ARTICLE AD BOX

- Bitcoin and Nasdaq struggle amid yen strength, with Bitcoin dropping 5% this month after a 17% February decline.

- Yen rally driven by rising Japanese bond yields may fade, potentially easing pressure on Bitcoin and Nasdaq markets.

Bitcoin and Nasdaq face sharp declines as Japan’s yen strengthens alongside rising government bond yields. Bitcoin, now trading near $81,400, has dropped 5% this month, extending February’s 17% decline. The price briefly touched $79,000 early on February 28, signaling continued volatility in the crypto market.

Meanwhile, Nasdaq is also struggling, reflecting broader investor concerns. The timing of this market dip aligns with a significant strengthening of the Japanese yen, raising speculation about a possible correlation. The yen’s rally has been driven by a sharp rise in Japanese government bond (JGB) yields, which have reached levels not seen in over 16 years.

The surge in yields stems from widespread expectations of further rate hikes by the Bank of Japan (BoJ) and a global bond market sell-off. The 10-year JGB yield has now crossed 1.5%, while the 30-year yield has surged past 2.5%, indicating inflationary pressures and a shift in Japan’s monetary policy.

Will Bitcoin and Nasdaq Find Relief?

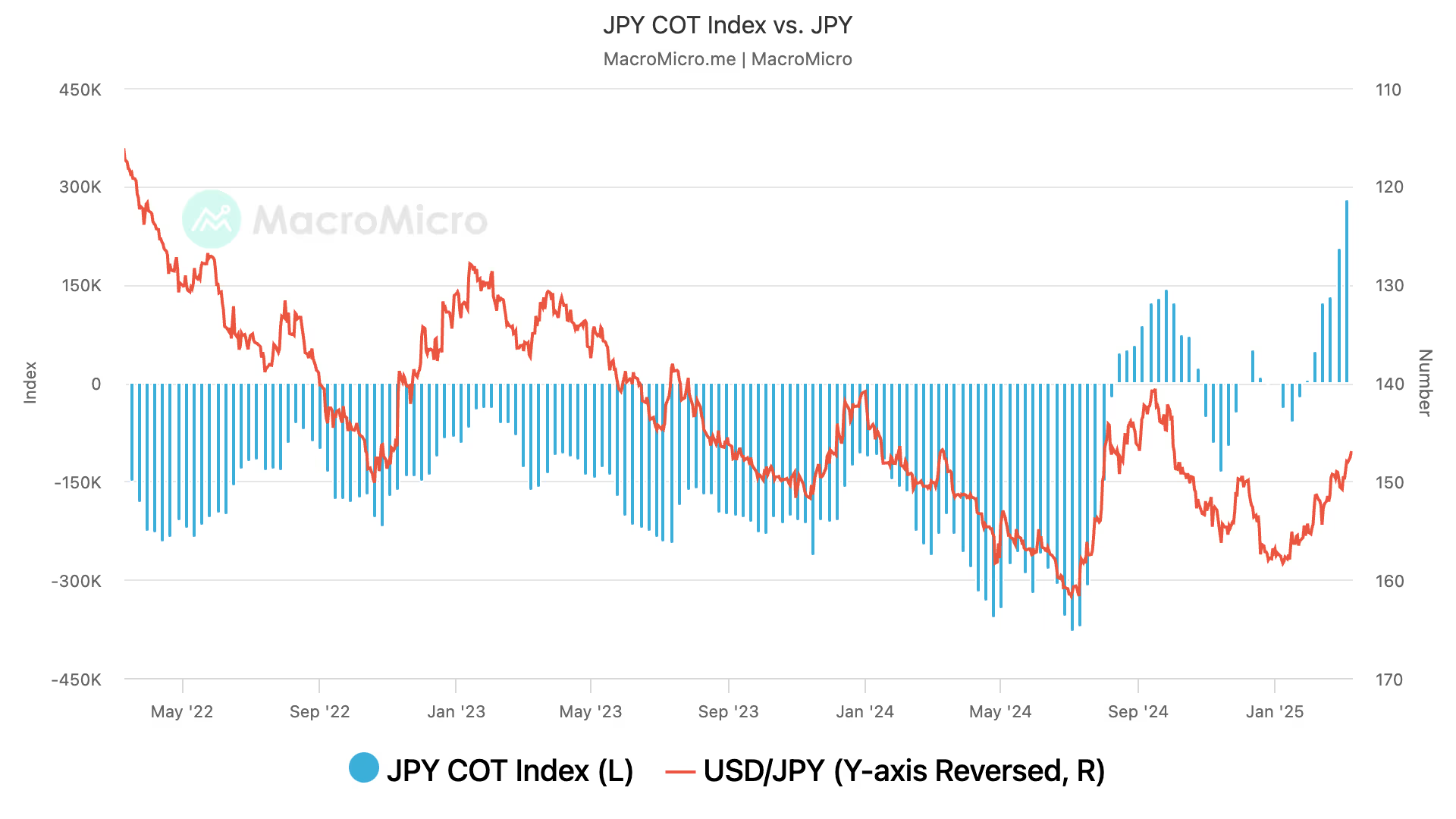

Although the yen has been on a strong run, some believe its bullish momentum may be reaching a peak. Data from the Commodity Futures Trading Commission (CFTC) shows that speculative positions in the yen hit record highs last week. Such an overstretched market condition often leads to a reversal, which could provide relief for Bitcoin and Nasdaq.

Source: MacroMicro

Source: MacroMicroMorgan Stanley’s G10 FX Strategy team has also warned that the yen’s strength may not last much longer. The company said:

We are now cautious on chasing further JPY strength, given stretched speculative positioning as well as strong dip-buying appetite from the domestic community.

A key factor limiting yen appreciation is the Nippon Individual Savings Account (NISA) scheme, which encourages Japanese investors to buy foreign assets during risk-off periods. Additionally, Japan’s public pension system has a tendency to rebalance out of yen assets, further preventing a prolonged currency surge.

Historical Patterns Could Signal a Turnaround

Looking at past trends, similar market dynamics played out in August 2023. The yen experienced a sharp appreciation, leading to a notable sell-off in equities. However, that rally in the yen eventually faded, triggering a renewed risk-on sentiment that benefited Bitcoin and Nasdaq.

The USD/JPY currency pair serves as a key indicator. It rebounded from its July- August low of 140 and eventually climbed to 158.50 by January 2024. Bitcoin followed a similar trajectory, recovering from its early August crash to $50,000 before rallying to new all-time highs above $108,000 in January.

Source: TradingView

Source: TradingViewFor now, USD/JPY is trading at 147, slightly up from a five-month low of 145.50 seen early Tuesday. The narrowing U.S.-Japan bond yield spread, which has now reached 2.69%, also supports a more bullish outlook for the yen.

.png)

12 hours ago

2

12 hours ago

2

English (US)

English (US)