ARTICLE AD BOX

Bitcoin’s (BTC) value surged by nearly 10% on Wednesday. This rise defied the prevailing trend of net outflows from US-listed spot Bitcoin Exchange-Traded Funds (ETFs).

These funds have seen a significant withdrawal of approximately $742 million this week. Notably, a substantial outflow of $261.5 million occurred on March 20 alone.

Why is The Bitcoin Bull Cycle Far From Over?

Farside Investors provided data showing a stark contrast between inflows and outflows within the sector. The Grayscale Bitcoin Trust (GBTC) and Invesco Galaxy Bitcoin ETF (BTCO) experienced the most significant losses, with $386.6 million and $10.2 million exiting, respectively.

Consequently, the modest inflows into other approved funds barely made a dent in the overall outflow scenario.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

| March 18 | 451.5 | 5.9 | 17.6 | 2.7 | 0.0 | 0.0 | 4.8 | 5.7 | 0.0 | -642.5 | -154.3 |

| March 19 | 75.2 | 39.6 | 2.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | -443.5 | -326.2 |

| March 20 | 49.3 | 12.9 | 18.6 | 23.3 | -10.2 | 19.0 | 2.9 | 9.3 | 0.0 | -386.6 | -261.5 |

Despite these hefty capital outflows, Bitcoin’s market performance has been remarkably resilient. After a dip to $60,775 on Wednesday, BTC rebounded to a high of $68,100. It later adjusted to $66,640 during early Thursday.

This recovery occurred as Federal Reserve Chair Jerome Powell expressed a dovish stance. Additionally, the Fed maintained its projection for three rate cuts this year, even amidst rising inflation.

The market dynamics of ETF outflows contrasted with Bitcoin’s price surge illuminate the intricate relationship between institutional movements and cryptocurrency valuations. While ETF outflows might usually indicate bearish sentiment, Bitcoin’s robust demand suggests a different story, highlighting its capacity to withstand negative institutional pressures.

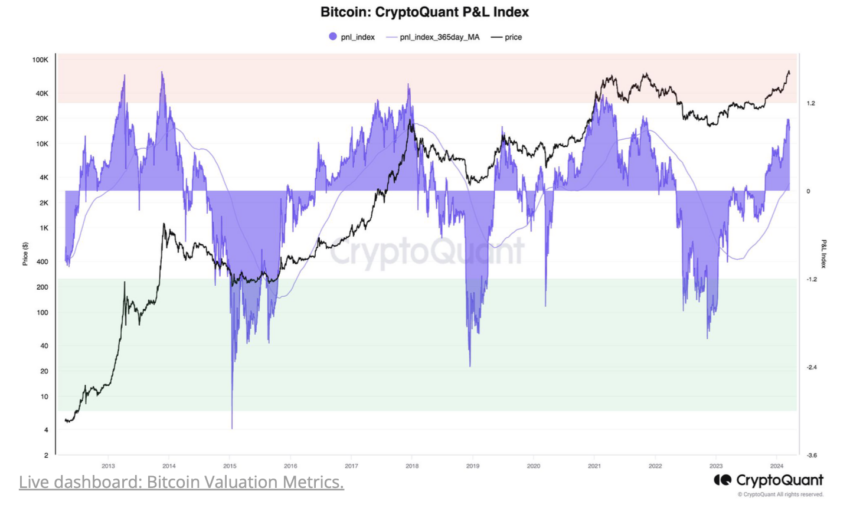

Additionally, analysts from CryptoQuant have provided a longer-term outlook, indicating that the Bitcoin bull cycle is far from over. The firm’s data suggests that the current investment influx from short-term holders comprises 48% of total Bitcoin investment. Historically, the end of a bull cycle sees this figure between 84%-92%.

Moreover, valuation metrics such as the CryptoQuant P&L Index remain outside the typical market top zone, maintaining a position above the 1-year moving average.

Read more: Bitcoin Price Prediction 2024/2025/2030

Bitcoin P&L Index. Source: CryptoQuant

Bitcoin P&L Index. Source: CryptoQuantThis indicates that despite the market’s volatility and the ETF outflows, Bitcoin’s valuation is not in the territory that traditionally signifies an imminent market downturn.

The post Bitcoin Surges 10% Despite $742 Million in ETF Outflows appeared first on BeInCrypto.

.png)

7 months ago

1

7 months ago

1

English (US)

English (US)