ARTICLE AD BOX

In a significant development in the cryptocurrency regulatory landscape, BitMEX, a major cryptocurrency exchange, has admitted guilt of violating the Bank Secrecy Act (BSA). This move follows earlier legal troubles for the exchange’s co-founders, who also faced criminal charges and received probation.

Background on the Guilty Plea

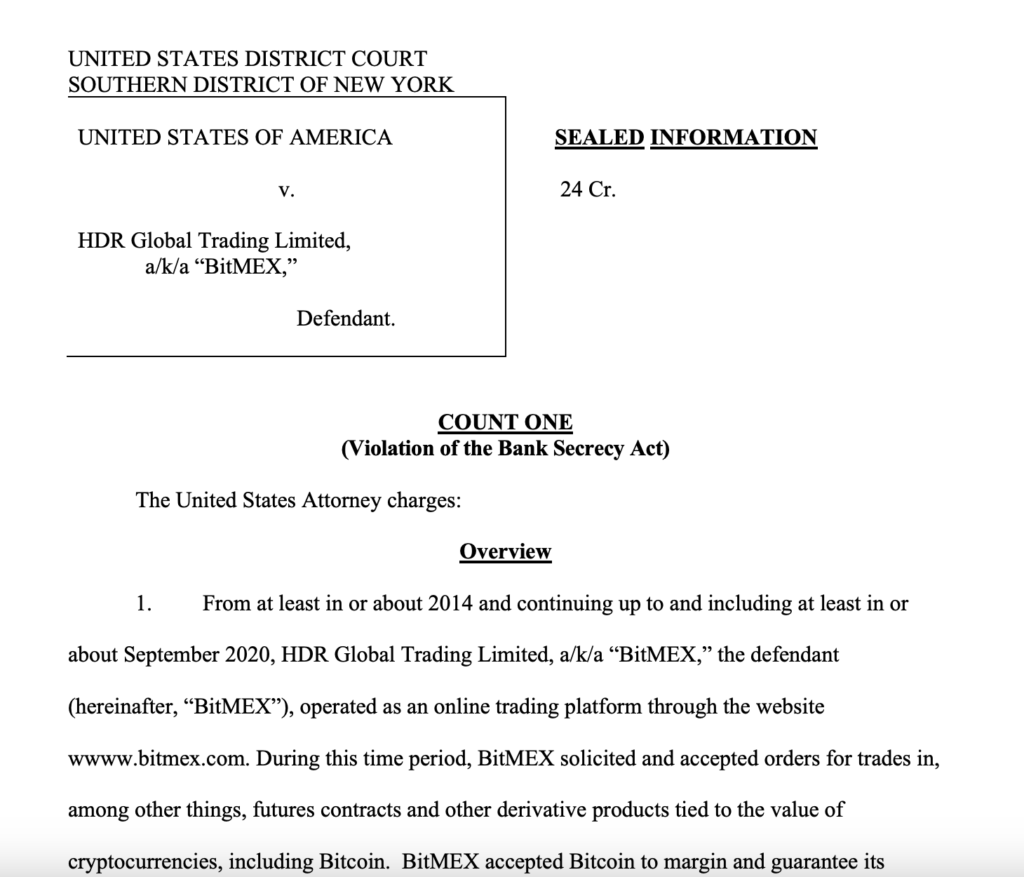

The U.S. Department of Justice announced that BitMEX, officially known as HDR Global Trading Limited, pleaded guilty to operating without a meaningful Anti-Money Laundering (AML) program. U.S. Attorney Damian Williams stated that from 2015 to 2020, BitMEX failed to establish, implement, and maintain an adequate AML program. This plea stems from earlier criminal proceedings against BitMEX’s founders and employees, revealing severe lapses in regulatory compliance.

Source: US Justice Department

Source: US Justice DepartmentBitMEX AML Program Deficiencies

According to Williams, BitMEX “willfully” neglected to implement an AML program that met the required Know Your Customer (KYC) standards. Instead, the exchange only required users to provide an email address, a measure deemed grossly inadequate for preventing money laundering and sanctions evasion. This negligence exposed BitMEX as a potential vehicle for large-scale illicit financial activities, posing a significant threat to the integrity of the financial system.

Consequences for Founders and Exchange

BitMEX’s co-founders, Arthur Hayes, Benjamin Delo, and Samuel Reed, were aware that their platform’s deficiencies violated federal laws, particularly those affecting U.S.-based users. In 2022, the trio were ordered to pay a combined $30 million civil penalty by the U.S. Commodity Futures Trading Commission (CFTC). Following their guilty pleas to similar AML violations, they were sentenced to probation.

The penalties for BitMEX are severe. As a corporation, the exchange could face up to five years in prison and significant fines. This case underscores the necessity for cryptocurrency companies to adhere strictly to U.S. laws if they wish to operate within the American market.

Broader Implications and Related Cases

This development is part of a broader crackdown on cryptocurrency exchanges and their compliance with financial regulations. Other notable cases include those related to the defunct cryptocurrency exchange FTX and Alameda Research.

In the upcoming months, U.S. courts will determine the sentences for individuals involved in these cases, including FTX co-founder Gary Wang and former engineering director Nishad Singh. Sam Bankman-Fried, former CEO of FTX, is currently serving a 25-year sentence following his conviction.

.png)

4 months ago

3

4 months ago

3

English (US)

English (US)