ARTICLE AD BOX

The tokenized US treasuries market is experiencing unprecedented growth.

High interest rates and a surge in demand for safe, high-yielding on-chain assets drive this achievement.

BlackRock’s BUIDL Takes the Lead in Tokenized Treasury Funds Segment

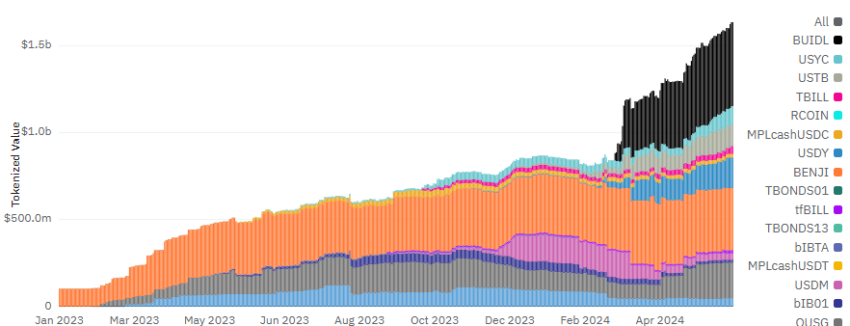

High interest rates have bolstered demand for secure, high-yielding T-bills on-chain. This has propelled the value of tokenized US Treasury products by over 1,000% since early 2023, reaching $1.64 billion by June 22.

Key players like BlackRock and Franklin Templeton are leading the charge. BlackRock’s tokenized US Treasury fund BUIDL, valued at $481.42 million, recently overtook Franklin Templeton’s BENJI $357.68 million fund to become the largest. Crypto hedge funds and market makers leverage BUIDL as collateral for trading coins and tokens.

Read more: What is Tokenization on Blockchain?

Value of Tokenized Government Security Products. Source: Dune/21co

Value of Tokenized Government Security Products. Source: Dune/21coThis growth shows a significant shift in the financial industry, where real-world asset (RWA) tokenization is becoming increasingly mainstream. Major financial institutions like Goldman Sachs, JPMorgan, and Citi are actively exploring and investing in tokenization technologies.

Tokenization, which creates digital tokens representative of real-world assets on a blockchain, offers numerous benefits. These advantages include increased liquidity, faster transaction times, and lower fees.

The use cases for tokenized treasuries are also expanding. According to RWA.xyz, tokenized treasuries are increasingly utilized as collateral.

“[For instance,] Superstate’s USTB and BUIDL can be used as collateral on FalconX Network. [Meanwhile,] Ondo Finance’s USDY can be used on Drift Protocol,” it mentioned.

Another example is Moody’s recent “A-bf” bond rating award to Hill Lights International Limited, the issuer of OpenEden’s tokenized US T-bills, TBILL. This rating elevates TBILL tokens to the investment-grade category. OpenEden currently collaborates with payment companies, DeFi protocols, crypto wallets, and other Web3 apps to allow users to access US T-bill yields across different blockchains.

Corporate Giants Embrace the Future of Tokenization

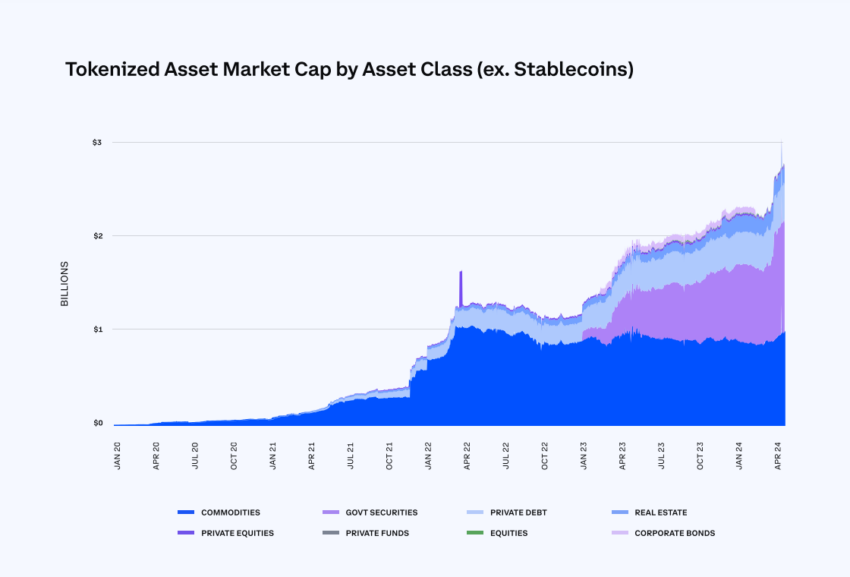

Despite the rise of real-world asset tokenization, data shows that stablecoins have driven the tokenization sector’s growth. The total value of tokenized non-stablecoin assets has exceeded $3 billion, doubling since early 2023. This figure only accounts for publicly trackable assets, with estimates from the Hong Kong Monetary Authority (HKMA) indicating an additional $3.9 billion in tokenized bonds.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Tokenized Asset Market Cap by Asset Class Excluding Stablecoins (January 2020 – April 2024). Source: Coinbase

Tokenized Asset Market Cap by Asset Class Excluding Stablecoins (January 2020 – April 2024). Source: CoinbaseMoreover, the emergence of stablecoins and other digital tokens revolutionizes payment systems, making transactions more efficient and cost-effective. These factors also attract major financial institutions, enhancing the overall market appeal.

Top companies increasingly recognize the benefits of stablecoins and other digital tokens for faster and cheaper transactions. A recent report from Coinbase revealed that 86% of top companies acknowledge the advantages of asset tokenization for their companies. Additionally, 35% of them plan tokenization projects, including stablecoins.

Commodities, especially gold, also remain significant in the tokenized assets market. This asset accounts for nearly all the $1 billion in tokenized commodities.

Indeed, tokenization promises to revolutionize the financial sector, providing faster, more efficient, and secure services. As more traditional financial giants explore blockchain technology, tokenization remains a key competitive advantage, driving growth and innovation.

The post BlackRock and Franklin Templeton Lead the Over 1,000% Surge in Tokenized US Treasuries appeared first on BeInCrypto.

.png)

4 months ago

3

4 months ago

3

English (US)

English (US)