ARTICLE AD BOX

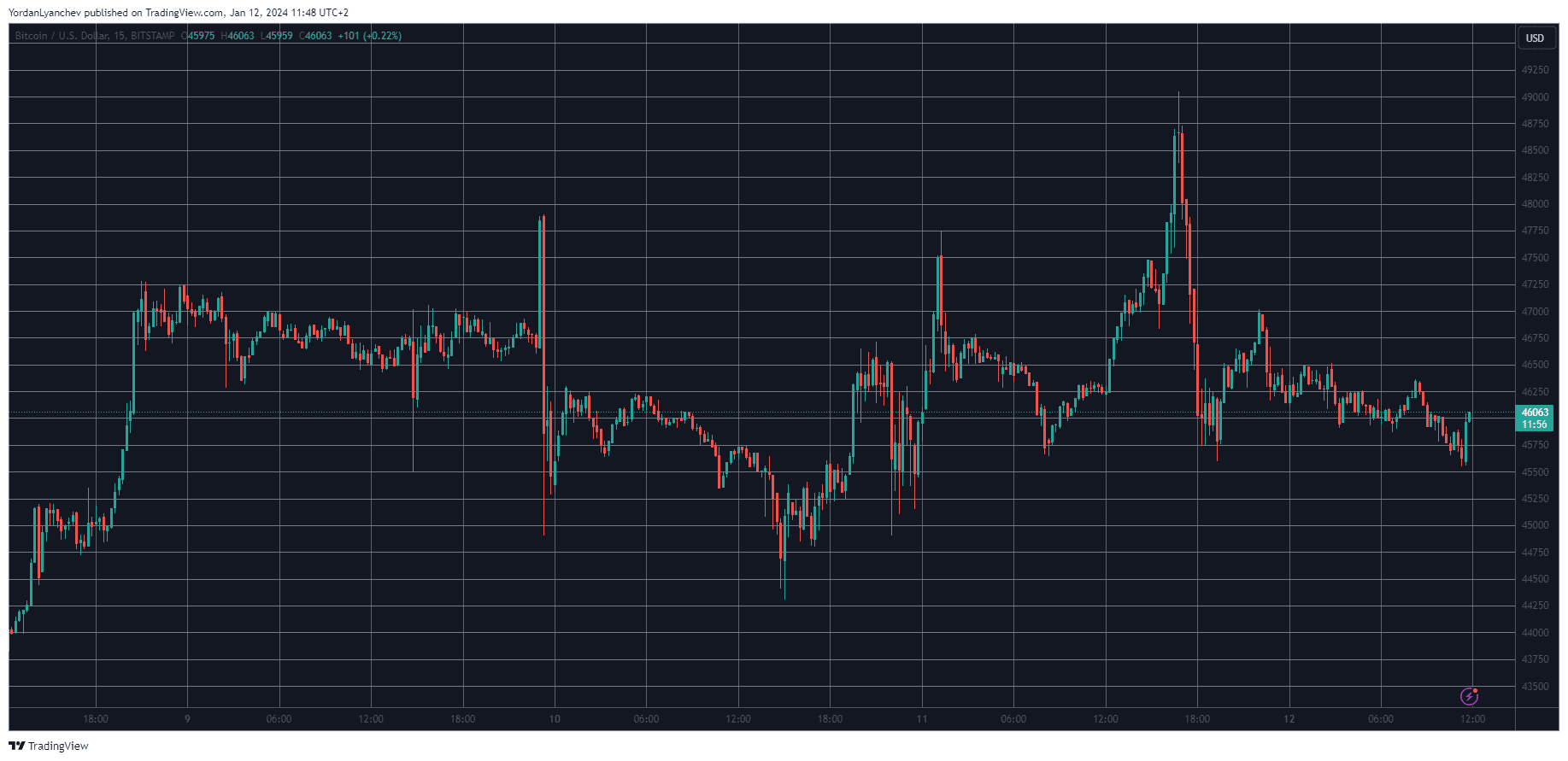

The first trading day of 11 spot Bitcoin ETFs on the US stock markets was quite eventful, with numerous price movements that resulted in a multi-year peak and a massive dump.

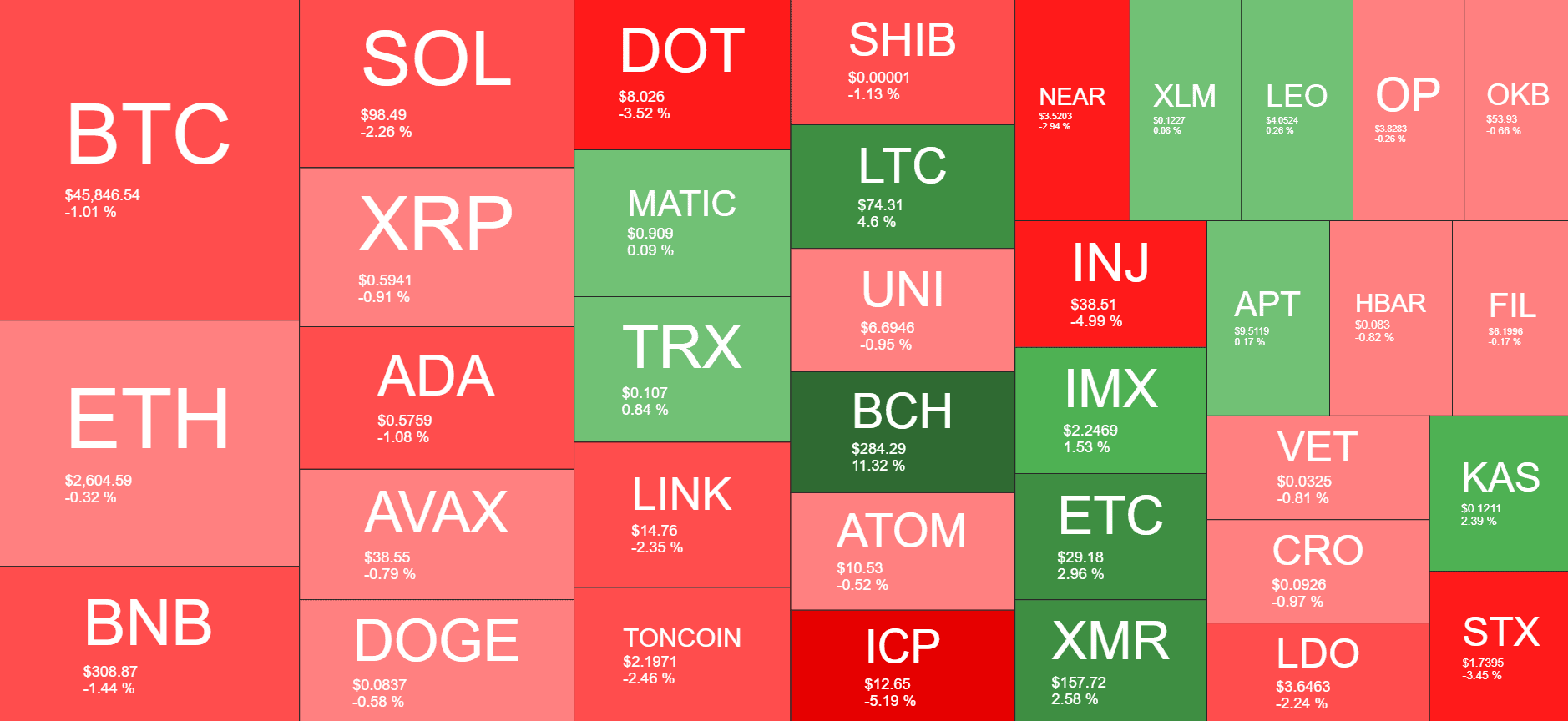

The altcoins are also slightly in the red now on a daily scale, aside from BCH and FTT, which have soared by double digits.

BTC’s Rollercoaster Kept Going

The primary cryptocurrency received controversial recognition and validation from the US Securities and Exchange Commission on Wednesday when the regulator finally greenlighted almost a dozen exchange-traded funds tracking its performance. Nevertheless, Gary Gensler had some negative comments about the asset after the approvals, which didn’t go without a few accidents.

This resulted in increased volatility for BTC. The asset dumped and pumped by several thousand dollars on Wednesday, and the situation worsened on Thursday – the first trading day for those products.

While the trading volumes skyrocketed to over $4 billion within a day, Bitcoin’s price shot up to over $49,000 for the first time in almost two years. Minutes later, the asset tumbled by over three grand, leaving millions in liquidations.

BTC has calmed since then and currently sits at around $46,000. Its market capitalization remains just inches above $900 billion, while its dominance over the alts is slightly over 51% on CMC.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingViewBCH, FTT on a Roll

Most alternative coins mimicked BTC’s highly volatile performance in the past few days but have calmed now with minor losses. ETH, BNB, SOL, XRP, ADA, AVAX, DOGE, and DOT are all slightly in the red on a daily scale now.

Bitcoin Cash and Litecoin defy these movements. BCH has soared by more than 11% and sits at $285, while LTC trades close to $75 after a 5% increase.

FTT has surged the most from the top 100 alts. FTX’s native token is up by 19% and trades well above $3.

The total crypto market cap has declined by around $20 billion overnight and sits at $1.760 trillion.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify CryptoThe post BTC Calms at $46K After ETF Rollercoaster, BCH and FTT Explode by Double Digits (Market Watch) appeared first on CryptoPotato.

.png)

11 months ago

7

11 months ago

7

English (US)

English (US)