ARTICLE AD BOX

The post BNB Flashes Sell Signal, Eyes on $525 Level appeared first on Coinpedia Fintech News

The ongoing selling pressure across the cryptocurrency market has shifted the sentiment to a downtrend. Amid this, Binance Coin (BNB) has begun to show bearish signals as it breaches a crucial support level of the ascending trendline and forms bearish price action on the daily time frame.

Binance Coin (BNB) Technical Analysis and Upcoming Level

According to expert technical analysis, BNB appears bearish as it has breached the crucial support of the ascending trendline and the horizontal level of $590. In addition to this breakdown, the asset has formed a bearish divergence on the daily time frame.

Between September 27 and October 21, 2024, the BNB price formed a higher high but during the same period, the asset’s Relative Strength Index (RSI) made a lower low, which is often considered as a bearish sign.

Source: Trading View

Source: Trading ViewBased on the recent price action and BNB’s historical momentum, there is a strong possibility that the asset could decline by 10% to reach the $525 level in the coming days.

Since July 2024, whenever BNB has reached the $590 level, it has consistently experienced a price decline of over 12%, dropping to the $520 level or below. However, investors and traders are anticipating a similar price decline this time.

BNB’s Bearish On-Metrics

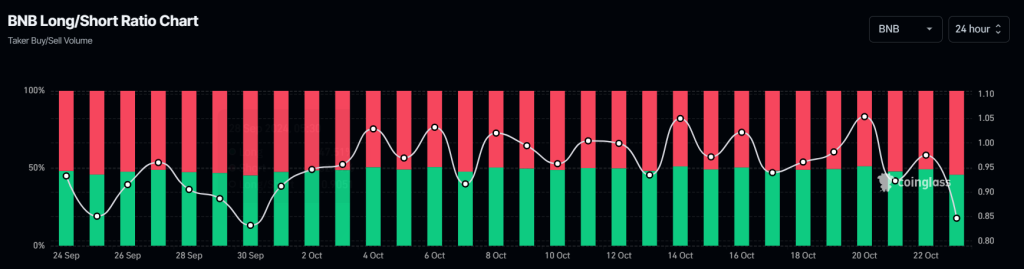

BNB’s bearish outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, the BNB Long/Short ratio currently stands at 0.847, the lowest since October 2024. This long/short value indicates strong bearish sentiment among traders.

Source: Coinglass

Source: CoinglassAdditionally, BNB’s open interest has dropped by 2.1% over the past 24 hours, suggesting a lower interest from traders amid bearish sentiment. Currently, 54.6% of top traders hold short positions, while 45.4% hold long positions.

Current Price Momentum

At press time, BNB is trading near $577 and has experienced a price decline of over 3.25% in the past 24 hours. During the same period, its trading volume dropped by 5%, indicating lower participation from traders and investors compared to the previous day.

.png)

1 month ago

1

1 month ago

1

English (US)

English (US)