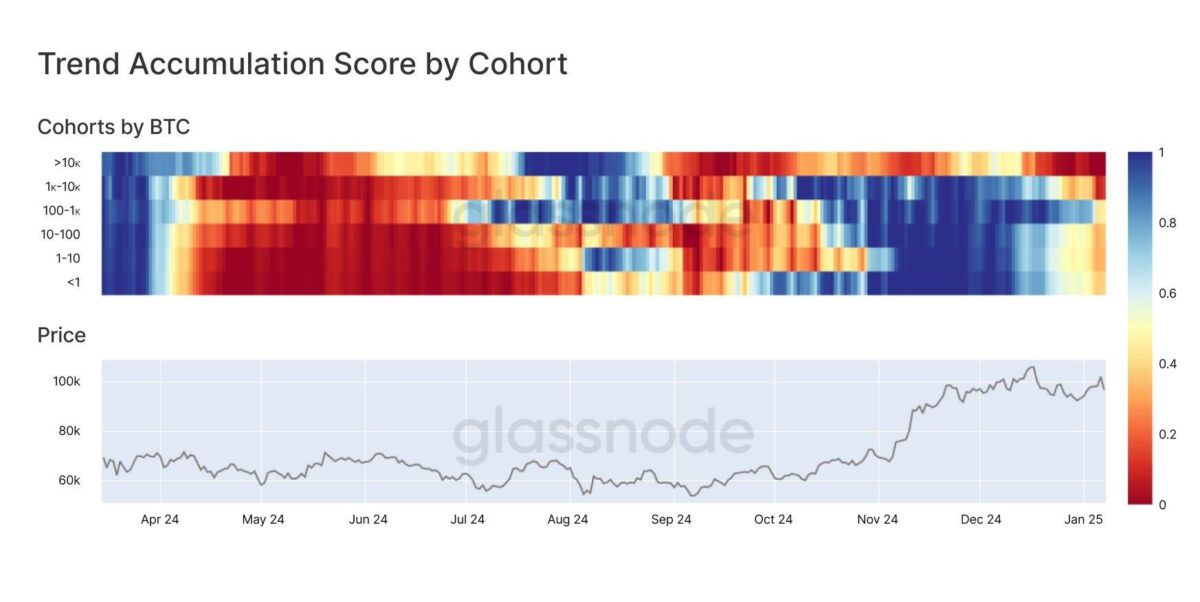

Data obtained from the market analytics firm Glassnode has shown there was a market shift. Its Trend Accumulation Score was seen at a level approaching zero. The number indicates that more Bitcoin holders are leaving accumulation and heading towards distribution.

Interestingly, while Bitcoin price rallied in November and December, its Trend Accumulation Score remained close to a 1, indicating heavy buying. However, recently, selling pressure has increased and is entirely dominated by larger BTC holders.

Source: Glassnode

Source: GlassnodeIt seems stronger-than-expected macroeconomic data is beginning to influence the dynamics of markets. The US ISM Services Purchasing Managers Index (PMI) and job openings for November 2024 were reported in excess of expectations, adding further uncertainty. Such developments are driving fears of an increasingly tight economic environment, which may also affect the direction of Bitcoin prices. Furthermore, the recent 69,000 BTC selloff by the US government has spread negative sentiment in the market, per the CNF report.

Markus Thielen, a crypto analyst, commented on the situation by referring to the liquidity challenges facing the world at large. “Following the Trump re-election, the strengthening US dollar has tightened dollar-denominated liquidity, signaling the potential for a consolidation phase in the near term,” he said in a recent memo.

Thielen also pointed to the increasing correlation between BTC action and traditional equities. He noted that the ongoing decline in U.S. stock markets may indicate similar consolidation risks for Bitcoin price, per the CNF report.

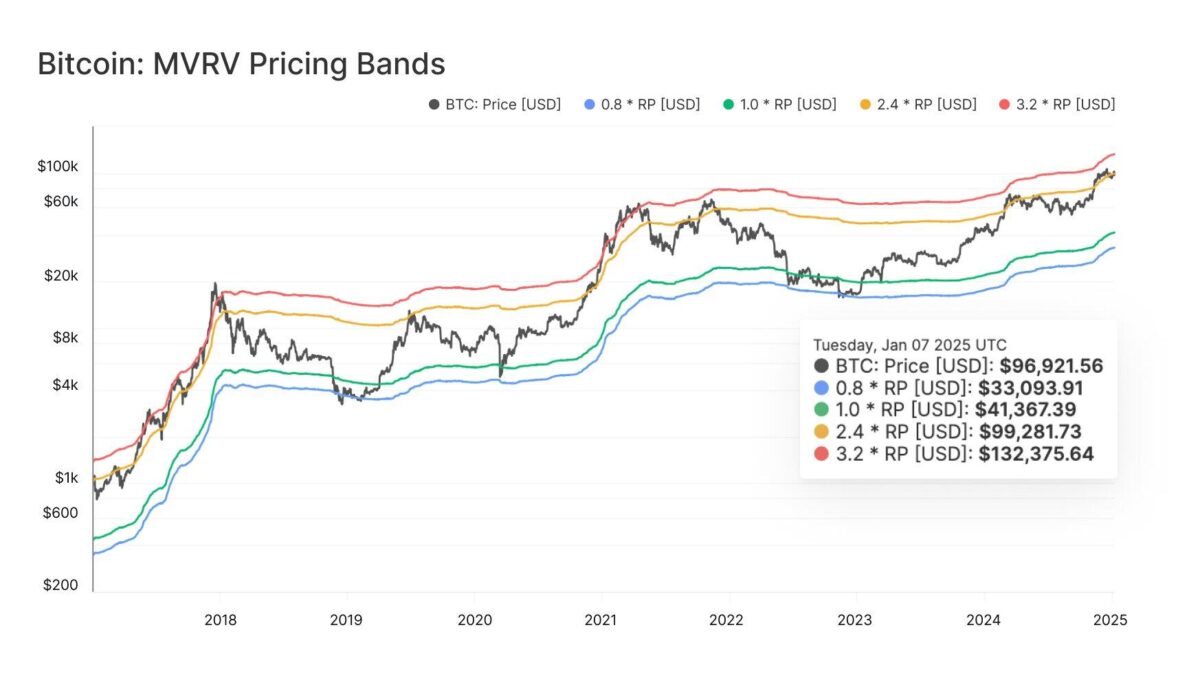

MVRV Indicates Bullish Outlook

Nonetheless, despite the selling pressure and market volatility, some key metrics indicate that Bitcoin’s current cycle has not yet peaked. Glassnode analysts pointed out that the Market Value to Realized Value (MVRV) ratio is one of the metrics used to determine the average profit or loss of all investors. They mentioned that Bitcoin’s MVRV ratio has yet to hit the critical 3.2 level, often associated with “extreme euphoria” in the market.

Source: Glassnode

Source: Glassnode“BTC price has spent only 5% of trading days above the 3.2 MVRV level,” Glassnode analysts noted. “This highlights how rare such peaks are and reinforces why it’s often considered an ‘extreme euphoria’ zone,” they explained. If the BTC price were to hit that zone in this cycle, Bitcoin would need to jump to about $132,000.

For further context, the recent sell-off comes after Bitcoin price reached an all-time high above $108,000. Though some metrics suggest continued selling, the prospects for further upward movement in the ongoing cycle remain in full view. Thus, a strong rebound for BTC price could be on the cards in the short term.

.png)

9 hours ago

6

9 hours ago

6

English (US)

English (US)