ARTICLE AD BOX

Following the lifting of Bolivia’s crypto ban, which had been in place since 2020, President Luis Arce finally revealed that the reason behind this decision was the dollar and fuel shortages in the country.

Arce stated that its administration seeks to mitigate the lack of foreign currency that has affected the country due to the fall in gas exports, which is its main source of income until 2021. He sees cryptocurrencies as a solution to Bolivia’s macroeconomic challenges.

Bolivia’s Financial Modernization: Balancing Innovation and Caution

BeInCrypto reported that on June 26, the Central Bank of Bolivia (BCB) allowed the use of virtual assets through Electronic Payment Instruments (EPI). Edwin Rojas, the BCB president, explained that this new regulation will enable electronic payment channels and instruments for the purchase and sale of virtual assets. However, Rojas stressed that the only legal currency in the country remains the boliviano under Law 901 of 1986.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

“A virtual asset is not legal tender, is not cash, and there is no obligation for the public to accept it as a means of payment. Therefore, the inherent risks of using and trading these assets will be borne by the users of such assets,” the BCB official announcement reads.

To support this transition, the BCB also launched a comprehensive training program on July 2 to educate various sectors about virtual assets. The first phase concentrates on educating journalists from major cities.

The effort ensures the accurate dissemination of public information about virtual assets. This includes their conceptual aspects, characteristics, regulatory aspects, security, and risks.

This initiative is part of the BCB’s broader effort to enhance the population’s understanding of new financial technologies. Additionally, the central bank aims to support the country’s economic modernization.

Weighing the Pros and Cons of Crypto Adoption

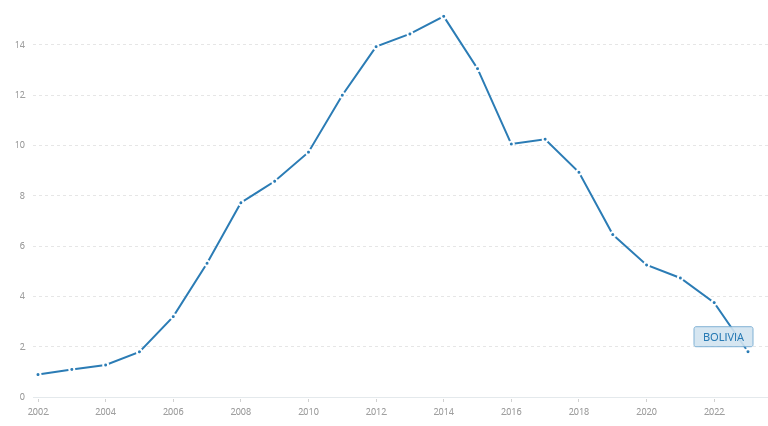

Bolivia’s total value of reserves, including gold and US dollars, has constantly declined over the last decade. According to the World Bank, this has brought them back to values close to 2006-2007.

Total Value of Reserves in Bolivia. Source: World Bank

Total Value of Reserves in Bolivia. Source: World BankFrom a macroeconomic perspective, lifting the crypto ban would potentially attract foreign investment to Bolivia. This is because cryptocurrencies allow for fast and secure transactions at a global level. Without traditional currency restrictions, this could encourage individual and corporate investors to diversify their assets in emerging markets, such as Bolivia.

Furthermore, Bolivia, which receives considerable remittances from its citizens abroad, could benefit significantly. Cryptocurrencies offer a faster and cheaper way to send money into the country, reducing transaction costs.

Cryptocurrency adoption can also boost e-commerce. In most cases, cryptocurrencies allow local businesses to sell their products and services internationally without the barriers of the traditional banking system. This would diversify the country’s revenue sources beyond gas exports.

In the context of inflation and devaluation of the local currency, cryptocurrencies could offer a more stable store of value. This could protect citizens’ savings and foster greater confidence in the financial system.

However, it is crucial to note that the unintended liberalization of cryptocurrencies in the country could lead to significant systemic risks. Cryptocurrency volatility can destabilize the balance of payments, as sudden fluctuations in their value could affect international reserves and exchange rate stability.

Moreover, mass crypto adoptions would need a strong regulatory framework to prevent credit market disruptions. Such issues might reduce confidence in the traditional banking system and hamper banks’ lending ability. This could worsen the economic crisis by limiting credit access for businesses and consumers, hindering economic recovery, and increasing financial uncertainty.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Ultimately, everything will depend on how regulators implement this new transition process and local actors’ macroeconomic expectations.

The post Bolivia Lifts Crypto Ban to Mitigate Dollar Shortage and Fuel Economic Growth appeared first on BeInCrypto.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)