ARTICLE AD BOX

- Bitget Research reveals 20% of Gen Z and Alpha prefer crypto-based pensions over traditional retirement systems.

- Transparency and decentralization drive younger generations’ interest in adopting cryptocurrency for long-term financial planning.

The recent survey of Bitget Research demonstrates a striking trend among younger generations in terms of financial retirement desires. The survey found that 20% of Gen Z and Alpha respondents said they would be ready to get their pensions in crypto.

The report also shows the growing attractiveness of digital assets and blockchain-based financial solutions since 78% of respondents had more trust in alternative pension options than in traditional retirement systems.

Challenges and Opportunities in Crypto Retirement Adoption

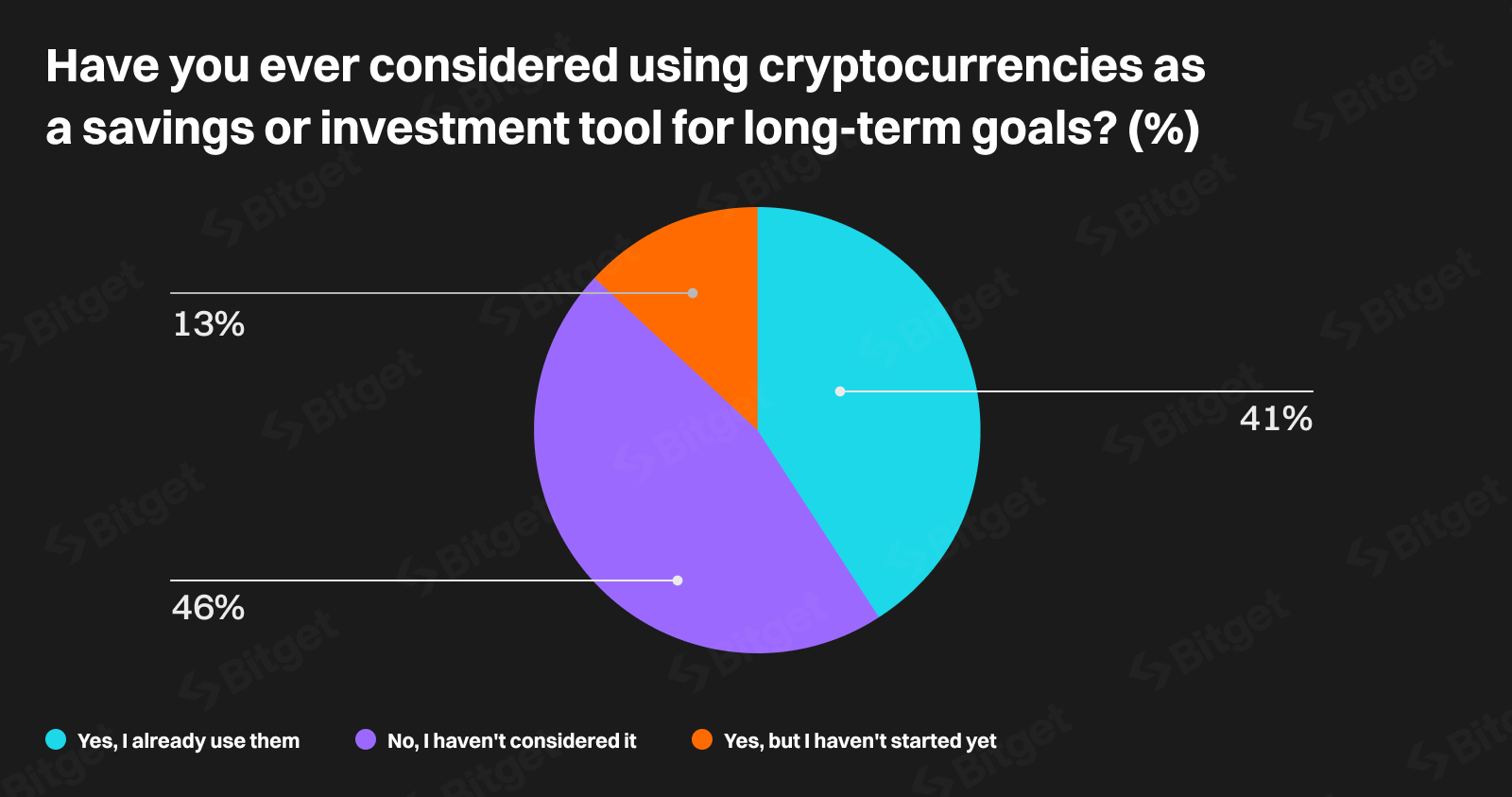

Over 40% of these younger people have already made investments in cryptocurrencies, highlighting their faith in the long-term value of digital coins. Especially, the survey shows that 73% of the respondents do not know exactly where or how their traditional pension money is put.

Source: Bitget

Source: BitgetTraditional retirement plans’ lack of openness and accessibility could be the reason behind their rising curiosity in cryptocurrency.

The adoption of crypto as retirement investments does, however, present difficulties. One of the most important obstacles is price volatility since the character of crypto prices can compromise the stability of long-term savings.

Furthermore clouding the acceptance of digital assets are regulatory ambiguities as governments and financial institutions all around try to create explicit policies for their use. Furthermore, for possible investors, cybersecurity issues, including hacking and scam, continue to be major worries.

How Gen Z and Alpha Embrace Crypto Values

Notwithstanding these difficulties, the results point to the need for more financial education and openness in order to solve these problems. A notable knowledge gap was highlighted by more than 20% of respondents confessing to knowing nothing about both traditional and crypto-based pension systems.

Closing this divide is crucial to providing younger generations the tools and knowledge required to make wise financial decisions.

Gen Z and Alpha’s connection with principles like openness, decentralization, and accessibility drives their inclination for cryptocurrencies as well. Many times lacking in traditional financial systems, these qualities make digital assets a desirable alternative.

Moreover, despite the related risks, crypto provides the possibility for better returns than traditional investment tools. Younger people looking for creative approaches to safeguard their financial destiny have turned to digital assets because of their attraction of possible returns.

The Changing Role of Crypto in Traditional Finance

Fascinatingly, this tendency fits more general changes in the blockchain and crypto industries. Many financial institutions and platforms are changing their offerings to fit the increasing demand for digital assets, which they see.

Consequently, we are seeing a slow integration of crypto-based solutions into traditional financial institutions, so supporting their usage as a practical investment choice.

On the other hand, given their inherent risks, critics warn against depending too much on crypto. Unquestionably, there is great potential for huge returns; nonetheless, one must overlook the volatility and regulatory uncertainty connected with digital assets.

Dealing with these issues through strong rules, improved security measures, and thorough financial education would help cryptocurrency to acquire more acceptance as retirement investments.

On the other hand, as we previously reported, Bitget has merged its BWB token into BGB to simplify its ecosystem and increase uses on DeFi and blockchain systems. By 2025, BGB is expected to be Bitget’s main token, allowing staking, lending, and interaction with offline payment systems.

.png)

3 hours ago

2

3 hours ago

2

English (US)

English (US)