ARTICLE AD BOX

The post Bitcoin vs. Stock Market: Michael Saylor Explains the Short-Term Correlation appeared first on Coinpedia Fintech News

Since February when Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

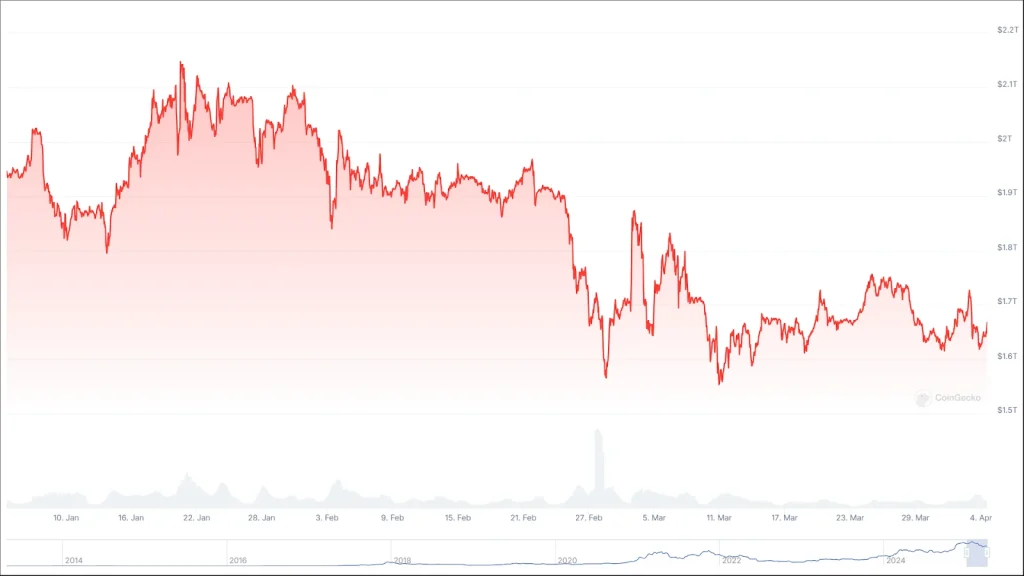

officially announced his aggressive tariff plan, the US economy has been in a turbulent state. At the start of that month, the S&P market was at $5,969.58. Since then, the market has declined by at least 9.5%. Similarly, the Nasdaq 100 index has dropped by over 12.14%. Surprisingly, Bitcoin, which is generally considered as a hedge against market uncertainty, has followed the trend in the US stock market during the period, as it has decreased by approximately 18.49%. Meanwhile, during the period, gold has surged by no fewer than 10.47%.

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

officially announced his aggressive tariff plan, the US economy has been in a turbulent state. At the start of that month, the S&P market was at $5,969.58. Since then, the market has declined by at least 9.5%. Similarly, the Nasdaq 100 index has dropped by over 12.14%. Surprisingly, Bitcoin, which is generally considered as a hedge against market uncertainty, has followed the trend in the US stock market during the period, as it has decreased by approximately 18.49%. Meanwhile, during the period, gold has surged by no fewer than 10.47%.

The development has triggered heated debates on whether Bitcoin really is an independent asset or not. Now, Strategy co-founder michael saylor

michael saylor

Michael Saylor is a Co-founder of Strategy formerly MicroStrategy. Before founding Microstrategy, he was a rocket scientist and studied aeronautics and astronautics at MIT on an Air Force scholarship. He dubs Bitcoin 'Digital Gold'. He made some early investment in Bitcoin as soon as he realized it was going to be the next big thing in shaping decentralized finance from traditional finance. His firm Strategy has made Bitcoin their primary treasure reserve. He is a vocal advocate and Top Bitcoin Speaker who participates in various Bitcoin and Crypto events. Michael Saylor is highly skilled in and has a rich knowledge of numerous fields, including analytics, data warehouses, SaaS, management, cloud computing, enterprise architecture, mobile devices, and many more.

Personal Details:

Born: Feb 4, 1965Location: United StatesGraduation: He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society.

Michael Saylor – Career Timeline

1983–1987: Studied Aeronautics & Astronautics and Science, Technology & Society at Massachusetts Institute of Technology (MIT).

1989: Co-founded MicroStrategy (Strategy).

1998: MicroStrategy IPO – Took MicroStrategy public on the NASDAQ at $12 per share.

2000: Accounting Scandal & Crash – MicroStrategy's stock plunged 62% in a day due to an accounting misstatement, wiping out billions in valuation.

2004–2019: MicroStrategy Rebuilds – Worked towards cloud-based analytics and AI-driven business intelligence, regaining stability.

2020: Bitcoin Strategy & Investment – Led MicroStrategy’s $425M Bitcoin investment. He made it the first publicly traded company to adopt Bitcoin.

2021: Bitcoin Evangelism – Became one of Bitcoin’s most vocal advocates, encouraging corporations and institutions to adopt BTC and blockchain.

2022: Stepped Down as CEO – Transitioned to Executive Chairman to focus entirely on Bitcoin strategy.

msaylor@microstrategy.com

EntrepreneurCrypto and Blockchain ExpertAuthor

an ardent advocate of Bitcoin, shares a very convincing argument on why he thinks the correction between the US stocks and Bitcoin is a temporary phenomenon. Curious to know more! Read on!

michael saylor

Michael Saylor is a Co-founder of Strategy formerly MicroStrategy. Before founding Microstrategy, he was a rocket scientist and studied aeronautics and astronautics at MIT on an Air Force scholarship. He dubs Bitcoin 'Digital Gold'. He made some early investment in Bitcoin as soon as he realized it was going to be the next big thing in shaping decentralized finance from traditional finance. His firm Strategy has made Bitcoin their primary treasure reserve. He is a vocal advocate and Top Bitcoin Speaker who participates in various Bitcoin and Crypto events. Michael Saylor is highly skilled in and has a rich knowledge of numerous fields, including analytics, data warehouses, SaaS, management, cloud computing, enterprise architecture, mobile devices, and many more.

Personal Details:

Born: Feb 4, 1965Location: United StatesGraduation: He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society.

Michael Saylor – Career Timeline

1983–1987: Studied Aeronautics & Astronautics and Science, Technology & Society at Massachusetts Institute of Technology (MIT).

1989: Co-founded MicroStrategy (Strategy).

1998: MicroStrategy IPO – Took MicroStrategy public on the NASDAQ at $12 per share.

2000: Accounting Scandal & Crash – MicroStrategy's stock plunged 62% in a day due to an accounting misstatement, wiping out billions in valuation.

2004–2019: MicroStrategy Rebuilds – Worked towards cloud-based analytics and AI-driven business intelligence, regaining stability.

2020: Bitcoin Strategy & Investment – Led MicroStrategy’s $425M Bitcoin investment. He made it the first publicly traded company to adopt Bitcoin.

2021: Bitcoin Evangelism – Became one of Bitcoin’s most vocal advocates, encouraging corporations and institutions to adopt BTC and blockchain.

2022: Stepped Down as CEO – Transitioned to Executive Chairman to focus entirely on Bitcoin strategy.

msaylor@microstrategy.com

EntrepreneurCrypto and Blockchain ExpertAuthor

an ardent advocate of Bitcoin, shares a very convincing argument on why he thinks the correction between the US stocks and Bitcoin is a temporary phenomenon. Curious to know more! Read on!

Is Bitcoin Really Independent?

Bitcoin is one of the digital assets that has benefited from the change in the political climate of the US. At the start of November 5, 2024, the Bitcoin price was as low as $67,772.62. Between November 5 and 22, 2024, alone, the BTC market surged by over 45.80%. On December 17, 2024, it reached the peak of the year of $108,389.70.

During early January 2025, the Bitcoin market was oscillating inside a range of $89,310 and $106,395.41. On January 20, it marked a new all-time high of $109K.

After the inauguration of Donald Trump as the president of the United States – particularly after his announcement of his aggressive tariff policy, the market lost its upward momentum, mirroring the general trend in the US stock market.

Since February, the market has slipped over 18.49%, triggering serious concerns about its status as a trustworthy hedge against market uncertainty.

The development has triggered heated debates on whether Bitcoin is an independent asset or not.

Short-Term vs Long-Term: Bitcoin’s Double Personality

Strategy co-founder Michael Saylor, dismissing all the statements questioning the credibility of Bitcoin as a reliable hedge against market uncertainty, states that the correction between Bitcoin and the US stock market is a temporary phenomena.

He argues that Bitcoin’s high liquidity and 24/7 availability make it a convenient asset to sell during market downturns.

He claims that when people panic, they sell what they can, and Bitcoin is always able to be sold.

He emphasises that this short-term correlation does not mean Bitcoin is inherently tied to the stock market in the long term.

He reinforces the idea that long term, Bitcoin can still be a non correlated asset – an independent asset.

In 2024, the Bitcoin market witnessed a growth of 121.1%. During the same year, the S&P 500 index only experienced a rise of 24.05% and the Nasdaq 100 just 27.10%. The gold market, during the period, saw a surge of just 27.54%.

In conclusion, as discussions around Bitcoin’s market behaviour continue, one thing is clear: its short-term volatility does not undermine its long-term potential.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

.png)

6 days ago

4

6 days ago

4

(@saylor)

(@saylor)

English (US)

English (US)