ARTICLE AD BOX

- At the time of writing, Bitcoin is trading at $43,108, up 5.01% in the last 24 hours.

- If the price manages to go past $43,380 then it will likely test $47,200 resistance level.

A resurgence of interest in the possibility of the spot Bitcoin ETF launch in the U.S has sent the price of Bitcoin soaring beyond $43,000.

With the SEC expected to reach a final ruling on spot ETFs in early January, the revelation that asset management BlackRock has amended its policy to accept Bitcoin redemptions for its product has spurred confidence.

Inscriptions Craze

Moreover, the increase of inscriptions and the corresponding jump in fees paid to miners is one of the most noteworthy trends. The fees from inscriptions, which include data in Bitcoin transactions, have exceeded $175 million.

This not only shows how strong and flexible the Bitcoin network is, but it also helps keep the blockchain secure by miners earning more income. Increased fees for miners encourage a decentralized and secure network, which may reassure investors about the asset’s potential future worth.

The $28 million reduction in holdings by ARK Investment led by Cathie Wood in Grayscale Bitcoin Trust (GBTC) shares continues its pattern of disposal. The ARK Next Generation Internet ETF (ARKW) reportedly raised almost $28 million via the sale of 809,441 GBTC shares.

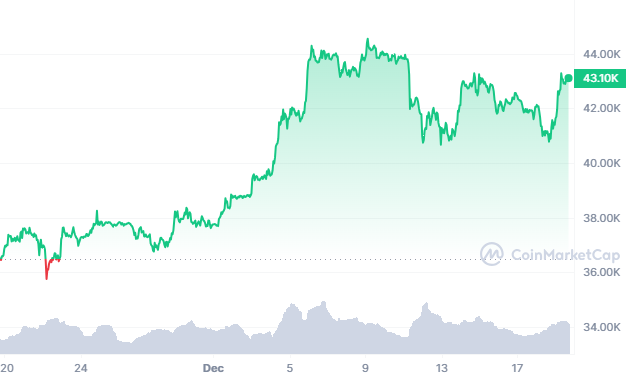

At the time of writing, Bitcoin is trading at $43,108, up 5.01% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is up 10.18%. The price recently found support at $40,800 level and the bulls drove the prices upside.

Source: CoinMarketCap

Source: CoinMarketCapIf the price manages to go past $43,380 then it will likely surge further to test $47,200 resistance level. On the other hand, if the price manages to go below $41,830 level, then it will likely test the $40,800 support area.

.png)

1 year ago

7

1 year ago

7

English (US)

English (US)