ARTICLE AD BOX

Currently, traditional assets are continually debased due to overproduction and inflation. Bitcoin emerges as a beacon of stability with its immutable scarcity and superior monetary properties.

As the next Bitcoin halving approaches, experts and market analysts spotlight BTC as the ultimate tool for long-term savings.

Bitcoin: the Ultimate Savings Tool

According to a new report, Bitcoin’s unique attributes position it ahead of traditional savings instruments. Joe Burnett, researcher at Unchained, explained that the upcoming Bitcoin halving, which will reduce the block reward from 6.25 BTC to 3.125 BTC, is set to cement Bitcoin’s role as a prime savings medium.

Burnett described the modern economic environment as an “innovation trap.” Here, rapid technological advancements and market competition lead to an oversupply of goods and services, ultimately causing asset values to plummet.

He argued that in such a scenario, storing significant wealth outside of Bitcoin will be “increasingly difficult” due to the debasement of traditional assets.

“Bitcoin may be the asset class that increasingly captures a significant share of total global wealth, all at a time when global wealth is rapidly increasing due to the relentless acceleration of innovation. In a world of abundance, hyper-productivity, and intensely competitive markets, storing significant wealth outside of Bitcoin will be increasingly difficult,” Burnett said.

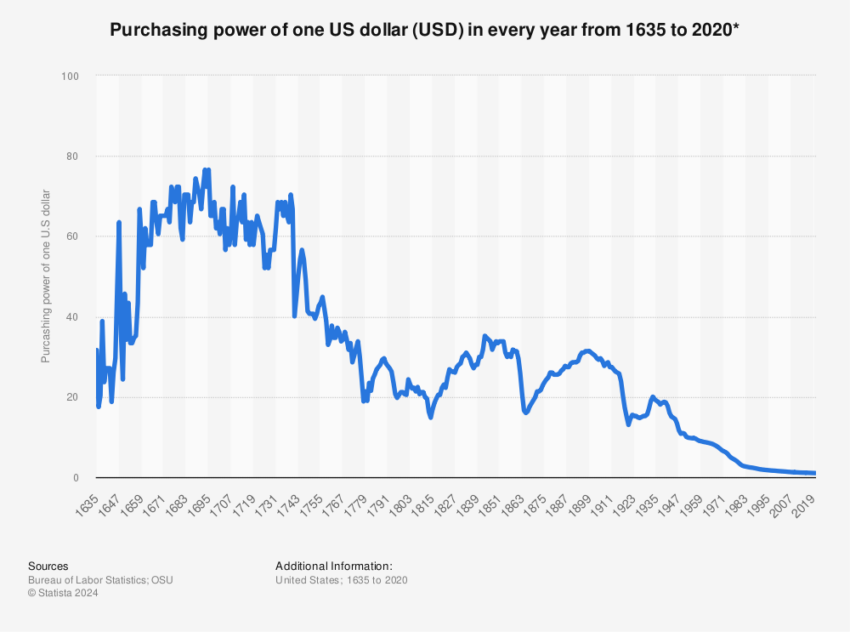

The researcher also highlighted that traditional assets, including fiat currencies, stocks, and real estate, are susceptible to value erosion over time. For instance, the US dollar has depreciated significantly, down 92.8% over the last five years when measured against basic consumer goods.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Purchasing Power of the US Dollar. Source: Statista

Purchasing Power of the US Dollar. Source: StatistaThis trend is mirrored in other asset classes, with the 20-year Treasury Bond dropping more than 94.8% in the same period.

Even precious metals like gold and silver are not immune. Despite their historical reputation as stable storeholds of value, the increased efficiency in mining and production technologies has led to a surge in supply, which, in turn, diminishes their value.

“There’s practically infinite gold in the universe, and there’s even an estimated ~$771 trillion worth of gold just in Earth’s oceans (~70x the current circulating supply). The potential circulating supply of gold has no serious limit, and gold holders will have their savings endlessly devalued as humanity becomes more productive at mining and extracting gold,” Burnett explained.

These findings underscore the diminishing returns of traditional investments and highlight the increasing relevance of Bitcoin. Burnett argued that Bitcoin’s “immutable absolute scarcity” uniquely suits it as a savings tool, especially in a hyper-competitive, innovation-driven economy.

The Effects of the Halving on BTC

As the halving approaches, reducing Bitcoin’s supply inflation by 50%, Burnett pointed out this will decrease sell pressure and potentially lead to significant price appreciation.

Likewise, Matthew Howells-Barby, VP of Growth at Kraken, noted that the Bitcoin halving has historically catalyzed substantial price increases. New all-time highs are typically reached within a year following past halving events.

“The Bitcoin halving has historically served as a launching point for new price discovery in BTC. New all-time highs have been reached within the year following each of the past three halving events, dwarfing any of the gains made in the year before the halving,” Howells-Barby told BeInCrypto.

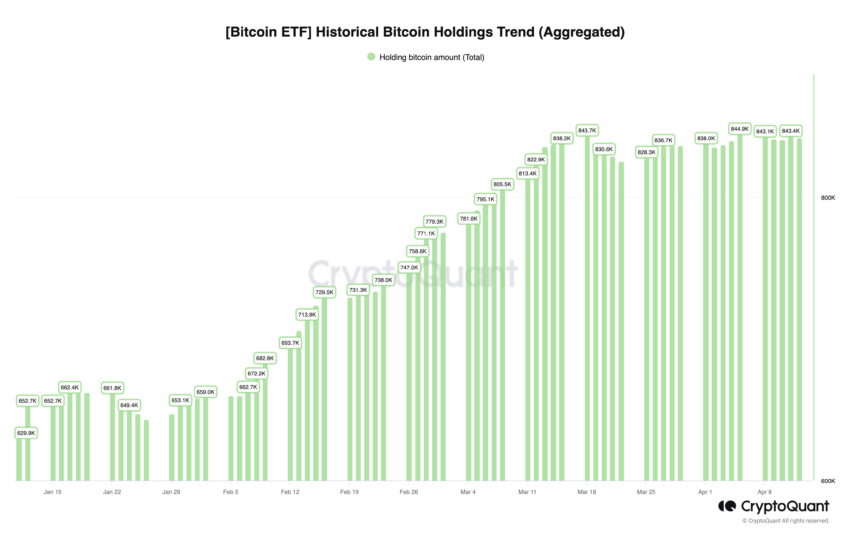

He further elaborated that the influx from the spot Bitcoin exchange-traded funds (ETFs) has likely accelerated BTC’s appreciation more than anticipated. Therefore, it is setting the stage for another bullish cycle post-halving.

Bitcoin ETF Historical Holdings. Source: CryptoQuant

Bitcoin ETF Historical Holdings. Source: CryptoQuantPrice predictions place Bitcoin between $100,000 and $120,000 in the current bull market. Even more optimistic long-term forecasts by analysts like Cathie Wood predict BTC could reach $1.48 million by 2030. For this reason, the case for Bitcoin as a superior savings tool is compelling.

“One of the most significant differences in this cycle when compared to previous ones is the investor mix. The spot Bitcoin ETsF have brought in a significantly greater volume of institutional capital, which should, in theory, reduce the volatility of BTC prices over a longer period of time. I still believe we’ll experience future bear market conditions, but the upside potential is even greater,” Howells-Barby concluded.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

The argument for Bitcoin’s superiority lies in its performance and foundational technology. It ensures no more Bitcoin can be created beyond its 21 million cap. This aspect of Bitcoin is particularly pertinent as the halving nears, highlighting its resilience against inflation and its capability to safeguard against economic uncertainty.

The post Bitcoin Will Become the Best Savings Tool After the Upcoming Halving appeared first on BeInCrypto.

.png)

7 months ago

5

7 months ago

5

English (US)

English (US)